Fast Retailing mulls direct listing in HK

Fast Retailing, owner of the popular Japanese clothing brand, may consider a direct listing if city's exchange adopts paperless trading

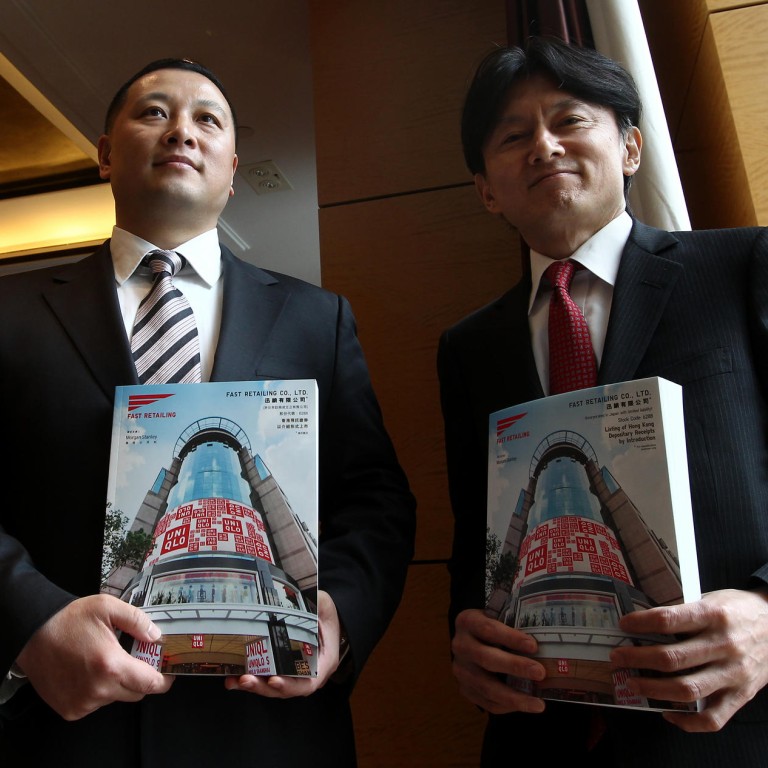

Fast Retailing, the parent company of Japanese fashion chain store Uniqlo, will consider listing directly in the city if its Hong Kong depositary receipts (HDRs) are well-received and the exchange could adapt to paperless trading in the future.

The fourth-largest fashion retailer after H&M, Zara and Gap, Fast Retailing is hoping Hong Kong will eventually launch paperless trading because its shares in Tokyo are being dealt on a paperless basis.

The HDRs will begin trading on March 5, with each representing 0.01 share of the company on the Tokyo Stock Exchange.

Pan Ning, the company's group executive vice-president, said China would replace Japan as its largest contributor in sales in five to 10 years.

Uniqlo Japan accounts for nearly 60 per cent of group sales while Uniqlo International, which includes Greater China, South Korea, Southeast Asia, Britain, France and the United States, contributes 22 per cent. The remainder is from other subsidiaries such as GU and J Brand.

The household brand popular in Hong Kong and mainland China has lost its momentum in earnings growth. It projected earnings for the year to August would increase by only 1.8 per cent to 92 billion yen (HK$6.98 billion). The stronger yen was partly blamed for the tepid performance.

Japan's lukewarm economy and mounting competition among fashion retailers had clouded the company's prospects, said Stephen Leung, a director at UOB Kay Hian Securities. "Its profit margin is under stress as it launches promotions earlier than its rivals due to competition," he said.

Operating income at Uniqlo Japan contracted 5.4 per cent in the past fiscal year, for the third consecutive year of decline. The company is pressing hard to expand to markets such as China, Southeast Asia and other emerging economies to compensate for the weakness in its home market.

Pan said the number of stores in China would grow at 80 to 100 per year while sales were expected to expand at 30 per cent. "Most of the stores will be opened in the mainland as we would like to be present in 661 cities, including those inland, from just 50 cities now."

E-commerce platforms in every market will be reinforced.

Fast Retailing sources 700 million to 800 million pieces of clothing a year, with about 70 per cent from mainland China, where labour costs are on the rise.

"We will continue to diversify our sourcing base to Bangladesh, Indonesia and Cambodia so that the percentage from China will decline," said Takeshi Okazaki, the group's executive vice-president and chief financial officer.