New | China’s Hanergy Thin Film cancels deals with parent after SFC slaps indefinite ban on its shares

Hanergy Thin Film Power’s cancellation of agreements to buy huge volumes of solar panels from its parent has come too late to rescue its tainted reputation, analysts say.

“[Monday]’s announcement makes a mockery of [Hanergy Thin Film’s] business case,” a solar energy sector analyst said. “It should have known from day one, it is better to be open to having more than one panel supplier, preferably having open tenders on its procurement.”

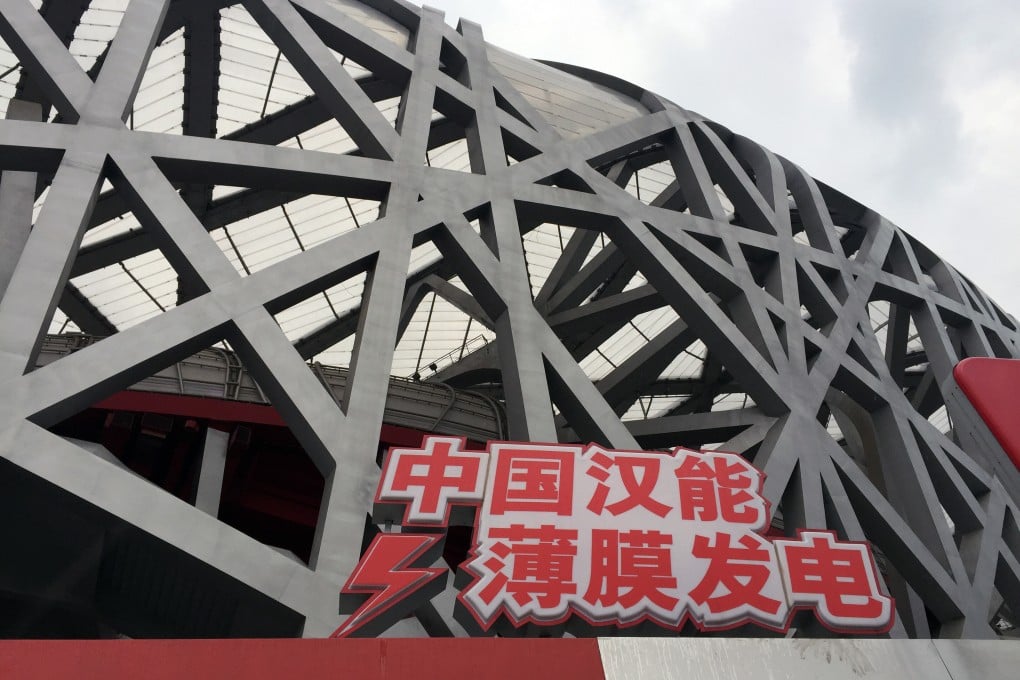

Hanergy Thin Film, whose shares have been suspended from trading indefinitely by the Securities and Futures Commission, said it had cancelled agreements signed in February that would have allowed it to buy solar panels worth up to HK$16.84 billion a year from its parent company in the three years to 2017.

The cancellation would give it “a wider choice” in selecting parts suppliers and “enhance the flexibility of its downstream business”, Hanergy Thin Film said in a statement to Hong Kong’s stock exchange Monday.

The Beijing-based firm, which had posted big profit rises after signing deals to sell solar panel production machines worth US$8.5 billion to parent Hanergy Group, agreed in February to buy vast amounts of panels from its parent, to be used in planned solar farms.

A dearth of credible third-party customers for its machines and its parent’s panels saw industry insiders and stock analysts question the sustainability of its business model and web of connected dealings.

Hanergy Thin Film said on Thursday the SFC had sent it a letter expressing concern about its “ongoing viability” given it is financial dependence on its parent, and its ability “to keep the market properly informed”.