Lifestyle sees profit dip on store move

Sales increase of 6.5pc at Hong Kong stores in contrast to flat growth at mainland outlets

Lifestyle International, the department store operator that owns Sogo in Hong Kong and Jiuguang on the mainland, expects single-digit earnings growth this year due to the closure of its Tsim Sha Tsui Sogo store that will reopen in the fourth quarter in a new location.

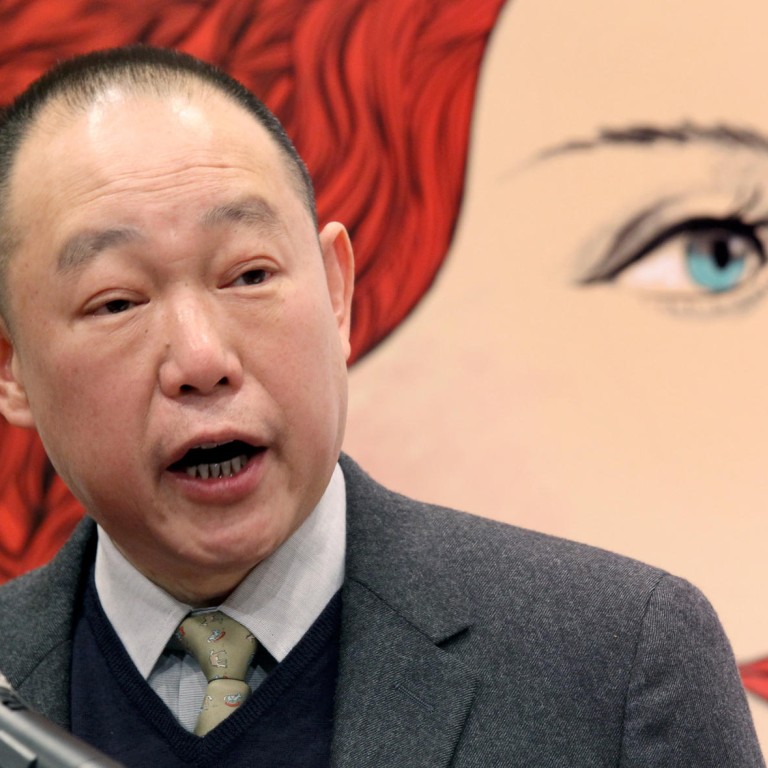

"Lost business is lost business. Turnover will definitely be smaller this year," chief executive Thomas Lau Luen-hung said yesterday.

Lifestyle operates the flagship Sogo store in Causeway Bay. Its Tsim Sha Tsui outlet closed on February 12. It will move to the arcade beneath the Sheraton hotel, with construction expected to begin mid-year.

A new format, aimed at a slightly younger audience, would be tried at the new store. Chief financial officer Terry Poon Fuk-chuen said it would be open to niche brands.

The company's current customer demographic is 35 to 45-year-olds.

The modest outlook stands in contrast to profit growth of 19 per cent for the year ended December. The group made HK$2.45 billion and declared a final dividend of 32.7 HK cents a share.

Sales from the two Hong Kong stores, which account for nearly 75 per cent of the group's total business, grew 6.5 per cent. Mainland operations were flat because of increased retail space competition in Shanghai and the opening of a new department store in Shenyang.

Same-store sales growth for the Shanghai Jiuguang store was negative two years in a row, falling 0.3 per cent year on year.

The company said some of its international luxury brand tenants such as Burberry, which brought in revenue of 10 million yuan (HK$12.7 million) a month, and Hugo Boss had moved across the road to the Kerry Centre. The firm said it expected the Shenyang store to be profitable within three years.

Poon said he was not too worried about competition from e-commerce. "Online retailers tend to sell mass-market products," he said.

Although the company has no immediate plans to set up an e-commerce platform, Poon said the group would explore a model in which customers could order online and pick up in person, similar to competitor Lane Crawford.

The group opened its first supermarket store, Freshmart, in Shanghai's Changning district in July.

Lifestyle's share price yesterday fell 0.13 per cent to close at HK$15.50, as the Hang Seng Index dropped 0.8 per cent.