Silver market sets scene for new benchmarking in electronic era

Market replaces century-old 'fix' with auction-based and auditable mechanism that is also tradeable with more direct participants

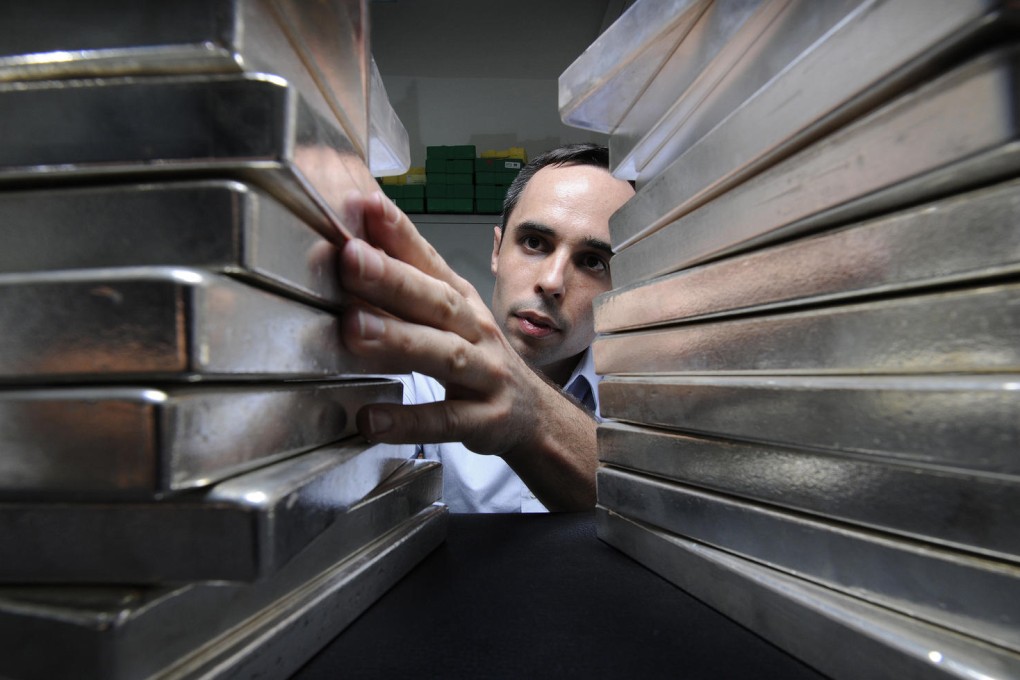

The silver market entered a new electronic era in benchmarking yesterday after a regulatory drive for more transparency in price setting brought the 117-year-old silver "fix" to an end.

Driving the change has been the increased scrutiny of precious metals "fixes" by European and United States watchdogs in the wake of benchmark manipulation in other financial markets.

The new price mechanism is not only electronic, auction-based and auditable, it is also tradeable with an increased number of direct participants.

The process will be operated jointly by the Chicago Mercantile Exchange, which provides the platform and algorithm, and administrator Thomson Reuters.

The London Bullion Market Association, which acted as a facilitator in the quest to find an alternative to the benchmark, said on its website that the exact number of participants in the first auction would not be known until yesterday.