Plan to combine power, gas units sparks sell-off

Analyst predicts shareholders will block China Resources' bid to merge two subsidiaries

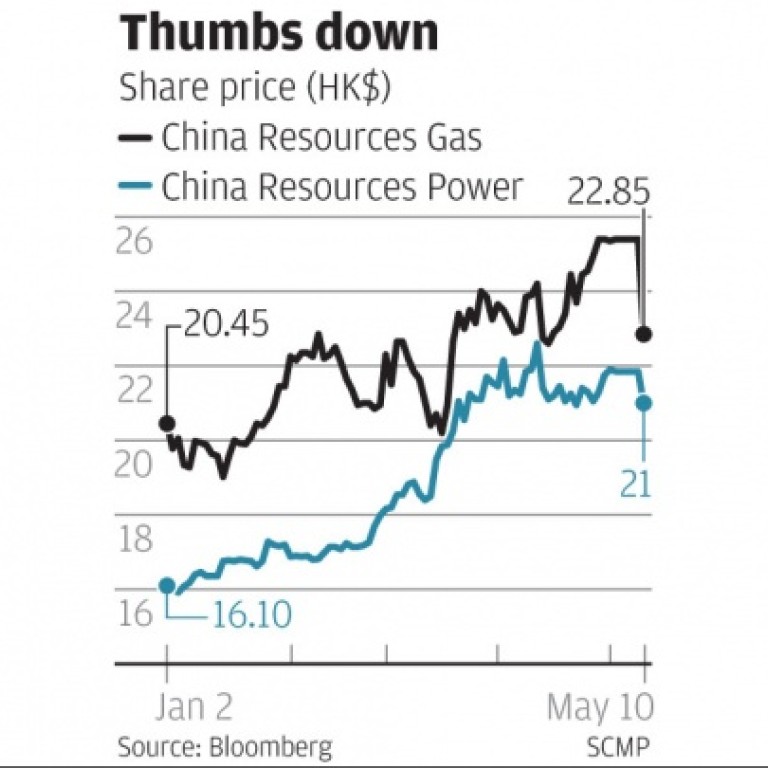

Investors gave a harsh verdict on state-owned China Resources' proposed merger of its gas and power subsidiaries, selling down shares in both companies yesterday, as one analyst suggested the move would not get the necessary shareholder approval.

Market scepticism centres on the increased debt burden for limited business gains, the valuations of the entities and an apparent lack of synergies.

China Resources Power (CR Power) is offering to merge with China Resources Gas (CR Gas) by issuing 97 of its own shares for every 100 shares in CR Gas, CR Power said in a stock exchange filing yesterday. It agreed to pay HK$24.64 a share to CR Gas shareholders, representing a 13 per cent premium on CR Gas' closing share price on May 3, its last day of trade before both stocks were suspended.

However, investors are concerned that CR Power's earnings per share will be diluted, and CR Gas will face derating risks, since capital markets tend to give higher valuation to the natural gas sector, which enjoys structural growth, rather than the heavily indebted power producers. CR Gas is valued at 25 times this year's earnings, while CR Power's price-earnings ratio stands at 13 times.

Alma Yang, a portfolio manager at Shenyin Wanguo Asset Management, said: "CR Power bought something that is not very helpful in the near term at an expensive price, while CR Gas sold itself cheaply, as its valuation would be dragged down significantly. It is highly likely that shareholders will not approve the deal."

CR Power shares fell by as much as 10 per cent to finish at HK$22.85 yesterday, making it the day's worst performer on the Hang Seng Index. CR Gas lost 3.9 per cent to HK$21, its biggest daily decline in nearly a month.

The proposed merger, if completed, will create the largest Hong Kong-listed, mainland-focused energy utilities company by market capitalisation, with assets of HK$220 billion.

However, the proposed deal must be approved by CR Power's independent shareholders at an extraordinary general meeting. It also needs to be backed by shareholders representing not less than 75 per cent of the votes attached to CR Gas shares. Both meetings are yet to be scheduled.

Deutsche Bank analyst Colin Tan said the merger would lead to a debt-capital ratio of 54 per cent, against 49 per cent for CR Gas and 55 per cent for CR Power.