Robust quarterly profit at China’s largest producer suggests instant noodles are back in flavour

Tingyi Holding reports 64.26 per cent jump in net profit to 712 million yuan

Shares in Tingyi Holding, China’s largest producer of instant noodles and drinks, were trading at a six-week high on Tuesday, after the company posted a better-than-expected first quarter late on Monday, on the back of robust sales of instant noodle products.

Its shares jumped by about 9 per cent to an intraday high of HK$18.16 in Hong Kong, after the company reported a 64.26 per cent jump in its net profit to 712 million yuan (US$111 million) during the first three months of the year.

China’s instant noodle industry is showing an optimistic trend, with positive overall growth in 2017

Tingyi, which posted a net profit of 434 million yuan during the first quarter last year, benefited from a 8.6 per cent jump in sales revenue from instant noodle products, the Hong Kong-listed company said in a filing on Monday. The sector recorded robust sales growth in the first quarter, and the company said the industry was showing signs of recovery after declining sales between 2013 and last year.

“China’s instant noodle industry is showing an optimistic trend, with positive overall growth in 2017,” said Tingyi, which also produces and distributes drinks, baked goods and soft drinks under its household brand name, Master Kong.

A simple recipe involving the addition of boiling water to flavoured sauces, dehydrated meats and vegetables and noodles, instant noodles were once an ultra convenient food favoured by millions of China’s urban and rural residents.

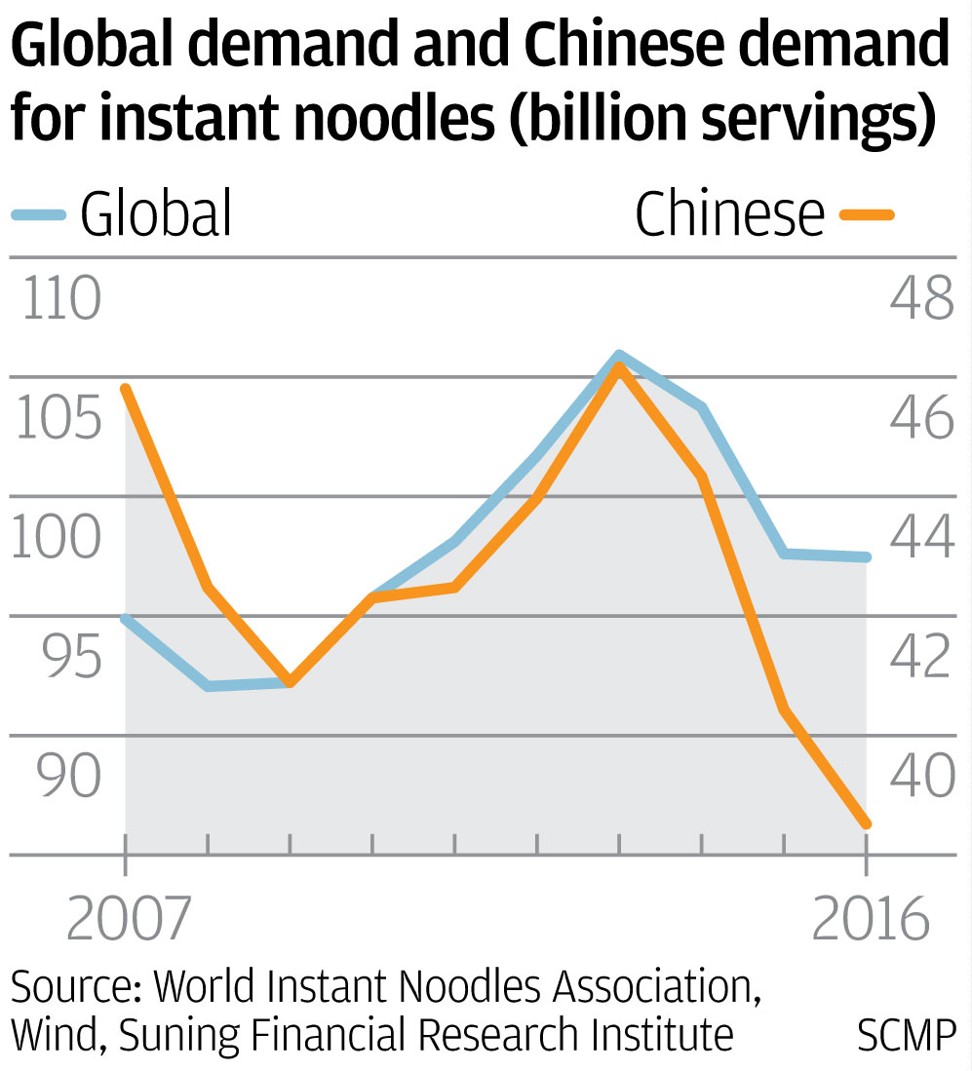

However, with the emergence of a more health-conscious middle class, instant noodles fell out of favour, with sales volumes dropping from 46.2 billion packets in 2013 to 38.5 billion in 2016 in Hong Kong and mainland China, about 17 per cent drop, according to the World Instant Noodles Association.

Things started to pick up last year, when the overall sales amount of instant noodles in Hong Kong and mainland China increased by 3.6 per cent for the whole year, according to Nielsen. In the first three months this year, sales of instant noodles continued to go up, expanding by 11.9 per cent during the period compared with last year, according to Nielsen.

The reversal in fortunes could partly be down to a rising demand among residents of China’s lower tier cities, where disposable incomes are lower than those in tier 1 cities such as Beijing, Shanghai and Shenzhen, said analysts.

“The rise in sales of instant noodles means there is an overall rebound in consumption among people living in lower tier cities,” said Dai Jiaxian, an analyst at Citic Securities.

Instant noodles are “basic low-tier” consumer goods, which include items such as Chinese baijiu brand Erguotou, ham sausages and beer, said Dai, adding that a rebound in consumption in low tier cities boded well for these items too.