Chinese developer in via the back door

Landsea pays HK$863m for two-thirds stake in listed HK company Shenzhen High-Tech to give it access to international capital markets

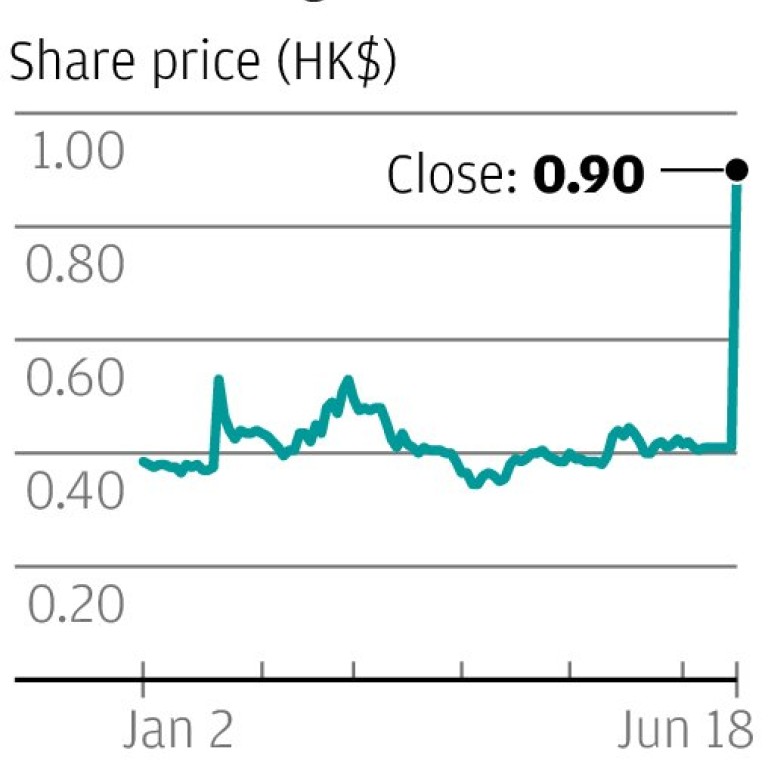

Shares in Shenzhen High-Tech Holdings trebled in price briefly yesterday after the company announced that it had become a back-door listing vehicle for a mainland developer engaged in "green" residential property development.

Shenzhen High-Tech, dubbed a "Qianhai concept stock", as it owns a commercial building near the special economic zone in Shenzhen, said Landsea Group would buy a nearly two-thirds stake in the firm from its chairman, Richard Wong Chung Tak, for HK$863.1 million.

The stock surged to an intra-day high of HK$1.25 when it resumed trading at 1pm yesterday, before closing at 90 HK cents, up almost 120 per cent from the last trading day on June 7. The company had suspended trading on June 10 pending the announcement.

Kenny Tang Sing-hing, general manager of AMTD Financial Planning, said: "More mainland developers are looking for Hong Kong-listed firms as targets for back-door listing. Listing in Hong Kong gives mainland firms a platform to tap international capital markets. Mainland private developers will encounter difficulties in financing amid the austerity measures and credit crunch aimed at cooling the property market."

Tang said given that any sizeable mainland property project easily required at least 10 billion yuan in investment, he believed more mainland developers to follow suit. The announcement said Wong had agreed to sell 1.26 billion shares, 63.4 per cent of the issued share capital of the firm, to Landsea for 68.5 HK cents a share.

The offered price represents a premium of 67.1 per cent over the closing price of 41 HK cents on the last trading day before the shares were suspended.

Landsea's chairman, Tian Ming, said: "Following the completion of the transactions, the listed company will be the only listed platform under Landsea engaged in green residential property development business."

Landsea would consider acquiring more high-quality assets or businesses to facilitate the development of the company when suitable opportunities arise, the company said in a filing with the stock exchange.

Landsea's property business currently covers major cities, including Nanjing, Shanghai, Changzhou and Shaoxing, with more than 30 ongoing and completed property projects with a total development area of about 5.4 million square metres.

Tian, who is the founder and largest shareholder of Landsea, has built up his property business into a company with 15 billion yuan in total assets, from 10 million yuan in 2001.

The deal is expected to take place on or before June 25.