NQ Mobile chief has defences up

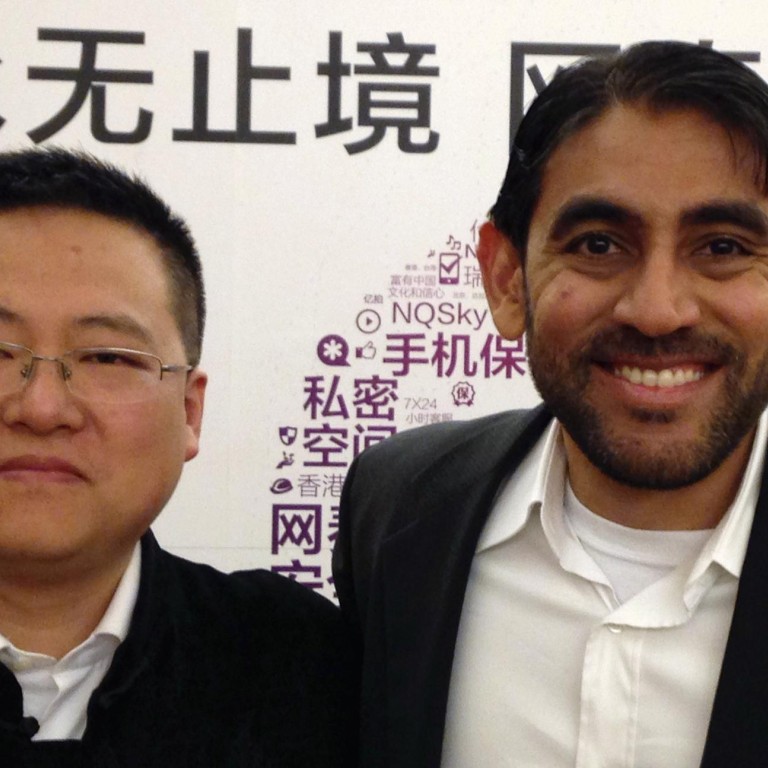

As Omar Khan helped whip up 1,500 guests and employees gathered in a Beijing ballroom for NQ Mobile's eighth birthday bash last week, the co-chief executive himself had little to celebrate.

As Omar Khan helped whip up 1,500 guests and employees gathered in a Beijing ballroom for NQ Mobile's eighth birthday bash last week, the co-chief executive himself had little to celebrate.

A day earlier, NQ Mobile, the maker of security software to thwart mobile-phone hackers, was accused by a research firm of inflating revenue, triggering a 47 per cent stock plunge.

The "Never Quit" emblazoned on workers' purple shirts was no longer just a sales slogan: it could be read as a reminder for Khan to dig in and defend his company.

"All of the allegations are false," Khan said as he stepped off the stage.

His challenge now is to respond to the October 24 report by research firm Muddy Waters. He will be drawing on sales skills he honed as a young executive building Samsung's Galaxy smartphone brand at trade shows.

He will be matched against Muddy Waters founder Carson Block, who gained fame after regulators halted trading in four of the first five companies the short seller targeted with his research.

If Muddy Waters is totally right, there’s no way Omar will weather it

Muddy Waters last week initiated coverage of NQ Mobile with a strong sell rating. The first sentence of Block's 81-page report pulled no punches: "NQ Mobile is a massive fraud." Its biggest customer, he wrote, was itself.

"If Muddy Waters is totally right, there's no way Omar will weather it," said Michael Mahoney, the senior managing director at Falcon Point Capital in San Francisco.

"If Muddy Waters is a little bit right, and it was a judgment call but not a falsification of the business, he'd still be tarnished."

Mahoney for now is giving Khan and NQ Mobile the benefit of the doubt. The shares have risen for three straight days, closing at US$14.40 on Thursday in New York. They are still down 37 per cent from the day before the Muddy Waters report.

A particular focus of the report is on revenue, which NQ Mobile in August estimated might reach as high as US$188 million this year, above the upper limit of its prior forecast of US$184 million.

"We believe it is a zero," Block wrote.

NQ Mobile said on Tuesday it had sued Muddy Waters in Beijing. Zachery Kouwe, a spokesman for the research firm, said yesterday that Muddy Waters had not yet seen such a lawsuit.

"For us it's all hands on deck," Khan said. "We are returning to business as normal. Our partners have stood by us."