HK can become Belt and Road funding hub – but analysts warn investors that its thousands of expected projects are not guaranteed gravy trains

SFC’s more flexible listing approach – clearly an effort to attract what could be US$20 trillion worth of infrastructure projects – welcomed by industry players, but they also warn on the risks involve

The decision to ease Hong Kong listing conditions on companies involved in China’s flagship “One Belt, One Road” infrastructure-building economic initiative could prove a massive boost to the city’s standing as a fund-raising hub, according to analysts.

They also warn, however, that the levels of risk on such projects — which could be worth some US$8 trillion until 2020 – could be high, and may not be a natural fit for all investors.

The Securities and Futures Commission (SFC), the ultimate regulator for listing matters in Hong Kong, revealed the likely easing in Belt and Road-linked planned flotations last week, which will allow companies to list on the main board, even if they do not meet certain normal criteria.

Hong Kong’s international profile and reputation as a venue for capital raising puts it in an excellent position to take advantage of the opportunities presented by the Belt and Road initiative

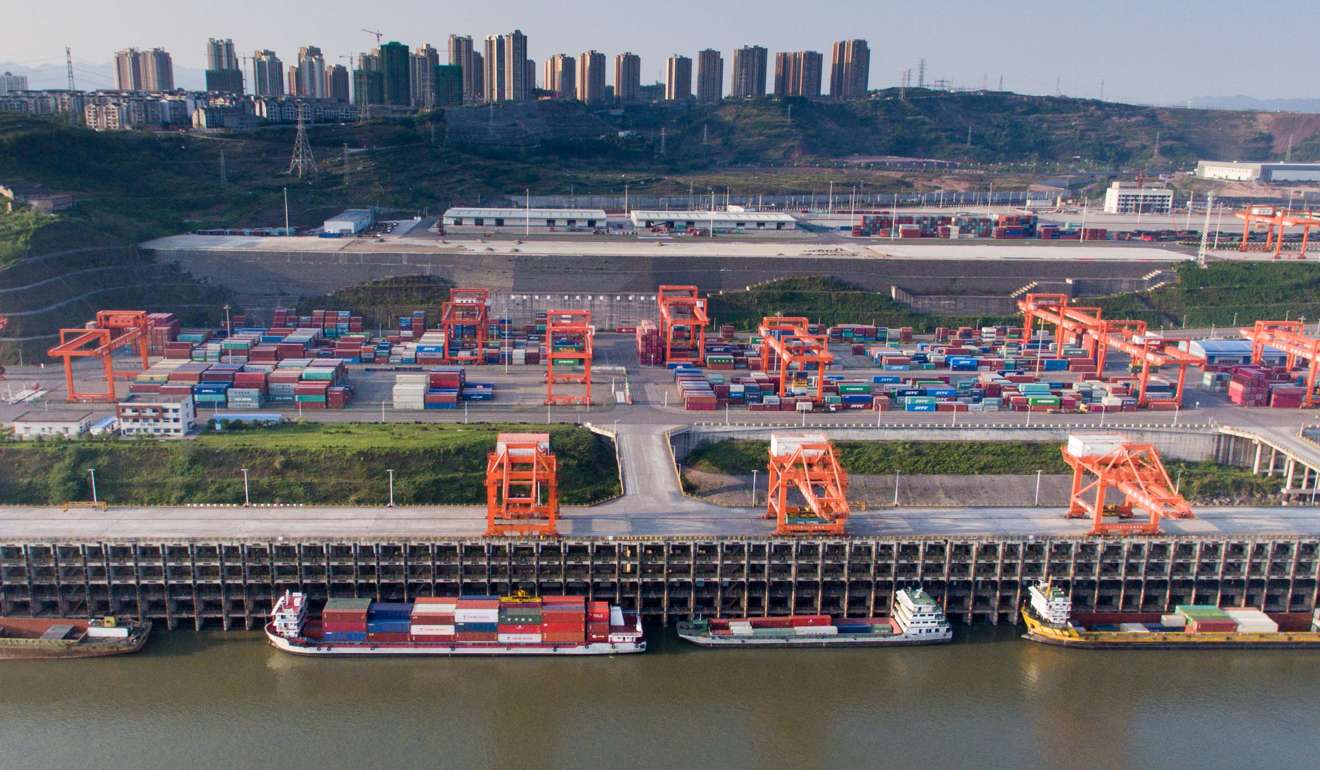

The Belt and Road was launched by Beijing in 2013 to promote the building of railways, roads, power plants and other infrastructure projects in 60 countries from Asia to Europe to promote trade and economic growth.

