China’s state media talks up stock market as most accurate strategist says it’s not time to buy

Financial and securities newspapers have drawn on data – stock valuations, corporate earnings growth and share buy-backs, to shore up the market

China’s state media is in full gear to shore up the nation’s stock market after a rout wiped out almost US$2 trillion in market value, compounding a call by one of the nation’s most accurate strategists that the sell-off still has room to run.

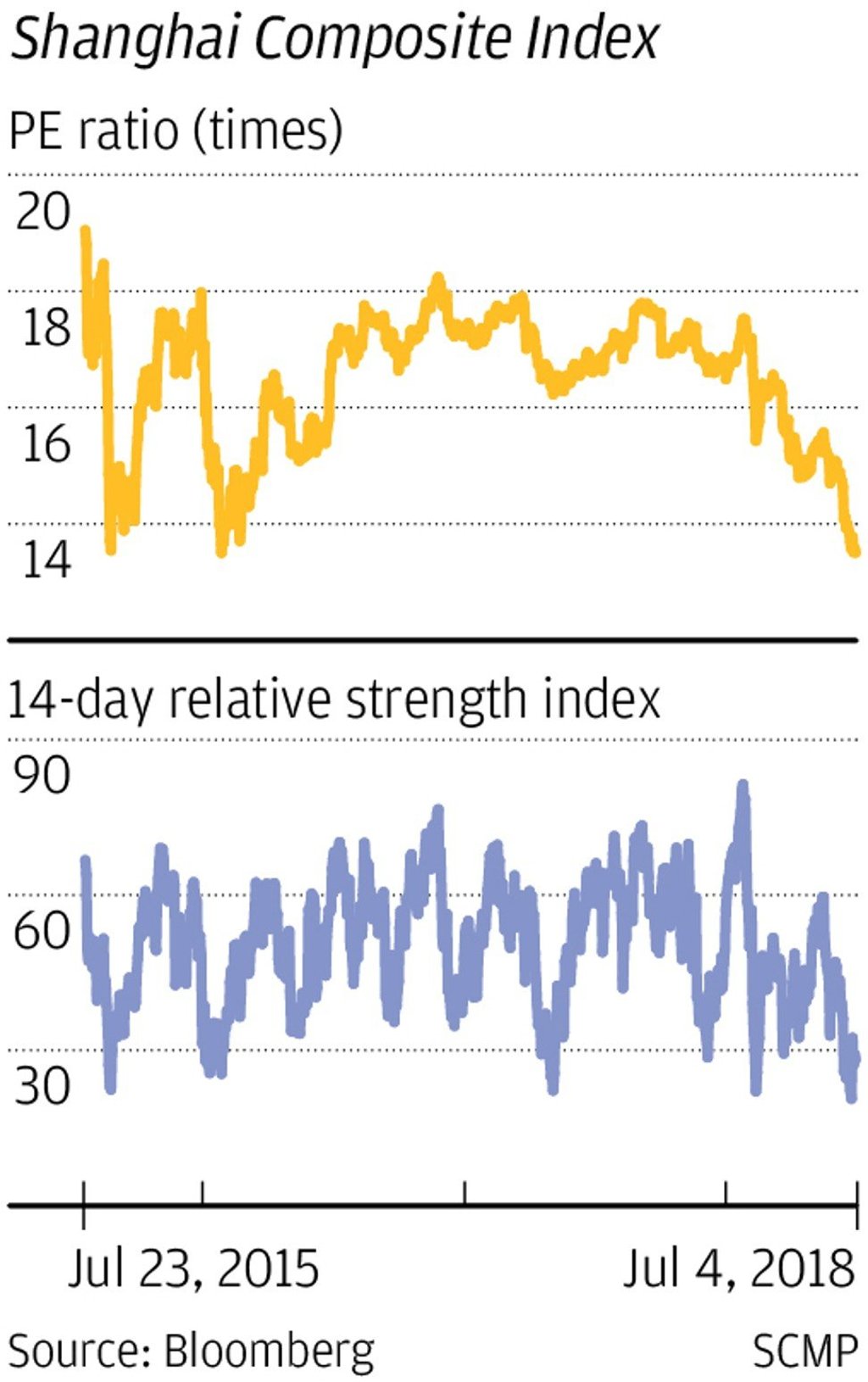

The Xinhua News Agency ran an article on Wednesday reassuring investors that the valuations of Chinese stocks are already close to the historical low levels, while major financial newspapers controlled by Xinhua and People’s Daily published stories this week calling the ongoing declines irrational and overdone, and that signs of market bottoms are building up.

Even so, Hong Hao, Hong Kong-based managing director at Bocom International Holdings who correctly predicted the bubble bursting on mainland Chinese stocks three years ago, disagreed. He said the turnover velocity, a gauge measuring how fast shares change hand, still remained at elevated levels, indicating that the bulls have not fully capitulated, and the risk of forced liquidation of pledged stocks is lurking.

With the undertone to arrest further declines, China Securities Journal and three other major securities newspapers have also drawn on data and facts – battered valuations of China’s stocks, corporate earnings growth and executives’ increased stock buy-backs in the secondary market, to shore up the market.

“The markets are signalling characteristics of a bottoming out,” the Shanghai Securities News said in an article on Tuesday. “It is the seed-sowing stage. With quality core assets in hand, time will be your friend as the probability of outperforming the market is in the future.”