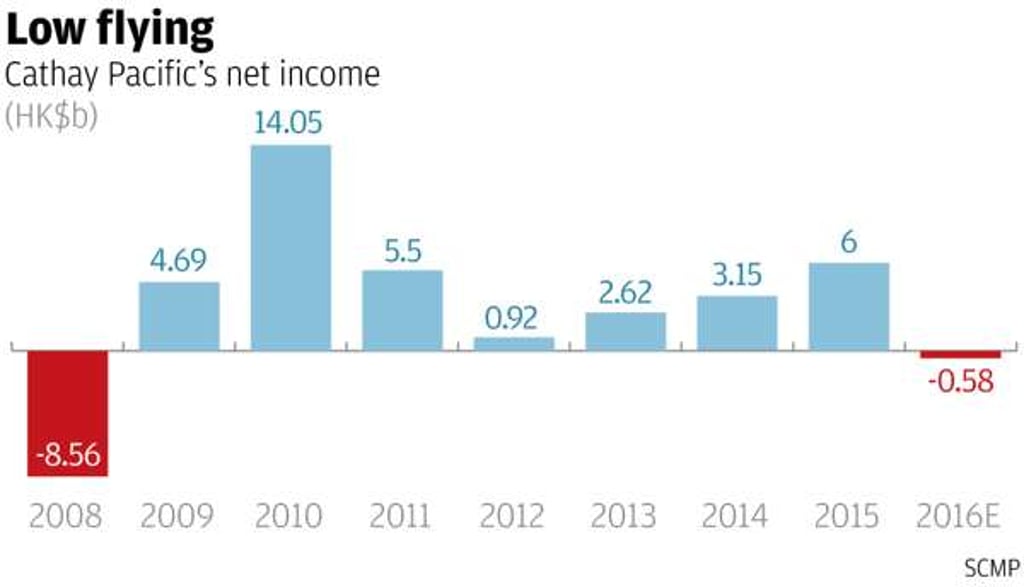

Cathay Pacific reports first loss since 2008 as rivals’ cheaper fares erode margins

The downward trend will continue in 2017, and the airline is likely to incur a hedging loss this year, airline executives say

Cathay Pacific Airways, which unexpectedly swung into its second loss in nine years, said the passenger yield on major routes will remain under pressure in 2017, amid a slump in business travel, increasing competition with cheaper Chinese carriers serving mainland routes and dwindling visitor numbers flying into Hong Kong.

This year “is going to be a difficult year and current trends won’t stop,” chief operating officer Rupert Hogg said in an interview after the carrier’s 2016 loss of HK$575 million, a shocking contrast to the HK$369 million profit expected in a Bloomberg survey of 18 analysts. Revenue fell 9 per cent to HK$92.75 billion.

Passenger yield, the money earned from flying a passenger for one kilometre and a key measure of profitability, was down 9.2 per cent to 54.1 HK cents from 59.6 HK cents.

The unexpected loss puts pressure on Hogg and chief executive Ivan Chu Kwok-leung to execute their turnaround plan to return Hong Kong’s premier carrier to financial health. Cathay Pacific unveiled a three-year transformation plan in January to revive its business, investing in technology and a fuel-efficient fleet to save costs, and redeploy its staff.

“Mainland Chinese airlines increased their global reach,” said chairman John Slosar. “We have to find ways to attract customers to fly with Cathay Pacific. We can operate in lower cost, be more agile and provide better service to our customers.”