China's gold consumption poised to surpass India's this year

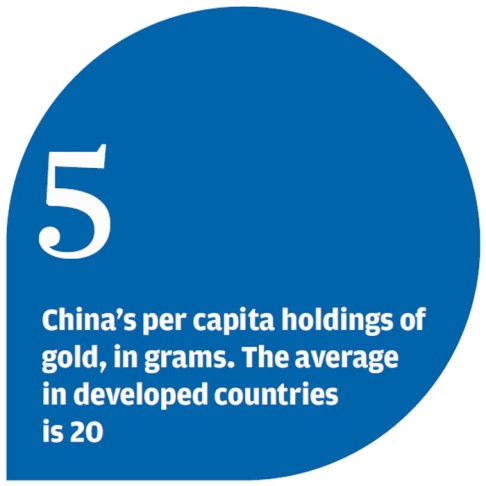

China is poised to pass India as the largest bullion consumer as early as this year after New Delhi raised import taxes and Beijing made investing easier, the China Gold Association said.

China is poised to pass India as the largest bullion consumer as early as this year after New Delhi raised import taxes and Beijing made investing easier, the China Gold Association said.

"We saw some frenzied buying following gold's rout in April and our preliminary estimate confirms that consumption reached about 137 tonnes, more than double a typical month," Zhang Yongtao, the association's vice-chairman, said yesterday in Zhaoyuan, Shandong province. "Chinese demand for gold will remain robust because people are getting wealthier and investment choices are limited."

Gold's slump into a bear market in April spurred "unprecedented" demand from both countries as buyers thronged shops for jewellery, coins and bars, the producer-funded World Gold Council said in May.

Bullion fell 20 per cent this year amid concern the US Federal Reserve may rein in stimulus that helped it cap a 12-year bull run last year and as investors reduced holdings in exchange-traded products backed by the metal.

Bullion of 99.99 per cent purity on the Shanghai Gold Exchange fell 4.3 per cent in the first quarter. The international gold price fell than 4 per cent to below US$1,300 an ounce last night.