Thin turnover expected in debut for HKEx metal contracts

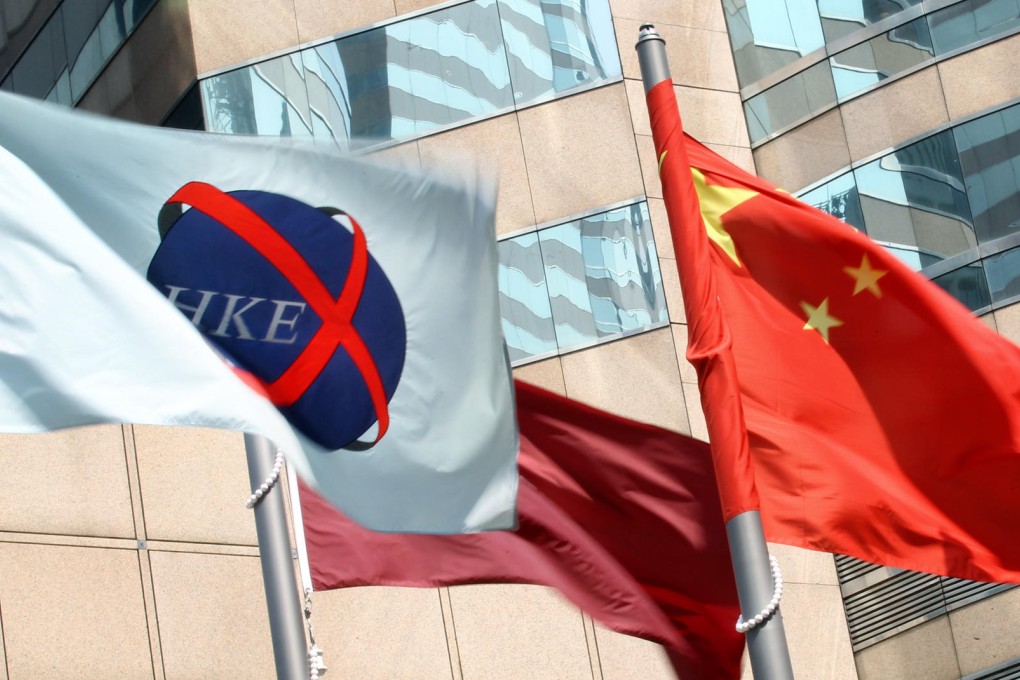

Zinc, copper and aluminium futures denominated in yuan to make their trading debut today, setting a milestone for the Hong Kong exchange

The Hong Kong Exchanges and Clearing will today launch a milestone commodities trading platform by introducing Hong Kong investors to three yuan-denominated metal contracts.

Two weeks ago, the exchange was linked to its Shanghai counterpart in the landmark stock through train scheme allowing cross-border trading.

Brokers' reaction to the metal contracts has, however, been tepid. Of the 179 brokers, only 72 have prepared their systems to trade the products.

"I have my system ready and have promoted the products to customers. But customers so far have shown little interest," said Gary Cheung Wai-kwok, the chief executive of Tung Shing Futures (Brokers). "That is not a surprise as many of them only like to trade Hang Seng Index futures and have little interest in other futures products."

The three contracts - zinc, copper and aluminium - will be traded electronically, with each contract size set at 5 tonnes, representing a fifth of normal contract size traded on the London Metal Exchange, the world's largest metal exchange that HKEx took over in a HK$16.96 billion deal in December 2012.