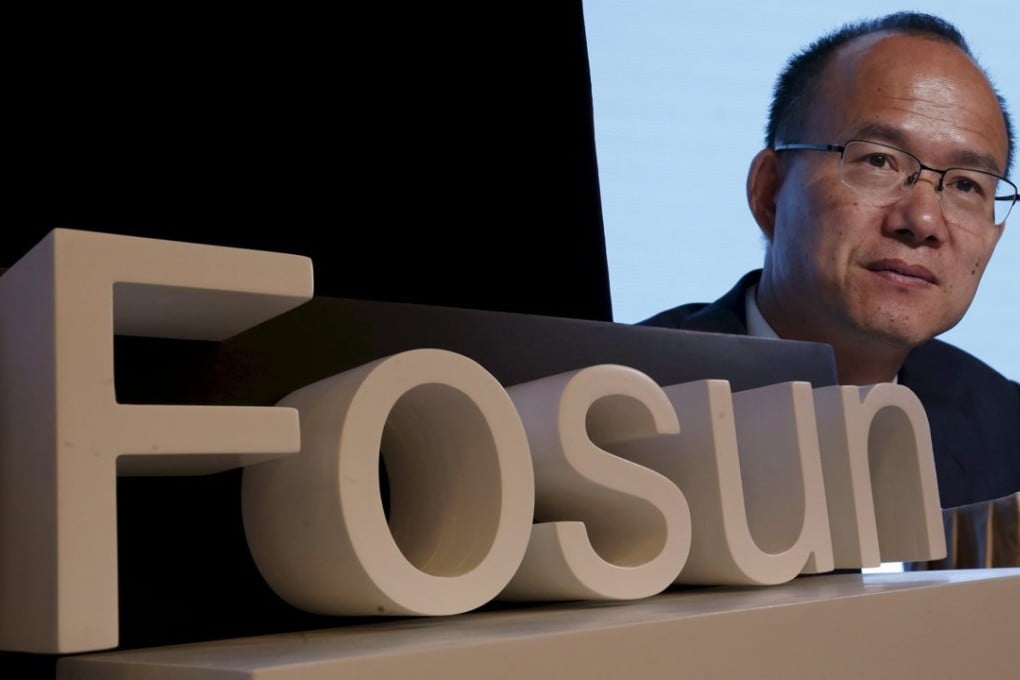

New | Fosun chairman ‘assisting investigations’, trading to resume Monday

The chairman, dubbed China’s Warren Buffett, can attend to company decision making

The story in brief:

- Trading halt in seven Fosun companies in Hong Kong and China to be lifted Monday

- Fosun Chairman Guo Guangchang “assisting with investigations”

- Nasdaq listed Fosun shares sunk 11.4 per cent

- Fosun officials concerned that Guo’s absence could lead to instability in creditor relationships

- Guo, once dubbed China’s Warren Buffett, is one of the country’s richest men

Guo Guangchang, Fosun’s mysteriously absent billionaire chairman, has been “assisting investigations” since Thursday afternoon, but can attend the company’s decision making “in proper ways”, his company Shanghai Fosun Pharmaceutical (SFP) said in a filing to Shanghai Stock Exchange late Friday night.

Trading of the SFP will resume on Monday. The company announced trading suspension on Friday morning, together with another six companies under Guo’s conlomerate Fosun, including two Hong Kong listed firms.

The company has broken its silence more than 24 hours after rumours of his Guo’s arrest for questioning at Shanghai International Airport began swirling.

Two Fosun officials said earlier today Guo was allowed to make phone calls but his personal freedom is restricted, although it remains unknown whether he was detained on corruption charges or was assisting in probes into other people.

Five mainland China listed companies controlled by Fosun announced a trading suspension early Friday.

READ MORE: The making of tycoon Guo Guangchang

Two Hong Kong listed companies, Shanghai Fosun Pharmaceutical and Fosun International also announced trading suspensions in the morning a day after the disappearance of Guo.