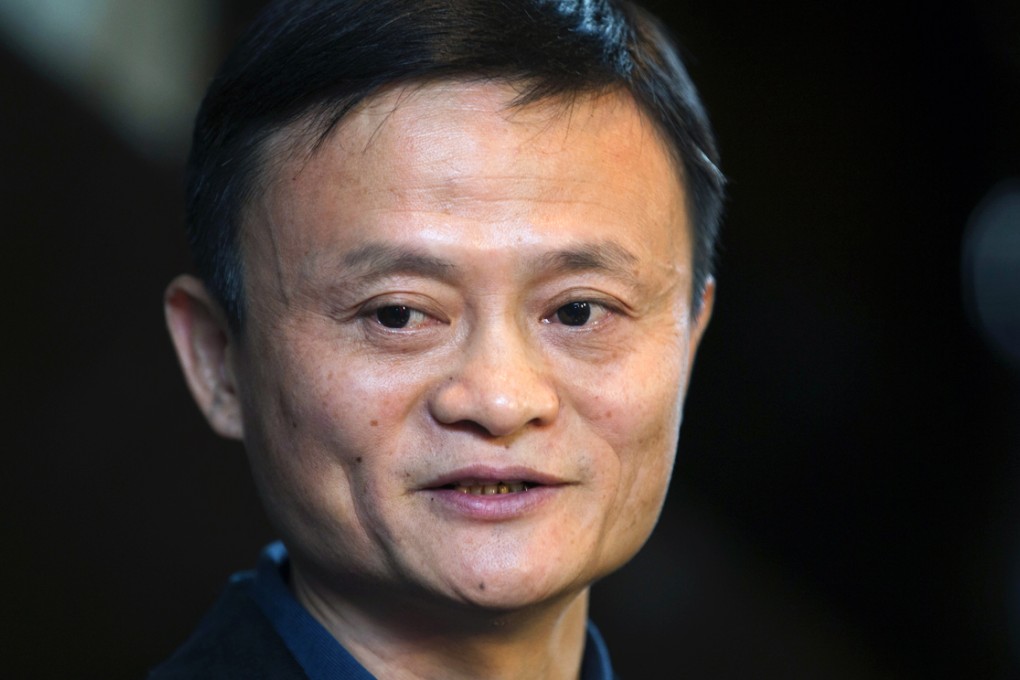

Alibaba eyeing Europe and US for growth after IPO, says Jack Ma

Alibaba chief talks of growth plans while visiting Hong Kong to launch roadshow

Mainland e-commerce giant Alibaba plans to speed up its business expansion in the US and Europe after its mammoth initial public offering in New York this week, chairman Jack Ma Yun said in Hong Kong yesterday.

Ma also said Alibaba respected Hong Kong's decision to turn down its proposed partnership structure, which led to it seeking to list in New York instead, describing the decision to list elsewhere as "a regrettable move" due to Alibaba's lack of preparedness and limited communication with relevant parties.

"I speak from my heart, I love Hong Kong," Ma, 50, said at the Ritz Carlton Hotel in Kowloon, where hundreds of institutional investors and reporters had gathered for the start of Alibaba's pre-IPO roadshow in Asia.

"We hope to become a truly global company."

Ma, a former English teacher who founded the e-retailer in Hangzhou in 1999, said it planned to expand its footprint in the United States and Europe, but would not give up on Asia.

Alibaba accounted for 80 per cent of online retail sales in China last year.

Through a number of profitable sites including Taobao and Tmall, it generated gross merchandise volume of US$296 billion in the 12 months to the end of June this year, on the back of growing internet usage and an expanding middle class.