China’s Big Telcos go from ‘value destroyers’ to world beaters as Beijing’s grand tech plan triggers rare stock re-rating

- China Mobile, China Telecom and China Unicom are fetching a premium over benchmark index’s average valuation amid Beijing’s tech drive

- Stock gains this year in Shanghai and Hong Kong have outpaced returns by peers like AT&T and Vodafone in the US and Europe

China’s three telecom operators, perennial value destroyers in stock markets, are no longer market laggards. Tailwinds from Beijing’s digitalisation plan and efforts to bolster global leadership in technology are giving Big Telcos a rare re-rating.

China Telecom has risen 52 per cent this year in Shanghai trading, while China Mobile advanced 28 per cent, outpacing the 7.7 per cent gain in the Shanghai Composite Index. In Hong Kong, China Unicom appreciated 35 per cent, while the Hang Seng Index rose 2.1 per cent.

The telco trio has trounced global peers. AT&T, the biggest phone operator in the US, has gained 2.2 per cent, while European giant Vodafone has climbed 19 per cent in London.

Such outperformance is rare. Chinese state-owned enterprises (SOEs) are often shunned by markets as value destroyers, with inefficient operations and boring outlooks to boot. Yet, investors are now willing to pay at least 34 per cent above the benchmark average to own the stocks, according to Bloomberg data.

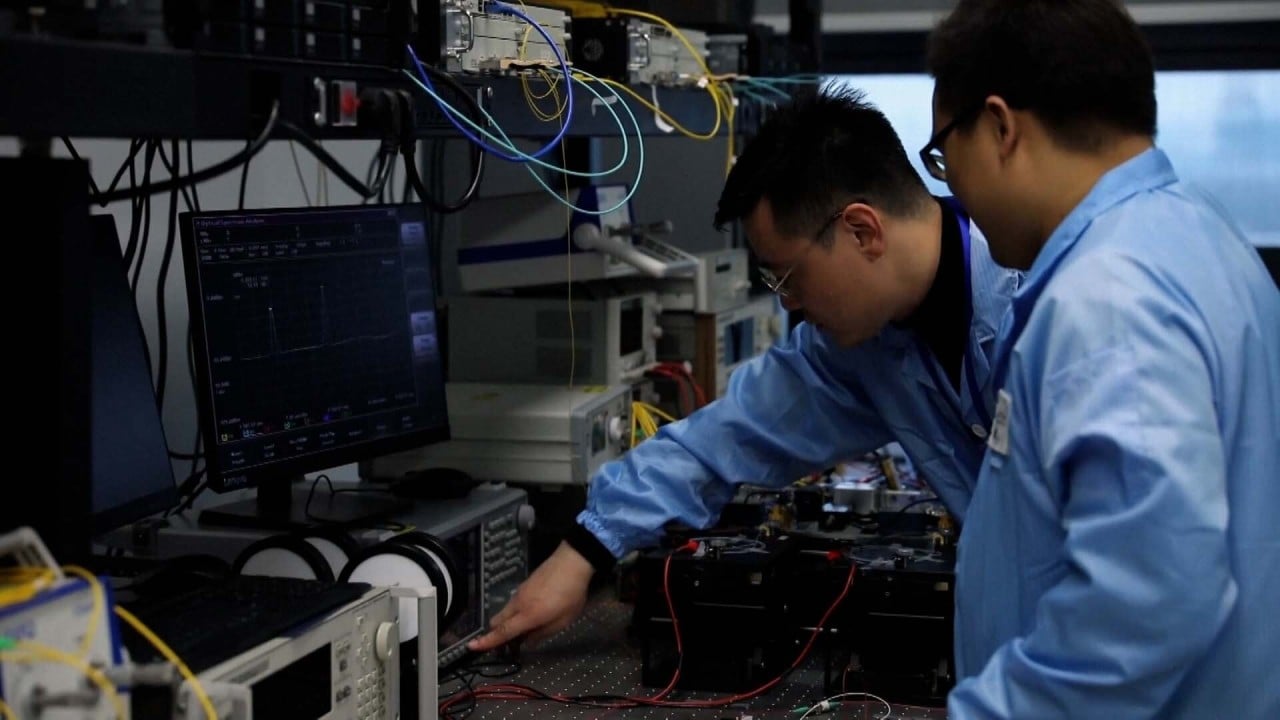

The State Council, China’s cabinet, last week unveiled a grand digitalisation plan to transform the economy, placing data resources as the foundation and pledging to expedite the construction of fifth-generation (5G) mobile-communications infrastructure and supercomputing to support its ambitions.

“The telcos will participate in the whole industry chain of the digital economy, and that will elevate their status,” said Li Na, an analyst at GF Securities in Guangzhou. “The stocks will be in for a revaluation. Digital assets and the valuation model will be the catalyst for the sector this year.”

China unveils grand digital plan powered by 5G, IoT and supercomputing

The Big Telcos’ vast pools of user data will enable the carriers to be deeply engaged in the process, according to China Merchants Securities and GF Securities. Data security means their underlying assets are being revalued to reflect Beijing’s concerns about leakages and national security, they added.

China Mobile, China Telecom and China Unicom had a combined 1.68 billion mobile-phone users at the end of 2022, according to China Merchant Securities. Their combined market value stood at 2.6 trillion yuan (US$376.6 billion).

Revenue from the big-data segment increased almost 59 per cent from a year earlier in the first 10 months in 2022, as the three explored new businesses and strengthened ties with tech platforms including Tencent Holdings and JD.com, the brokerages said.

Still, investors rushing into the Big Telcos may be stepping into a potential landmine. SOEs, represented in the Hang Seng Red Chip Index, have been “serial value destroyers” over the past 12 years, BCA Research said in a report last month.

What are ‘red chips’ and why do they matter to Hong Kong’s market?

“Despite the fact that China has been at the forefront of global technological innovation for telecom equipment and technologies, the shareholders of its telecom operators have lost a lot of money,” it said. “Their share prices have been flat-to-down in absolute terms and their price-to-earnings ratios have fallen to single-digits from 20 in early 2010s.”

Still, China has built the foundations to position itself as the world’s leading science and technology superpower, by establishing a lead in high-impact research across the majority of critical and emerging technology domains, according to the Australian Strategic Policy Institute.

Still, the race for producing ChatGPT-alike bots is underpinning sentiment around Chinese stocks. Huge amounts of processed data - essential for AI-generated content - put the Big Telcos in a favourable light to help justify the re-rating, according to Guosheng Securities.

As an added boost, the government has softened its stance about lowering service fees, according to Great Wall Securities. Authorities have also dropped “market share” as a metric for SOEs in their performance review, the firm added.

“The telecom industry is the digital infrastructure and an important player of the data industry too,” Ma Chenglong, an analyst at Guosen Securities, said in a report last week. “It’s expected to fully benefit” from the current digitalisation push, he added.