Quantitative easing does little to boost gold prices

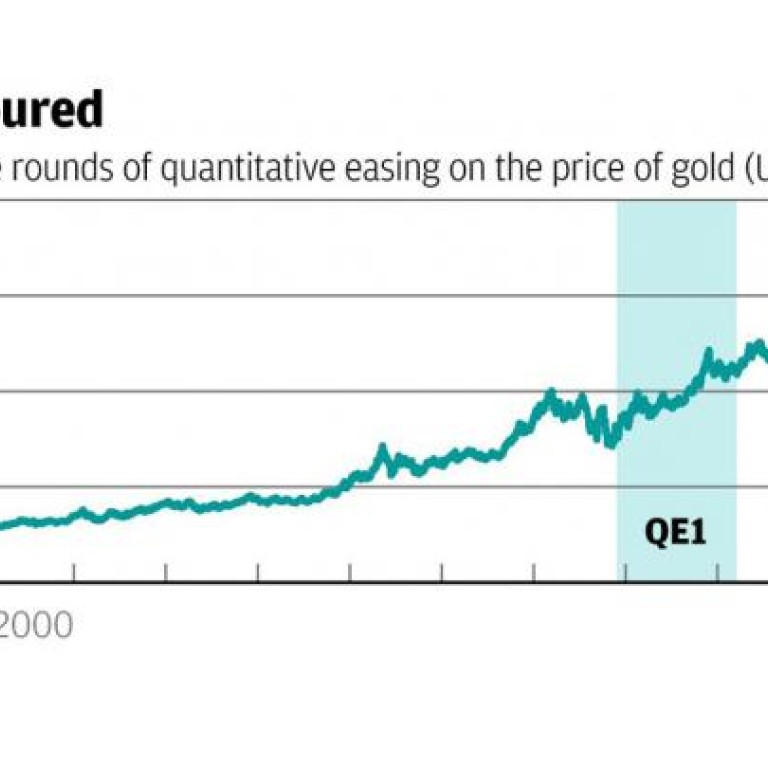

Gold is at a strange juncture. In sharp contrast to the previous two rounds of quantitative easing by the US Federal Reserve, gold prices are trending down, not up (see graph).

Quantitative easing is inflationary. Gold offers protection on inflation. Investors should be buying gold now to guard against QE3-fuelled inflation, but this is not the case.

Why not? Gold prices are largely driven by sentiment. No one has a fundamental need for gold. The annual production of gold is only about 3 per cent of the stock of gold held by investors around the world. Which means any price move in the metal is driven by sentiment, not annual supply and demand.

Sentiment is a fickle thing. Investors cannot be counted on to buy gold even if the circumstances suggest the time is right.

Although gold has had a great run in the past decade, much of it has come in response to the uncertain times unleashed by the global financial crisis, and the liquidity injections and rate cuts in the central bank actions that followed.

The fact that gold did not react positively to QE3 reflects the view that the US economy is recovering. As it picks up, the likelihood of another round of quantitative easing decreases. Already in the minutes of the US Fed meeting held in December last year, discussion has begun about winding down QE3.

Although the Fed has promised to hold the official interest rates steady until unemployment declines to 6.5 per cent and inflation is expected to rise above 2.5 per cent, the coming rate increase is likely to be reflected in the Fed communication and the market interest rates much before the official change occurs.

Any rise in the US dollar would also be negative for gold, as its price often picks up in response to US dollar weakness. The rise in rates would also reduce the relative attractiveness of gold and raise holding costs.

Those who want to take exposure to gold can do so through exchange traded funds (such as the SPDR Gold Shares or iShares Gold Trust), or in physical form, or through equity shares in gold producers.

Dilip Parameswaran is the head of Asia Credit Advisors