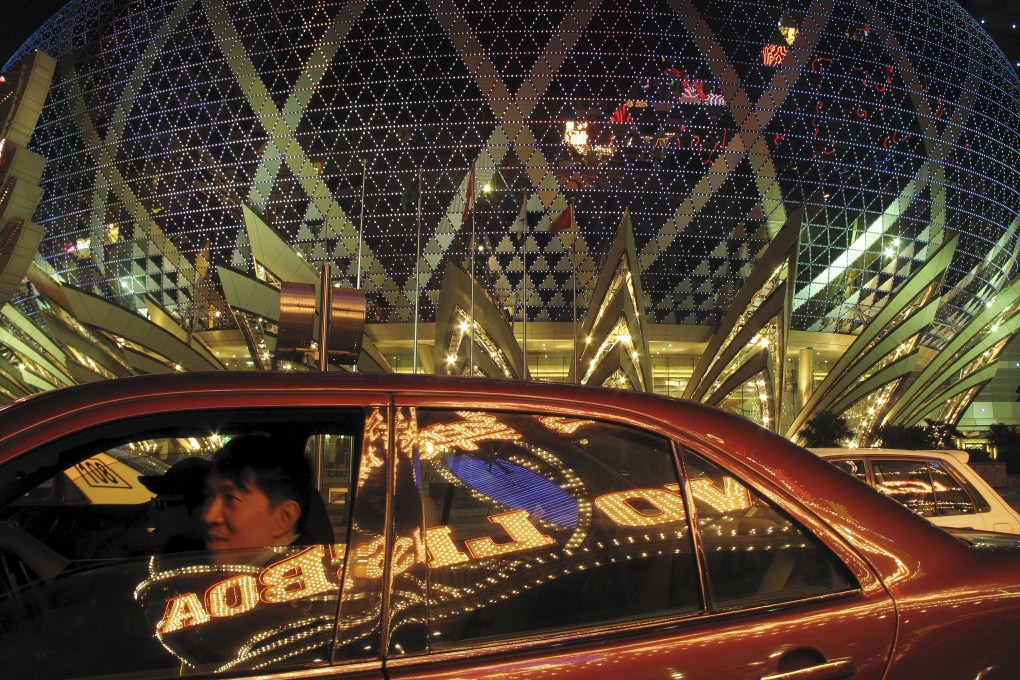

Portfolio | Are the chips really down for Macau casino stocks?

The cards are firmly stacked against recovery in Macau’s once bustling casino sector and investors should expect further stock market losses from entertainment groups that have sunk billions of US dollars into glitzy gambling meccas across the former Portuguese enclave.

That’s according to analysts at Daiwa Capital Markets who have just penned one of the most downbeat reports to yet emerge on the sector since high rollers started deserting casino floors more than two years ago in the wake of Chinese president Xi Jinping’s corruption crackdown.

The “build and they will come myth” has finally been put to rest, Daiwa analysts led by Jamie Soo wrote.

“The market continues to underestimate the impact of liquidity constraints, CNY (yuan) depreciation, cost inflation and negative operating liquidity.”

The report’s conclusions dovetailed neatly with a slew of casino stock results this week showing sector revenue was falling faster than many analysts anticipated.

Macau casino sector EBITDA will fall by 40 per cent year-on-year in 2015 and by 15 per cent in 2016, respectively 11 per cent and 33 per cent lower than Bloomberg consensus forecasts, Soo and his colleagues wrote.

Companies most at risk are Sands China, Galaxy Entertainment and Wynn Macau – all recently downgraded to ‘sell’ by Daiwa – on fears their stocks are overpriced. MGM and SJM were revised from ‘outperform’ to ‘hold’.