Pegasus Entertainment's shares bomb in market debut

Film firm's shares drop nearly 9pc on opening day, but what does it say about IPOs?

Film producer and distributor Pegasus' flop debut on the stock market yesterday came as yet more proof of the city's bleak IPO picture.

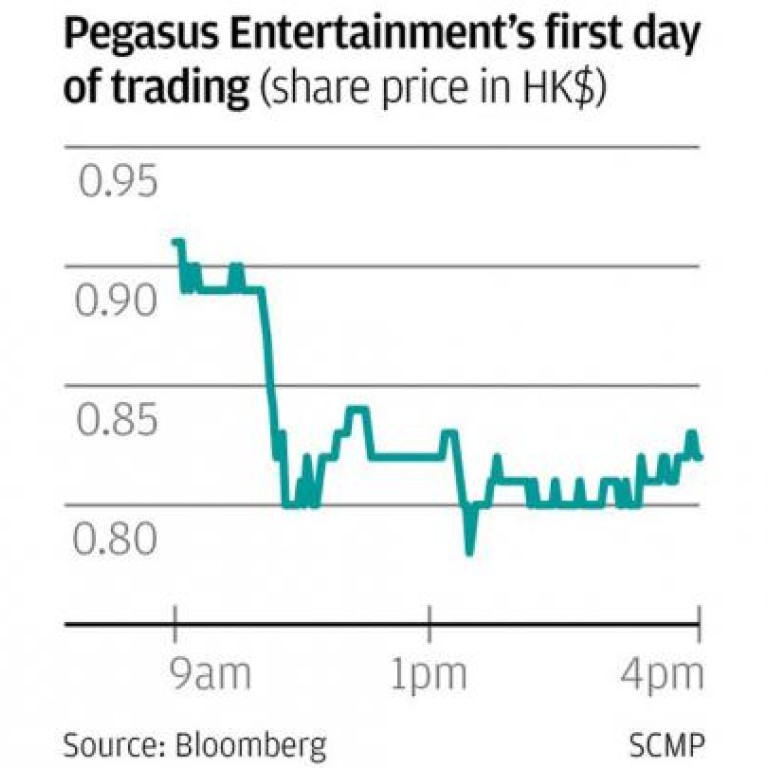

Pegasus, set up by veteran director and actor Raymond Wong Pak-ming, closed 8.9 per cent below its offer price of HK$0.91 on the first day of trading on the Hong Kong Growth Enterprise Market.

Before closing at HK$0.82, it fell up to 14.3 per cent, on a day the benchmark Hang Seng Index edged up 1 per cent.

"The IPO market hasn't heated up, and I can't see when it will," Francis Lun Sheung-nim, managing director of Lyncean Securities, said.

He said companies that only looked to raise funds without creating value for investors should not be allowed onto the stock market, especially when the sentiment was already low.

"Pegasus has no future on the stock market. It will just take the money and leave; they don't care about maintaining the share price," Lun said.

But Christfund Securities research director Simon Lam Ka-hang said he was "very optimistic" about the IPO market, adding Pegasus' poor performance on the opening day had more to do with the quality of the company.

"[Even in good times] the market doesn't guarantee every company will rise," Lam said.

He said there are just too many risks surrounding a film production company, and investors who valued safety wouldn't open their wallets for them.

"In the film industry, questions like 'will you be able to make the film', 'will that film be profitable' are all hard to answer."

Filmmaking has no good business model, either, according to Lam: "It's not like Wellcome supermarket, where you can calculate how much profit a company makes."

He expected the Pegasus stock to fall further to between HK$0.60 and HK$0.70.

Lam, however, was upbeat on the city's IPO market.

"It has been quiet for a long time. The warming-up will happen slowly, but I expect it to come next year as the mainland economy improves and the politics stabilises."