Advertisement

Advertisement

Opinion

Chart Book

by Nicole Elliott

Chart Book

by Nicole Elliott

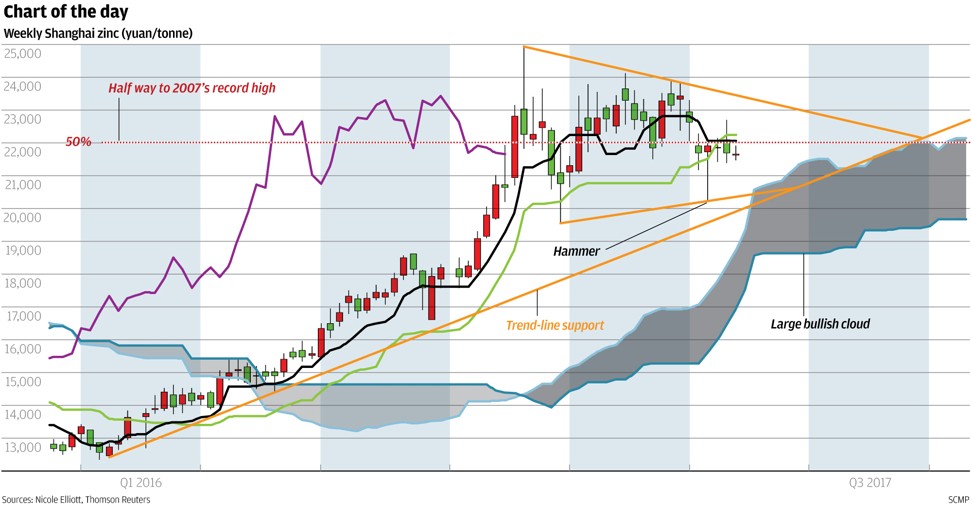

Chart of the day: Zinc swings

Since late last year the price of zinc on Shanghai’s Futures Exchange has seen some wild swings. What had been a right-angled triangle has morphed into a symmetrical one around to 50 per cent retracement level. Volume has been higher than average, open interest rising steadily, and observed volatility, while lower than in April, is one standard deviation above the long-term mean. This, coupled with a large supportive Ichimoku cloud, means that our bullish stance has not altered. If anything this year’s consolidation has put the market back closer to its long-term trend and likely to move at a more sustainable pace. Our upside targets remain at 27,000 and 28,650 yuan per tonne.

Nicole Elliott is a technical analyst

Post