“Hong Kong’s international profile and reputation as a venue for capital raising puts it in an excellent position to take advantage of the opportunities presented by the Belt and Road initiative,” said Ashley Alder, the SFC’s chief executive, announcing the policy.

Large infrastructure projects are often long-term events, meaning investors may have to factor in not making any profit from such an investment for years in some cases.

The SFC clearly understands this, and looks like excusing, for instance, the current requirement of a newly listed company to have earned a combined HK$50 million profit in the three year leading to its listings.

Although it did specify, that as well as the companies involved having to be working on projects tied to a country within the Belt and Road, they have to prove the risk levels are considered acceptable.

“This is a very positive and encouraging message for Belt-and-Road-related firms, including infrastructure companies, as it could open up many more promising fundraising opportunities and help boost sentiment in Hong Kong’s capital market,” said Christina Lee, a partner at Baker McKenzie’s capital markets practice in Hong Kong.

Lee said the SFC’s approach is actually in line with current Hong Kong Listing Rules, that expressly provide for flexibility in vetting listing applications with the possibility of waiving certain basic listing requirements for newly formed project companies.

“The SFC’s statement is a clear endorsement of the Belt-and-Road initiative and the likely companies taking part in it. We can see both investors and issuers will welcome and could benefit from this policy,” Lee said.

Clement Chan Kam-wing, managing director of accounting firm BDO, said the SFC announcement came at just the right time, too, as many infrastructure projects are currently scouting the mainland for funding from Chinese investors directly, which is proving tough for some in the current conditions.

“Since China tightened capital outflow last year, it is taking much longer for mainland firms to get approval for them to get money out of the country to start funding for some of these projects.

“And this may lead some to consider a listing in Hong Kong stock as their best option to raise funds,” Chan said.

Since China tightened capital outflow last year, it is taking much longer for mainland firms to get approval for them to get money out of the country to start funding for some of these projects. And this may lead some to consider a listing in Hong Kong stock as their best option

Keith Pogson, a senior partner at accounting firm EY, points out, of course, that the mainland’s two main stock markets in Shanghai and Shenzhen will also be working hard at grabbing their own share of any new Belt and Road-linked listings.

“The mainland markets are obvious locations for domestic companies to raise capital to support Belt and Road project funding – but to its advantage, Hong Kong brings a deeper level of skill and experience of project finance and of infrastructure investment.

“But the SFC has shown it is right behind the Hong Kong Exchange in developing its role as a potential Belt and Road fund-raising hub,” Pogson said.

“Over the next 15 years the world will need to raise US$ 30 trillion in infrastructure investment and countries involved in the Belt and Road will account for a substantial part of that spend.”

Brett McGonegal, chief executive of Capital Link International, offers a slightly different take on the more flexible approach being offered by the SFC, adding “indirectly it is admitting it’s rigid, inflexible rules have resulted in losing out to other exchanges recently”.

Over the next 15 years the world will need to raise US$ 30 trillion in infrastructure investment and countries involved in the Belt and Road will account for a substantial part of that spend

Hong Kong slipped to fourth in the world rankings for initial public offerings (IPOs) behind New York, Shanghai and Shenzhen in the first quarter, in the absence of any blockbuster new listings so far this year.

McGonegal thinks the easing could certainly help attract Belt and Road project owners to seek a listing here, but also warned that historically major infrastructure project investment is “a big boy’s game”.

“I would be very cautious in advising any client to jump headlong into a Belt and Road investment, just because it can now be listed. Each project and investment must stack up financially and investors must not let themselves be swayed by this accommodative behaviour by the regulators. That can never be allowed to offset risk,” McGonegal said.

Edmund Yun, head of investment solutions of CIC Investor Services, shared that view.

“The special considerations being offered by the SFC could increase the success rate for those companies applying for an IPO in Hong Kong,” he said.

“Listing in HK, however, would certainly not mean an instant recommendation for our clients to invest in these companies – we focus carefully on the valuations of any companies seeking an IPO.”