Missing aircraft sparks interest in aviation insurance

Following the disappearance of the Malaysian jetliner, more mainland travellers are now considering buying accident insurance

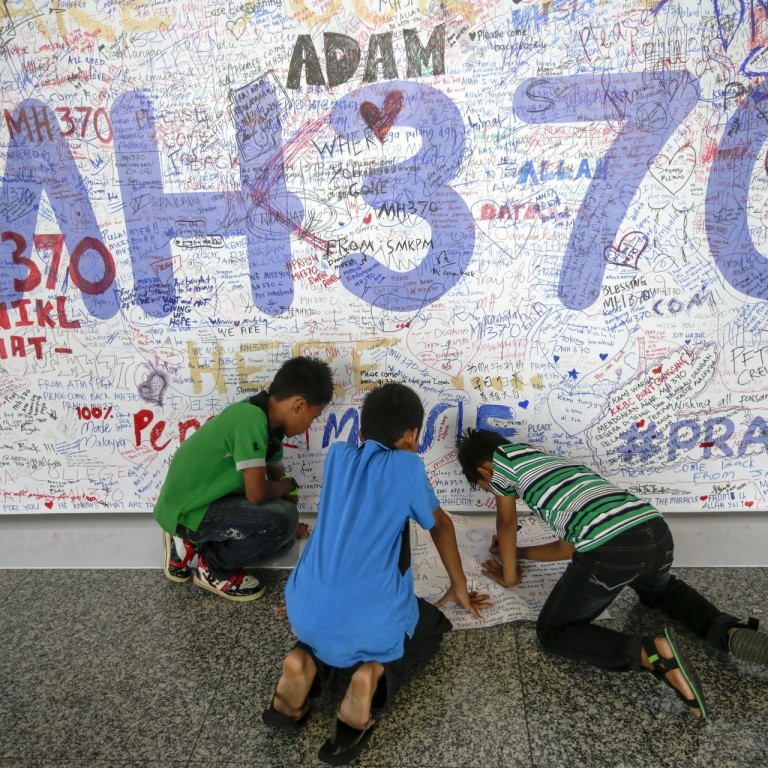

Mainland travellers have become more keen in buying aviation accident insurance after getting a rude wake-up call following the disappearance of the Beijing-bound Malaysian jetliner with more than 239 people on board.

"I didn't consider buying aviation accident insurance every time I travelled by plane, but I will the next time as the Malaysia Airlines case has made me alert to the risk," said Zhang Jin, a Beijing resident who flies four to five times a year. "I have to consider how to protect my family if I am injured or die in a similar plane incident.

The aviation accident insurance is on a voluntary basis, but it's preferred

"Actually, it's very easy to buy the insurance online, but I have never been aware of its importance. I may not buy travel insurance, but aviation accident insurance is needed."

Sales of aviation accident insurance have risen sharply after Malaysia Airlines flight 370 went missing after taking off from Kuala Lumpur on March 8.

The plane is yet to be found.

An aviation accident insurance product for a single round trip offered by China Pacific Insurance on online shopping platform Taobao saw an average of 43 transactions per day after the incident, while the average in the week before the flight vanished was about 22 transactions.

A PICC Life Insurance's one-year aviation accident insurance product recorded 12 policies sold after the case, compared with three policies sold a week before the incident.

Li Bin, a lawyer at Beijing Gaose Law Firm, said Chinese travellers were increasingly aware of the insurance but they should pay more attention to coverage of the different policies.

"The coverage of aviation accident insurance is quite limited. I would recommend general accident insurance which offers a more comprehensive coverage," Li said.

The coverage of aviation accident insurance begins only when the insured passenger steps into the aircraft and until he walks out of the cabin door, but he said other accidents could take place during the trip.

Many Chinese travellers' awareness on buying personal insurance is low, and some may rely on the liability insurance included in the ticket purchase.

"Claims against that kind of insurance are paid by the insurance company to the airline, and the airline pays the passengers in case of injury or death," Li said. "It's different from personal accident insurance that passengers can receive the claims from insurance companies directly."

Wang Xujin, an insurance professor at the Beijing Technology and Business University, said claims paid by the airline to passengers were lower than that for personal aviation accident insurance.

The payout for aviation accident insurance is capped at two million yuan (HK$2.49 million), according to the China Insurance Regulatory Commission.

"The aviation accident insurance is on a voluntary basis, but it's preferred," Wang said.

He also said travellers should pay attention to the legal terms and disclaimers on exclusion coverage such as war, military acts and terrorism.

Li said most insurance companies would exclude terrorism from coverage in aviation accident insurance, while some also excluded carriers of HIV, the virus which causes Aids.

Since aviation accident insurance is a type of product that travellers would prefer buying online, he said consumers should take note of exclusions in the coverage.