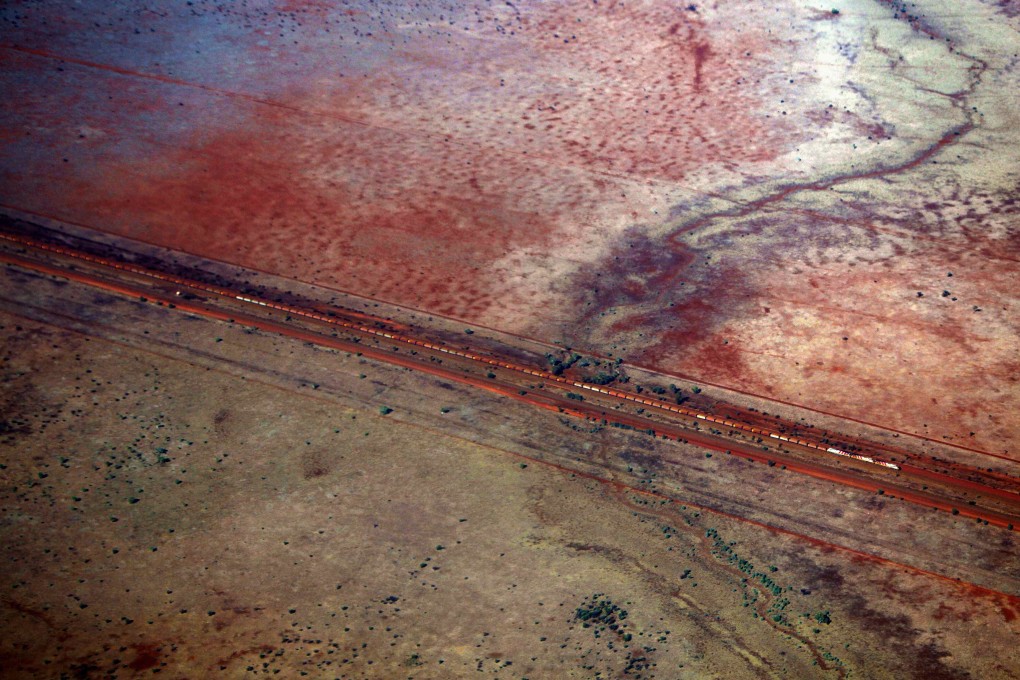

Iron ore plunges to 5-year low on falling demand from China

Iron ore and shipping costs have plunged to the lowest in five years amid signs China's slowing economic growth and a glut of the commodity are sapping seaborne trade.

Iron ore and shipping costs have plunged to the lowest in five years amid signs China's slowing economic growth and a glut of the commodity are sapping seaborne trade.

China imported 67.4 million tonnes of iron ore in November, down 15 per cent from October, according to customs data. This was the first November decline in China's iron ore imports since 1998. The only other time November imports fell since records began was in 1996.

The rate to ship the commodity on a capesize vessel to Qingdao from Tubarao, Brazil, fell 4.4 per cent to US$12.47 a tonne yesterday, the lowest since the start of 2009, data from the Baltic Exchange shows. Brazil's shipments fell 18 per cent in November to 26 million tonnes, the lowest for the time of year since 2010, government data shows.

"December might be even more disappointing than November," said Alex Gray, chief executive of Clarkson Securities, citing his firm's initial discussions with port agents in Brazil. "The absence of Brazilian volume in the scale we'd anticipated has been the key cause of the capesize drop."

Iron ore delivered to China fell 0.8 per cent to US$68.05 a tonne yesterday, the lowest since June 2009, according to Metal Bulletin data. The market needs to absorb a surplus of about 110 million tonnes next year, almost double the 60 million tonnes in 2014, Goldman Sachs Group estimated in October.