China EVs: lithium producers Ganfeng, Tianqi issue profit warnings, blame price plunge for battery material as stocks sink

- The two producers of the metal that powers EV batteries expect 2023 net profit to decline by as much as 80 per cent

- Ganfeng shares dropped 5 per cent and Tianqi declined 5.9 per cent on Wednesday in Hong Kong

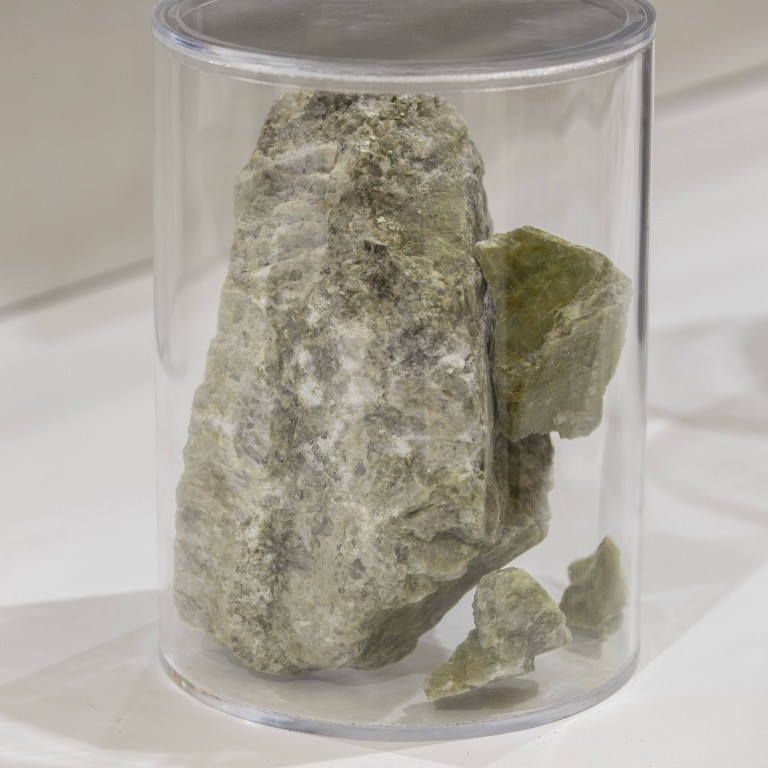

Shares of Ganfeng Lithium and Tianqi Lithium, two of the world’s largest producers of the metal that powers batteries for all kinds of products including electric vehicles (EVs), fell after warning their profits plunged last year due to sharply lower prices.

Xinyu, Jiangxi province-based Ganfeng, which said its production capacity was the world’s third largest and China’s biggest last year, said in a filing late on Tuesday that it expects its 2023 net profit to decline between 70 and 80 per cent year on year to between 4.2 billion yuan (US$587 million) and 6.2 billion yuan.

After accounting for non-recurring losses and gains, net profit will amount to between 2.3 billion yuan and 3.4 billion yuan, down between 83 and 88.5 per cent from the 2022 level, it added.

Sichuan province-based rival Tianqi also posted a profit warning on Tuesday, saying it expects net profit to decline between 62.9 and 72.6 per cent to between 6.62 billion yuan and 8.95 billion yuan.

Ganfeng shares dropped 5 per cent to HK$20.90 on Wednesday in Hong Kong, after falling as much as 6.6 per cent in morning trading. Tianqi declined 5.9 per cent to HK$34.45.

“Due to the cyclical [nature] of the lithium industry and the growth rate of [end-user] demand slowing down, [there was] a significant decrease in the price of lithium-salt products,” Ganfeng said in its filing to Hong Kong’s bourse.

This meant the company had to book major provisions for asset impairments, resulting in lower profits, according to accounting rules. It had 35.68 billion yuan worth of lithium ore at the end of June last year, according to its interim results report.

Tianqi also cited declining lithium prices for the need to book asset-impairment losses.

The average price of China-produced lithium hydroxide exported to South Korea fell to US$35.50 per kilogram last month, 45 per cent lower than the two-year peak of US$64.40 seen in February last year, according to a January 18 Daiwa Capital Market report, which cited China Customs.

Chinese EV battery giant CATL to share swapping tech with Didi in joint venture

Global lithium demand is projected to rise 27 per cent this year to 1.23 million tonnes of lithium-carbonate equivalent, after growing 5 per cent last year and 54 per cent in 2022, according to Daiwa’s forecast.

“In 2024, we believe the focus will be on the supply side,” said Daiwa’s analysts in the report. “De-capacity is the name of the game.”