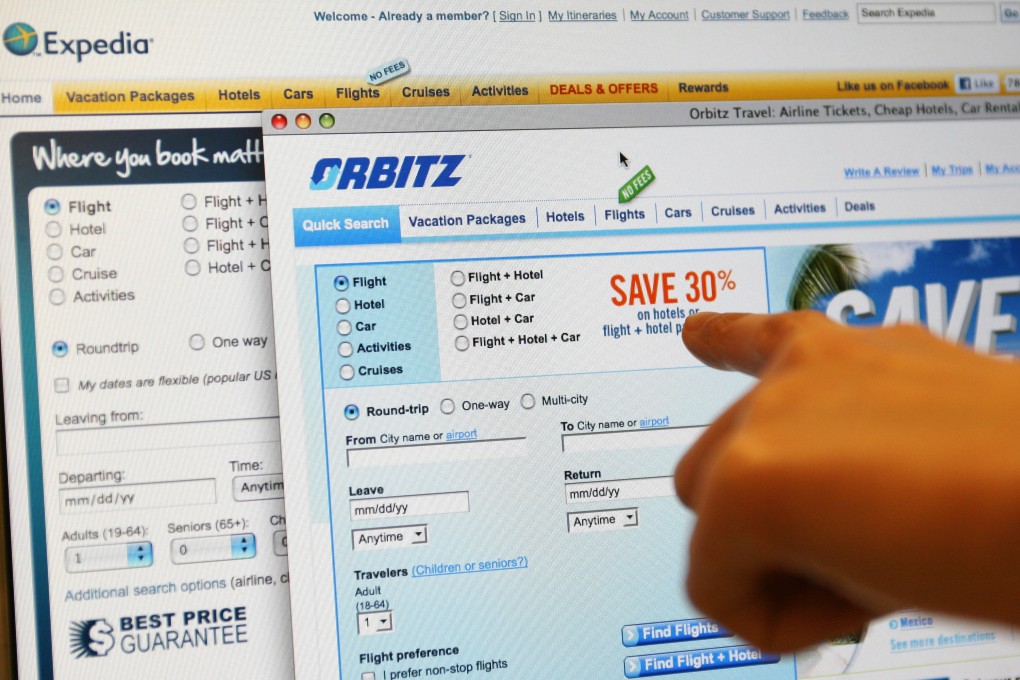

US travel site Expedia sells stake in Chinese online agent eLong

US travel major sells 62.4 per cent stake in loss-making mainland online agent eLong for US$671 million after 10-year struggle in Chinese market

US travel site Expedia on Friday said it sold its 62.4 per cent stake in Chinese online travel agent eLong for US$671 million, with rival Ctrip snapping up 37.6 per cent for US$400 million.

The sell-off, ending Expedia's decade-long investment, came as a surprise as it had said in November last year it planned to beef up investments in China for the market's long-term potential. It had also said it expected eLong's losses to continue this year.

Nasdaq-listed eLong incurred a US$29.6 million loss in the first quarter of this year following a US$27 million loss in the last quarter of last year.

Ctrip, also listed on Nasdaq and China's largest online travel agent, said in a statement it acquired a "strategic stake" in eLong and reached an agreement with Expedia "to cooperate with each other to allow their respective customers to benefit from certain travel product offerings for specified geographic markets".

Hou Xiaotian, the chief executive of research and advisory firm TH Capital, said: "I don't think Expedia is quitting the China market. It's market consolidation and rationalisation. ELong has been under great competitive pressure from Ctrip and Qunar." She was referring to China's two biggest online travel agents.

"It's a cut-throat market. Thin margins are not what Expedia or any investor would want, so in the end they have to all sit down and talk about how to make the cake bigger together," Hou said.