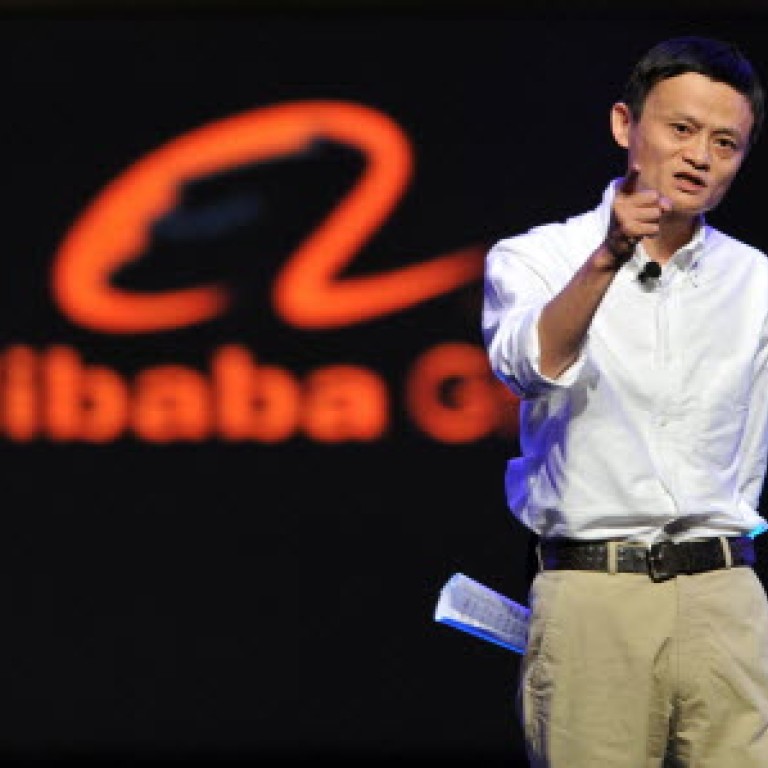

Control issue clouds Alibaba's Hong Kong IPO

Flotation's prospects dim amid founder Jack Ma's apparent desire to stay in charge clashes with listing rules forbidding separate voting rights

Market sources say the desire of chairman Jack Ma Yun to keep clear control of the company he founded in 1999 throws into doubt the likelihood of a Hong Kong share sale given strict listing rules that forbid dual structures that separate voting and ownership rights.

People close to Ma, who founded Alibaba in his hometown of Hangzhou, said the teacher-turned-entrepreneur had planned to move forward quickly with the listing of his Alibaba Group, but that sentiment had changed in recent weeks.

An Alibaba spokesman declined to comment on its plan for an initial public offering.

Market sources say Ma has been planning an IPO of shares in Alibaba Group since August last year, when he de-listed the flagship trade portal Alibaba.com from the Hong Kong stock market.

But that would not happen if he could not keep control of the company, investment banking sources told the .

Taking into account Ma's personal 7.4 per cent stake in Alibaba, the entire management team owns a combined 10.4 per cent stake in the firm. Japan's SoftBank owns 36.7 per cent and US internet giant Yahoo, 24 per cent, according to official information released by the two.

"The most viable solution for Ma to maintain control over Alibaba's board may be to establish a mutual agreement with the two biggest shareholders, Yahoo and SoftBank, who would agree to appoint Ma or his designated person to manage the company on a daily basis," said Edward Au, a Deloitte partner specialising in China listings. An agreement between Alibaba and its major investors Yahoo and SoftBank is, however, easier said than done.

In 2011, Alibaba and Yahoo had a very public dispute over Chinese electronic payments processing firm Alipay. The two parties later reached an agreement that Alibaba would get paid at least US$2 billion but no more than US$6 billion if Alipay goes public.

Alipay provides payment processing services to Alibaba Group and its affiliates, including Taobao, a popular consumer-to-consumer portal on the mainland and widely considered one of the jewels of the Alibaba portfolio.

Hong Kong's current listing rules do not allow a so-called "dual class" voting structure as the US market does. The US system allows the management of a company to retain control through shares that have more voting power than publicly traded shares.

In the New York listing of Manchester United last year, the Glazer family, which has owned the English football club since 2005, sold 42 per cent of its Class A shares to public investors, who would get only 1.3 per cent in terms of voting rights. Under the terms of that sale, Class B shares have 10 times more voting power than the publicly traded shares.

The Glazer family had once considered listing in Hong Kong or Singapore before it picked New York.

Some bankers with working ties with Ma said the Hong Kong securities regulator and the city's stock exchange might review and revise its existing listing rules to attract listings of technology firms such as Alibaba in the event of the US market unwinding the dual-class voting structure to cope with rising demand.

Firms like Alibaba are often run by a group of founding members who own minority stakes due to seed investments by other investors during the start-up period, requiring special provisions for control by founders.

Should China's largest e-commence company succeed in hitting a market capitalisation of US$100 billion, it would rank as the third-largest internet firm behind US search giant Google, with a market cap of US$290 billion, and online retailer Amazon. com, at US$133 billion.

The listing of Alibaba could easily run up to US$15 billion, which would be the biggest capital raising in the city this year.