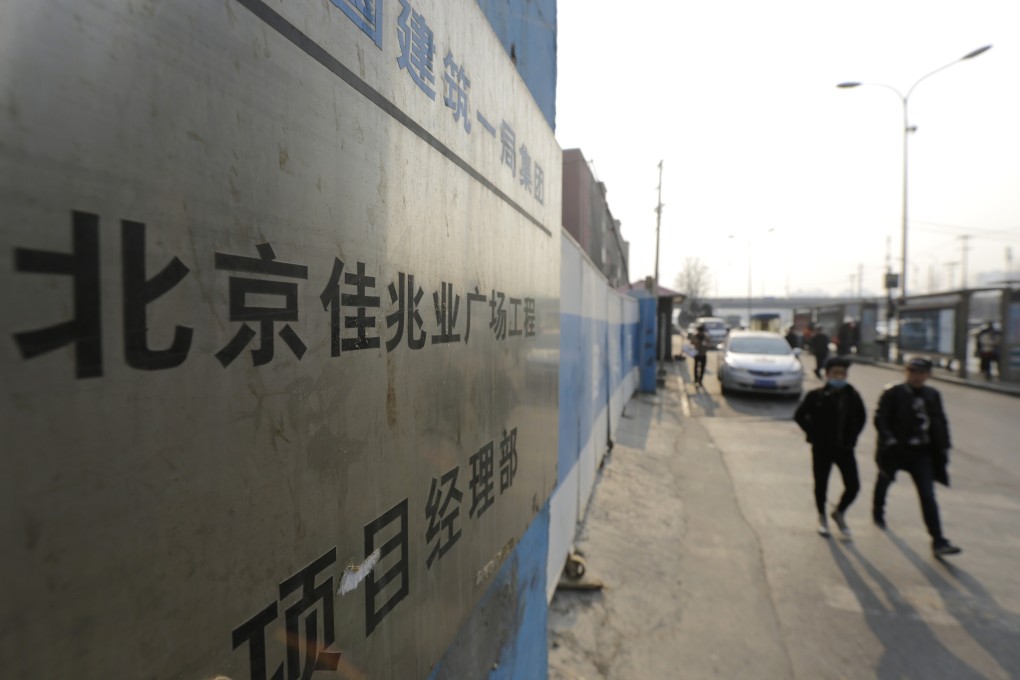

Developer Kaisa's shares tumble on US$2b frozen asset disclosure

Shares at Kaisa Group Holdings fell by more than 9 per cent on Tuesday morning as the troubled Shenzhen-based property developer revealed in a stock filing that assets frozen by courts to protect creditors soared to more than US$2 billion.

Trading in Kaisa shares was halted on Monday and resumed on Tuesday.

The company had said on Monday that its debts totalled more than US$10 billion (HK$78 billion) and that it needs to urgently restructure its borrowings in order for a proposed rescue deal by Sunac China Holdings to proceed.

In a stock exchange notice, it said its aggregate interest-bearing debt stood at 65 billion yuan (HK$81 billion) at the end of 2014, which includes trade creditors. As much as 35.5 billion yuan of this debt could be due before the end of 2015.

The company had previously reported that as of June 30, 2014 its borrowings only amounted to 29.8 billion yuan, though this number would not have included trade credit.

Kaisa’s problems rattled Asian corporate debt markets at the start of this year after it was in technical default on a HK$400 million loan from HSBC and was late on a US$26 million bond coupon payment.