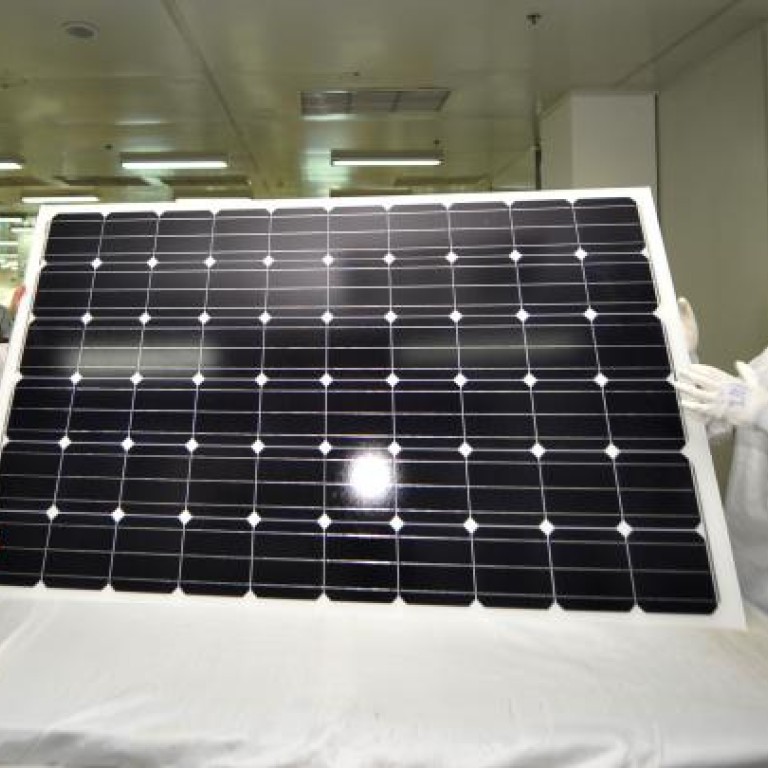

Solar: LDK cuts, First Solar in China

LDK's move toward a state-led takeover continues with its latest poor results, while foreign solar panel makers are likely to benefit from China's plans to build up its solar power sector.

There're quite a few news bits coming from the solar sector today, with more downbeat news from struggling LDK Solar (NYSE: LDK) even as two western panel makers make important new inroads to the China market. Meantime, Canadian Solar (Nasdaq: CSIQ) is also getting some good news in the form of new financing from a major western commercial lender for a new solar power project in Canada.

But its huge debt pile means there's really no way the company can survive without a government bailout, which is likely to be finalised by the end of next year's first quarter. Investors sold off LDK shares after the report came out, with the stock down 10 per cent as many are probably betting their shares could become worthless under an eventual state-led takeover.

It will be interesting to watch and see how First Solar, SunPower and the handful of other surviving western players do in the China market, where they will face stiff competition from local players like Trina (NYSE: TSL) and Yingli (NYSE: YGE). Both Washington and the European Union have taken recent actions to punish Chinese panel makers for receiving unfair support from Beijing, so it's still quite possible we could see Beijing retaliate by excluding foreign companies like First Solar and SunPower from receiving major orders in China. I suspect we'll probably see some bias towards the Chinese panel makers for these new Chinese projects, but that western companies should also be able to get some sizable orders.

Bottom line: LDK's move toward a state-led takeover continues with its latest poor results, while foreign solar panel makers are likely to benefit from China's plans to build up its solar power sector.