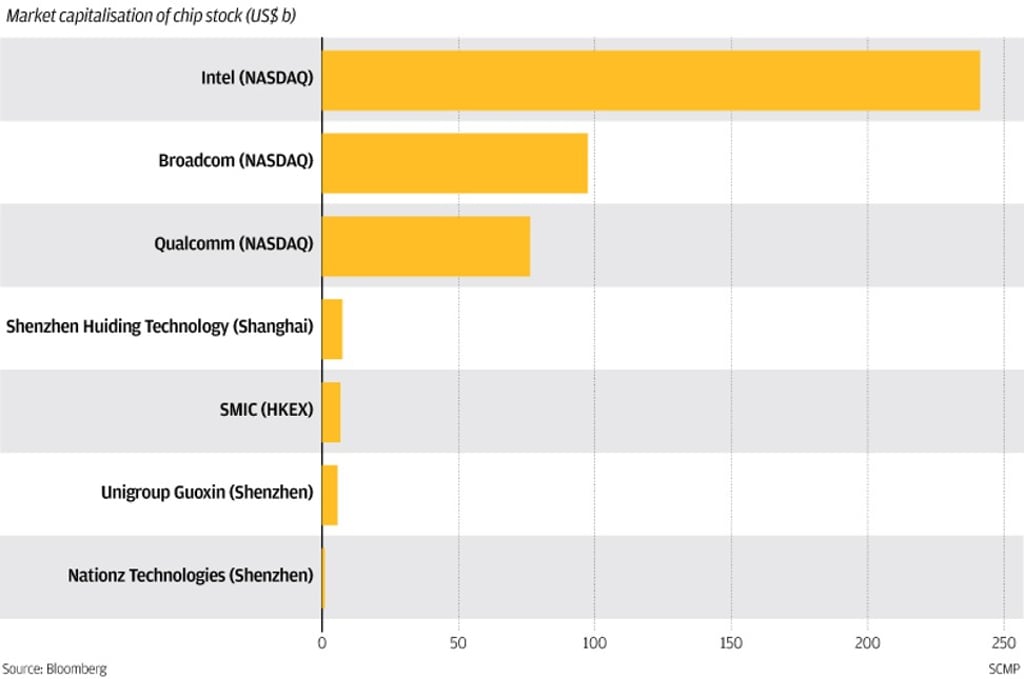

US semiconductor makers dwarf Chinese peers in market valuation as China’s chip dream remains distant

China’s biggest chip maker is valued at a fraction of US giants like Intel and Qualcomm; the mainland imports US$200b of US chips annually

Chinese chip makers are no match for their US counterparts at least in the stock market, even as the nation’s state media are fully charged to hype up the needs to develop its home-grown semiconductor industry amid the escalating trade row between the world’s two largest economies.

Intel, Broadcom and Qualcomm, the US suppliers of chips for smartphones and computers, are at least 10 times the market value of China’s biggest chip maker Shenzhen Huiding Technology, according to Bloomberg data. While the processors made by the US companies are mostly used in the upscale electronic products, the China-made ones can only fill the low-end market for products such as bank cards and USB-keys.

While the state-run Xinhua News Agency and the Communist Party’s mouthpiece People’s Daily both ran articles last week urgently calling for the speedy development of the country’s semiconductor industry, the gap with the US is unlikely to narrow any time soon, according to investors including Hengsheng Asset Management.

“The gap is still huge and the semiconductor industry is capital- and labour-intensive,” said Dai Ming, a money manager at the Shanghai-based fund management firm. “It requires massive investment and technology accumulation. It’s difficult for China to catch up with the US in the short term.”