Goldman lifts copper price forecast to US$7,050, with China expected to drive half of global demand over next five years

Rising electric vehicle sales to play significant part, as pure battery-powered cars use about four times the amount of copper than conventional internal combustion engines

Goldman Sachs has raised its 12-month copper price forecast to US$7,050 per tonne from its previous US$5,500, with China expected to drive half of the global consumption growth over the next five years.

It also said that electric vehicle development is becoming an increasingly important market for the metal.

“We expect China copper demand to increase 3.1 per cent in 2017 and 1.8 per cent per year on average from 2017 to 2022,” said Goldman analysts Hui Shan, Jeffrey Currie, Mikhail Sprogis, and Yubin Fu, in a research report on Tuesday.

China’s growth is expected to slow because of a shift away from an unbalanced economy where the property market played an overly dominant role. But it will still account for half of global copper demand increases over the next five years, they added.

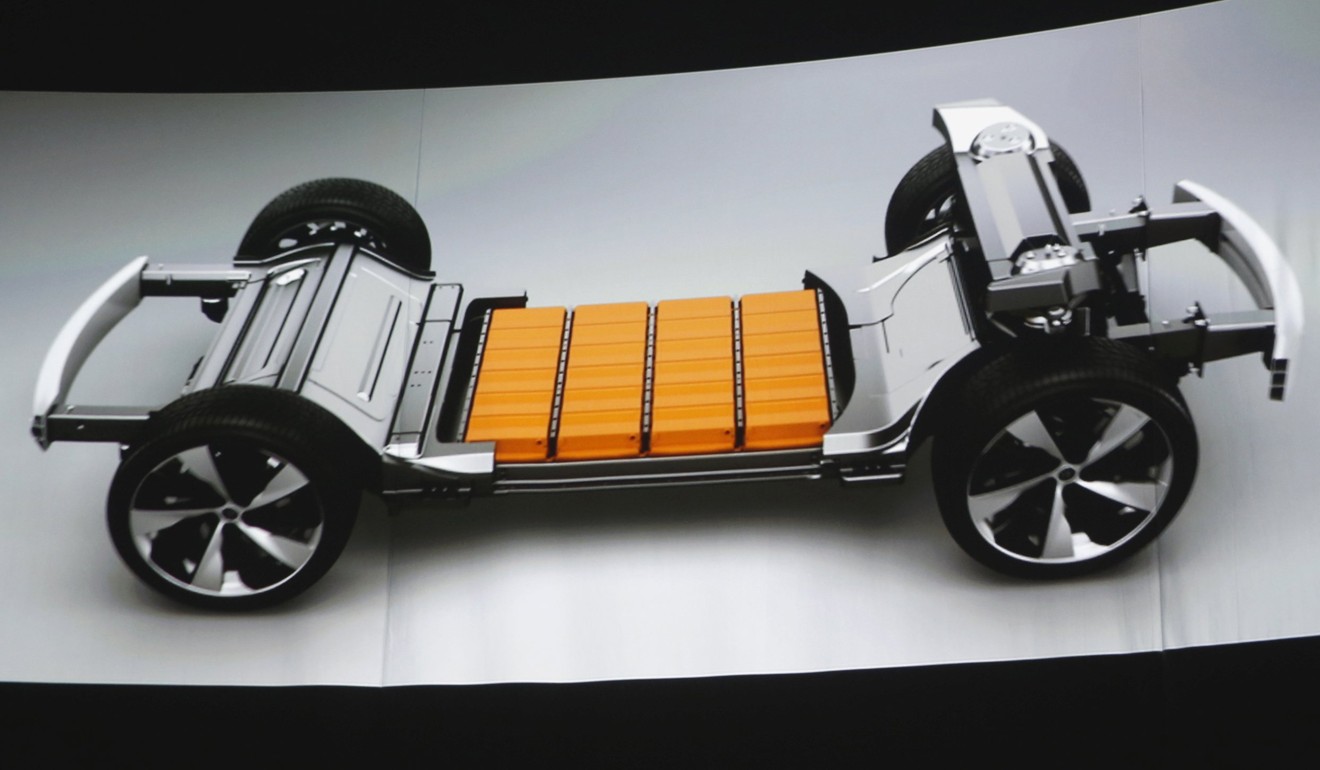

Electric vehicles use a substantial amount of copper, such as in lithium-ion batteries and rotary motors. An average pure battery-powered electric car uses about four times the amount of copper than conventional internal combustion engines.

Overall, Goldman projects world copper demand to rise 2.5 per cent in 2017 and 1.8 per cent per year on average from 2017 to 2022.

That demand growth, combined with a weaker US dollar, will translate into around a 10 per cent increase in copper prices from 2017 to 2018, they said.

The analysts raised their three-month, six-month, and 12-month forecasts to US$6,750, US$6,900, and US$7,050 per tonne, respectively, higher than the previous US$6,200, US$5,600, and US$5,500.

Copper prices recently breached the US$7,000 per tonne for the first time since 2014. Copper on the London Metal Exchange has soared nearly 30 per cent this year, heading for its biggest annual increase in seven years.

The recent rally is fundamentally driven, rather than speculatively driven, the analysts said.

“First, the dollar weakness since June alone would have pushed copper prices to US$6,600 per tonne by our estimates. Second, we believe receding fears about China’s economic tightening and growth slowdown contributed to the rest.”

After a dismal 2015, Chinese demand for copper picked up sharply in early 2016 on the back of a government-led credit stimulus.

Even though demand growth decelerated in 2017 as the property market slowed, it remains at “healthy” levels.

“The markets have not fully appreciated the synchronised nature of global growth and the reduced downside risks from China,” Goldman added.

“In essence, we now think global growth has more room to run and copper will benefit from the synchronised pickup in world economic activity.”

The analysts predicted global electric car sales growth will help drive copper demand increases of 850 kilotonnes by 2025, under their base case forecast that 8 per cent of total car sales in 2025 will be electric. However, they also warn copper may be about to hit a “wall of supply”.

Historical data suggests disruptions tend to rise when copper prices are strong, as higher commodity prices give workers and governments more bargaining power and disputes are more likely to emerge, they added.

Compared to their previous forecast, the analysts now expect slightly lower growth in mine supply in 2018, at 3.5 per cent.