US$14b default forgotten as Indonesia billionaire Widjaja sells debt

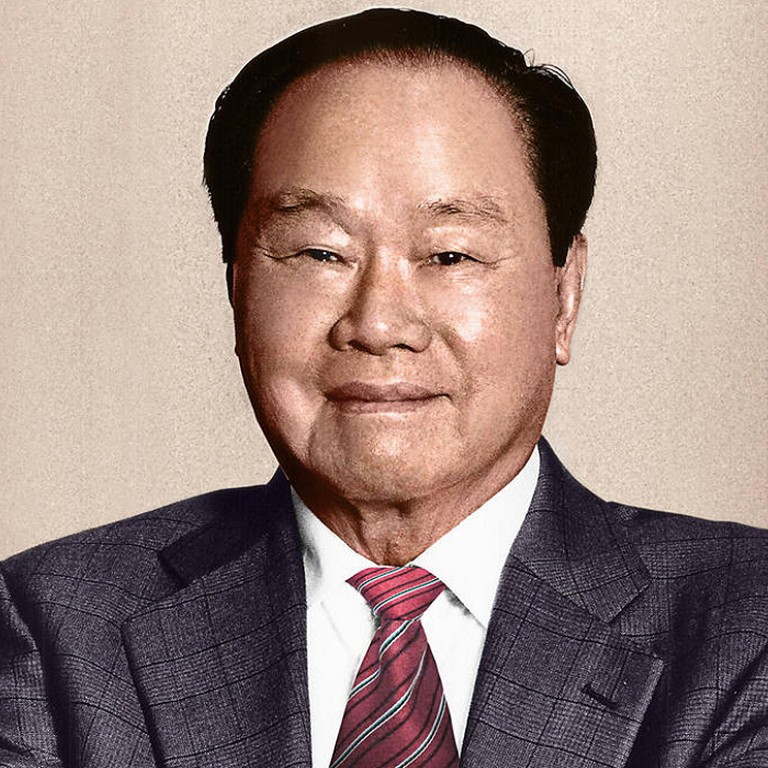

Foreign investors show confidence in companies backed by billionaire Eka Tjipta Widjaja despite involvement in Asia's worst corporate default

Foreign investors have either forgiven or forgotten the events that involved the billionaire Widjaja family in Asia's worst corporate default.

Companies backed by 91-year-old Eka Tjipta Widjaja, Indonesia's fourth-richest person, received orders twice the size of two bond issues last week at yields below the average of Asian junk-rated peers.

Developer Bumi Serpong Damai raised US$225 million from a debut sale of US dollar notes. Golden Agri-Resources, the world's second-largest palm-oil producer, issued S$125 million (HK$731 million) in its third sale in a year. The family is preparing a bid for an Indonesian coal producer in the midst of a dollar-debt restructuring.

Fourteen years after Widjaja's sprawling Sinarmas empire was pummelled by a US$14 billion default by its Asia Pulp & Paper business, investors are showing faith in its credit.

The combined market value of 12 family-controlled companies listed on the Singapore and Jakarta exchanges has held steady at about US$15 billion over the past year. Moody's Investors Service rated Bumi Serpong at Ba3, the third-highest junk grade, citing the developer's healthy finances.

"There's always going to be new investors keen to try their luck with the group even after the Asia Pulp & Paper debacle," said Charles Macgregor, head of Asia high-yield research in Singapore at Lucror Analytics.

"They will probably come back every now and then to re-establish their position in the debt market through some of their better businesses."

Asia Pulp & Paper halted payments on a total US$13.9 billion of bonds, loans and trade payables in 2001, after a 20 per cent plunge in global paper prices over three months. That included about US$6.7 billion of dollar notes, the biggest missed bond obligation by an Asian company to date, data showed. The firm became mired in legal challenges as Indonesian courts cancelled debts and creditors lost millions.

Founded in 1972, the pulp and paper business controlled by the Sinarmas Group embarked on a global fundraising drive that included a 1995 US share sale. Its failure came in the wake of the Asian debt crisis, when companies across the region defaulted on billions of dollars of liabilities and Indonesia was one of three countries forced to seek an International Monetary Fund bailout.

"All the corporate groups in Indonesia were suffering, especially during the 1998 Asian crisis, and Asia Pulp & Paper had tried to continue to service its debt right until we really had to give up in 2001 because of the deteriorating macro situation in the country," said Gandi Sulistiyanto, Sinarmas's managing director in Jakarta. "Our group is responsible with its debt despite the bad, difficult past."

The Widjajas are not alone in debt comebacks. Other Indonesian companies have had financial troubles and then successfully returned to the dollar bond market. Property firm Kawasan Industri Jababeka, which reorganised debt in 2002, is selling more of its 2019 notes. Gajah Tunggal, the nation's biggest tyre-maker, issued US$500 million of five-year notes in 2013, four years after a distressed bond exchange. Developer Pakuwon Jati restructured global notes in 2005 and raised US$200 million last year.

"Investors have to be mindful of the restructuring history of Indonesian corporates, especially given that many of them have had several reschedulings or restructurings in the past," said Brigitte Posch, head of emerging market corporate debt at Babson Capital Management.

"Investors also need to be familiar with the Indonesian insolvency framework, as it is not the most creditor friendly regime."

Sinarmas is also committing as much as US$300 million to a takeover bid for London-listed Asia Resource Minerals, which owns 85 per cent of Indonesia's fifth-largest coal miner Berau Coal Energy. If successful, the group may inject the Berau assets into its Singapore-listed Golden Energy & Resources unit, according to an April 15 exchange filing.

The turnaround in Widjaja's fortunes is splitting money managers who often reference the group's history as a cautionary tale in emerging-market investing after the note holder losses following Asia Pulp's default.

Hal Hirsch, a managing director at New York-based Alvarez & Marsal, which specialises in debt recoveries and is advising some of Bakrie Telecom's bondholders, said that Indonesia can be "a dangerous corporate labyrinth for investors and regulators" due to a lack of transparency.

"History repeats and provides lessons - even in finance," he said.