9pc profit fall latest setback for Citic

Falling steel demand hits bottom line as firm struggles to get giant Australian mine up and running

Citic Pacific, which recently suffered setbacks in a US$8 billion iron ore project in Australia, saw net profit fall 9 per cent year on year to HK$5.48 billion in the first half.

The drop in underlying profit of the property-to-steel conglomerate is even steeper after stripping off a HK$2.49 billion gain from the sale of its interest in computer network company Citic Guoan and a HK$909 million revaluation gain from investment property.

The company said yesterday the trial run of its Sino Iron project in Australia has been delayed until November. The contractor, China Metallurgical Group, failed to recruit enough licensed Australian engineers to sign off on construction certifications and meet local safety regulation standards, leading to the postponement in production, the company said.

As of June, the company had invested US$7.8 billion in the mine and expects the total cost to be under US$10 billion.

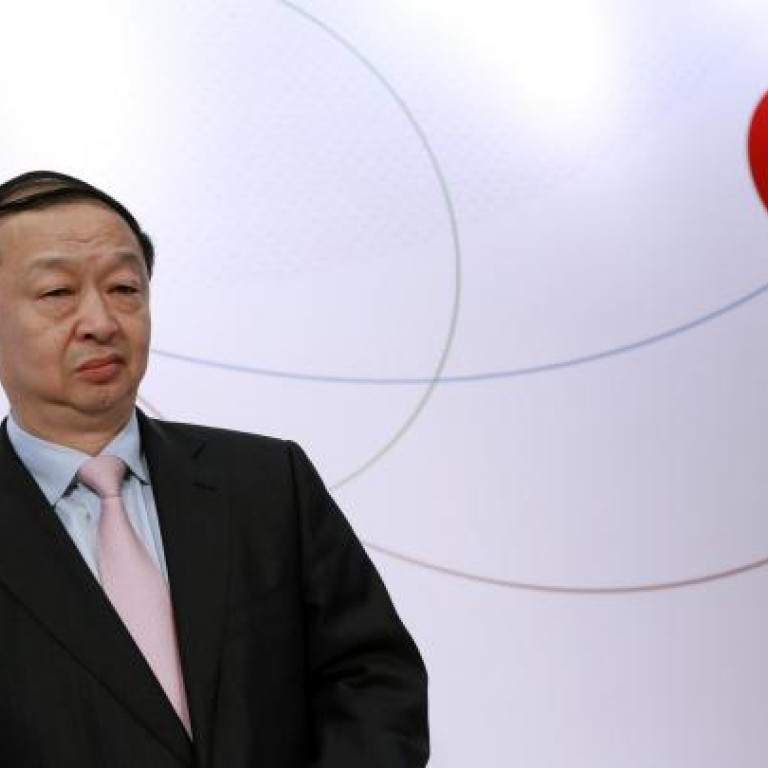

"As I have said before, in developing the world's largest magnetite iron ore mine, we have faced unpredictable challenges in completing a project of this scale," chairman Chang Zhenming said yesterday.

Differences in the regulatory requirements in China and Australia have hit China Metallurgical Group hard despite its experience of developing mines in China.

Chang said making the first production line operational was the top priority, adding it had assigned more personnel to the site and recruited more people, mainly from within Australia, to fill critical positions.

Slower economic growth on the mainland as well as curbs in the property market have taken a toll on steel demand. The iron and steel industry as a whole saw a 50 per cent plunge in net profit in the first half. Steelmakers and product manufacturers saw their profits slashed 68 per cent year on year to 24.9 billion yuan in those six months.

Citic Pacific's unit for special steel contributed 63 per cent less profit in the six months as product prices and margins were under pressure even while sales volume rose. "We expect the rest of 2012 to continue to be tough," said the company, adding overcapacity was the biggest problem for all steelmakers while demand remained weak.

The company's property sales were also hit by government curbs to check home prices. Sales at its projects in Shanghai and Wuxi, Jiangsu, have been slow but those in Yangzhou, Jiangzhou, and Hainan have been satisfactory as there are no sales restrictions in these regions.

Chang said the company would continue to be "prudent" in land purchases and maintain the present size of the land bank. It stopped buying land about seven years ago.

The board declared a dividend of HK15 cents on HK$1.50 earnings per share. The share price dropped 1.2 per cent to HK$ 11.44 yesterday.