New | Hanergy is Hong Kong's most traded stock as price jumps 22pc

Analysts remain concerned over business fundamentals despite upbeat net profit forecast

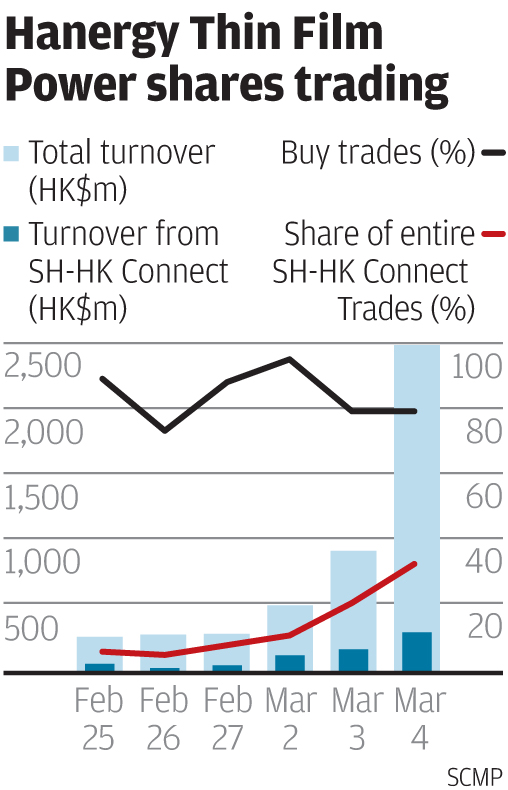

Hanergy Thin Film Power Group (HTF), whose soaring share price and growing web of connected transactions with parent Hanergy Holding have raised eyebrows and analysts' concerns, saw its share price jump 22 per cent and was the most traded stock in Hong Kong on Wednesday.

Although the share price surge was supported by the solar power panel production equipment maker and solar farms developer's announcement on Monday after the market closed that it expected last year's net profit to have jumped 55 per cent, analysts remained sceptical of its business fundamentals, brokers said.

"This stock is strictly for speculation, there is little in its fundamentals you can rely on," said GEO Securities chief executive Francis Lun Sheung-nim. "The talk in the market is that some well-heeled mainland investors are buying its shares like crazy, and a certain overseas hedge fund has racked up huge losses by shorting 1.2 billion of its shares when they were just over HK$1."

The shares closed at HK$6.40, up from HK$5.25 on Tuesday, after reaching an intraday record high of HK$6.44. It has risen more than fivefold in the past year. The Hang Seng Index fell 0.96 per cent on Wednesday.

HTF, 73 per cent controlled by Li Hejun, ranked mainland China's richest man by the latest Hurun rich list and the third-richest by Forbes, was called a stock market bubble by corporate governance activist David Webb in December last year due to its high market valuation compared to its net tangible assets, and big receivables owed by its parent, which bought its equipment.

Since then, the firm said its parent had fully settled amounts owed by last year-end, but added other amounts would be owed later when more batches of equipment were delivered.

It has signed two contracts to sell machinery to its parent totalling US$8.5 billion, which is capable of making 10 GW of solar panels.

Last month, HTF signed a contract with its parent to buy from it 2.3 GW of solar power panels between this year and 2017. CLSA head of sustainable research Charles Yonts estimated in a report that solar farms using that amount of panels would cost 52 billion yuan (HK$65 billion) to build. HTF has yet to disclose whether it has secured government approvals to build solar farms using the panels.

"So far, all we know of is 0.6 GW, of which 0.4 GW is in Ghana," Yonts wrote. "The company has not been very transparent about its pipeline even on a memorandum of understanding basis, let alone broken down by early-stage or late-stage pipeline."

While HTF has been making an attractive gross profit margin of some 80 per cent on equipment sold to its parent, such a level may not be sustainable as the parent and HTF "can make their prices whatever they want them to be," Webb told the .

HTF late last month signed a contract to sell US$660 million worth of panel making machines to Shandong Macrolink New Resources Technology, 40 per cent-owned by mainland private conglomerate Macrolink New Resources, which also agreed to buy a 3.5 per cent stake in HTF.

It would be its first major sale of machinery to a party other than its parent.