Henderson Land interim profit goes down 12pc

Contributions from property projects fall but developer has lined up sales launches until 2013

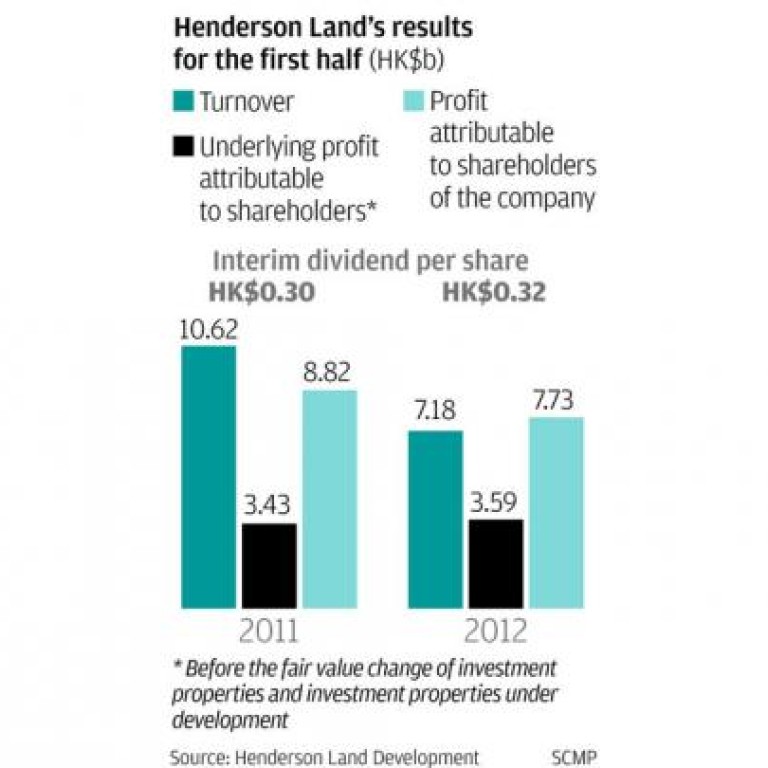

Henderson Land Development posted a decline of 12 per cent in its unaudited net profit to HK$7.73 billion for the six months to June 30 compared with the first half of last year, as contributions from property developments fell.

However, analysts expect higher development income will be booked in the second half, with contributions due from two residential developments - The Gloucester in Wan Chai, and the soon-to-be-sold Double Cove in Ma On Shan.

Chairman Lee Shau-kee cast a vote of confidence in the company, highlighting the positive future contributions due from the redevelopment of old buildings in urban areas and new developments in the New Territories. A total of 3.3 million square feet of residential gross floor area in Hong Kong would be ready for sales launches from the second half of 2012 to 2013, Lee said last night.

"The group's efforts in building up New Territories and land reserves and the redevelopment of old buildings in urban areas have started to bear fruit and pave the way for further development earnings growth," he said. Henderson Land has a total land bank equivalent to 42.4 million square feet of floor area.

During the period under review, profit contribution from property developments fell 56 per cent to HK$867 million, against HK$1.96 billion in the first half of last year, but net rental income rose 22 per cent to 2.4 billion yuan. Underlying profit attributable to equity shareholders amounted to HK$3.59 billion, representing an increase of five per cent over HK$3.43 billion for the same period in 2011.

Turnover amounted to HK$7.17 billion, down 32.49 per cent from HK$10.62 billion.

Earnings per share on net profit attributable to shareholders amounted to HK$3.26, down 17 per cent from HK$3.92 each.

Directors declared an interim dividend of 32 HK cents, up 7 per cent from 30 HK cents a share.

Paul Louie, head of regional property research (Asia ex-Japan) at Nomura Hong Kong, expects Henderson Land to reap an underlying profit of HK$6.9 billion for the full year of 2012, up about 25 per cent year on year from that of 2011.

Meanwhile, Henderson Land's subsidiary, Henderson Investment, said its net profit amounted to HK$23 million, representing a decrease of 59 per cent from HK$56 million for the six months ended June 30 last year.

Earnings per share were 0.8 HK cents, against 1.8 HK cents.

Henderson Investment said the decrease was due to a provisional suspension in the payment of toll fees at the Hangzhou Qianjiang Third Bridge to its joint venture company as of March 20.

The company issued a profit warning on Monday.