Li & Fung out, Geely in as HSI reshuffles Hang Seng Index

First H-share listing, Tsingtao Brewery, to be replaced by Postal Savings Bank, as the index compiler plans to add more red chips and private enterprises to reflect China’s market

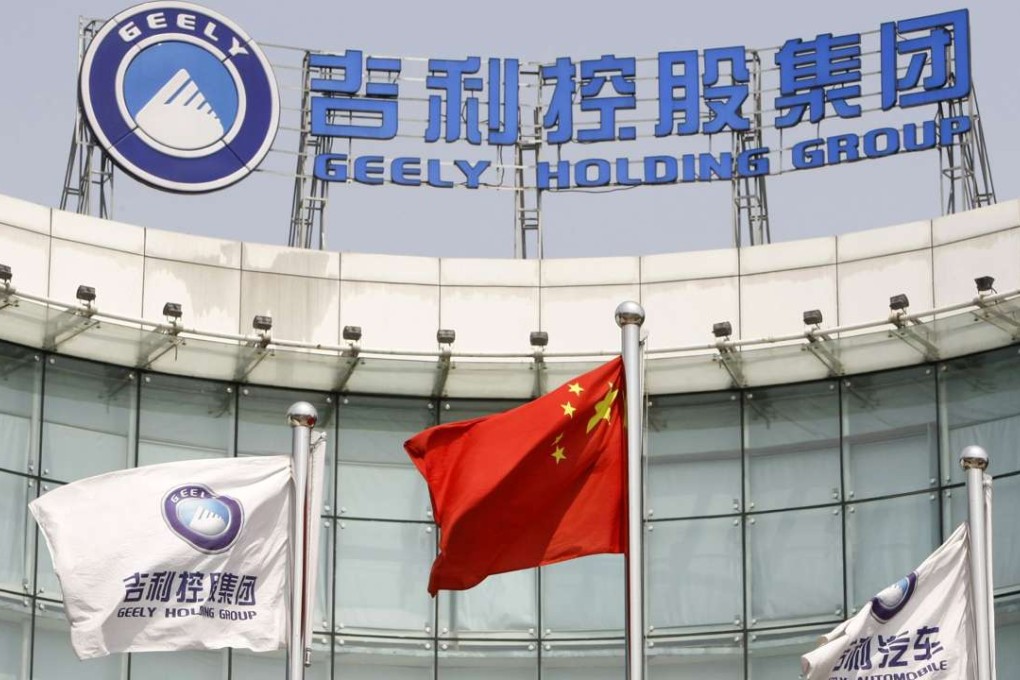

Trading firm Li & Fung will be replaced by mainland car maker Geely Automobile Holdings as a constituent stock in the Hang Seng Index from next month, according to index complier Hang Seng Indexes Company.

Separately, Tsingtao Brewery – the first H share listed in Hong Kong in July 1993 – will be removed from the H-share index, officially called the Hang Seng China Enterprises Index. Its constituent position will be replaced by Postal Savings Bank of China which had the largest initial public offering in Hong Kong last year, the index compiler said on Friday night.

The changes were decided upon after its quarterly review conducted at the end of December and will come into effect from March 6.

Louis Tse Ming-kwong, director of VC Brokerage, said the changes made sense.

“Geely is a major car maker in China. Its share price performance and market cap is big and would strengthen the Hang Seng Index as a reflection of the most important stock listings in Hong Kong,” Tse said.

“Li & Fung’s share price and business are not doing very well recently. It’s no surprise for it to be removed from the benchmark index.”

Tse noted that while Tsingtao Brewery may have a historical role to play as the first H share listed in Hong Kong, nowadays it has more major shareholders overseas. “In contrast, the Postal Saving Bank is a state owned lender while its market capitalisation is much bigger,” he added.