Opinion: Why IPO Connect will be needed for Hong Kong to win the biggest listing deal in history

Bourses around the world salivate at the prospect of landing Saudi Aramco’s US$100 billion public offering

Hong Kong is on the short list to host the biggest initial public offering in history – Saudi Aramco’s US$100 billion public offering – but the city will need to launch the so-called IPO connect as soon as possible to have a chance of attracting the oil giant.

Why? Because the IPOConnect scheme would give Hong Kong a competitive edge by allowing mainland investors to subscribe to initial public offerings in the city.

Currently the two Connect schemes between Hong Kong and Shanghai and Hong Kong and Shenzhen only allow investors to conduct cross border trading in companies already listed but not for IPOs.

Saudi Aramco has appointed HSBC as one of the sponsors for its mega listing which is expected to raise US$100 billion, the largest amount ever raised in an IPO worldwide. That estimate is based on expectations that Aramco will offer 5 per cent of its equity, valuing the company at about US$2 trillion.

With such sheer size in fund raising, it is no surprise to see government officials, regulators and stock exchanges in Hong Kong, London and New York vying for the prize.

Last month Saudi Aramco sent executives to meet with Hong Kong regulator the Securities and Futures Commission and stock exchange representatives, indicating the city was on the short list. But Hong Kong is seen as “too small” from the oil giant’s point of view, some insiders told White Collar.

Christopher Cheung Wah-fung, lawmaker for the financial services sector, said Hong Kong is aware of the problem and is actively lobbying Beijing to approve the launch of the IPO Connect as soon as possible. He said chief executive-elect Carrie Lam Cheng Yuet-ngor was keen on the opportunity and has cited Premier Li Keqiang as also showing his support.

Hong Kong also lost out to New York when looking at the past 20 years

Hong Kong has a good track record in new listings and has held onto the title of world’s largest IPO market in the past two years, and also was No 1 from 2011 to 2013. However, a lack of blockbuster listings saw Hong Kong drop to No 4 spot in the first quarter this year, behind New York, Shanghai and Shenzhen, according to data from Thomson Reuters.

Hong Kong also lost out to New York when looking at the past 20 years. The city raised US$388 billion from 1997 to the first quarter of 2017, second highest in the world but far behind New York at US$675.8 billion.

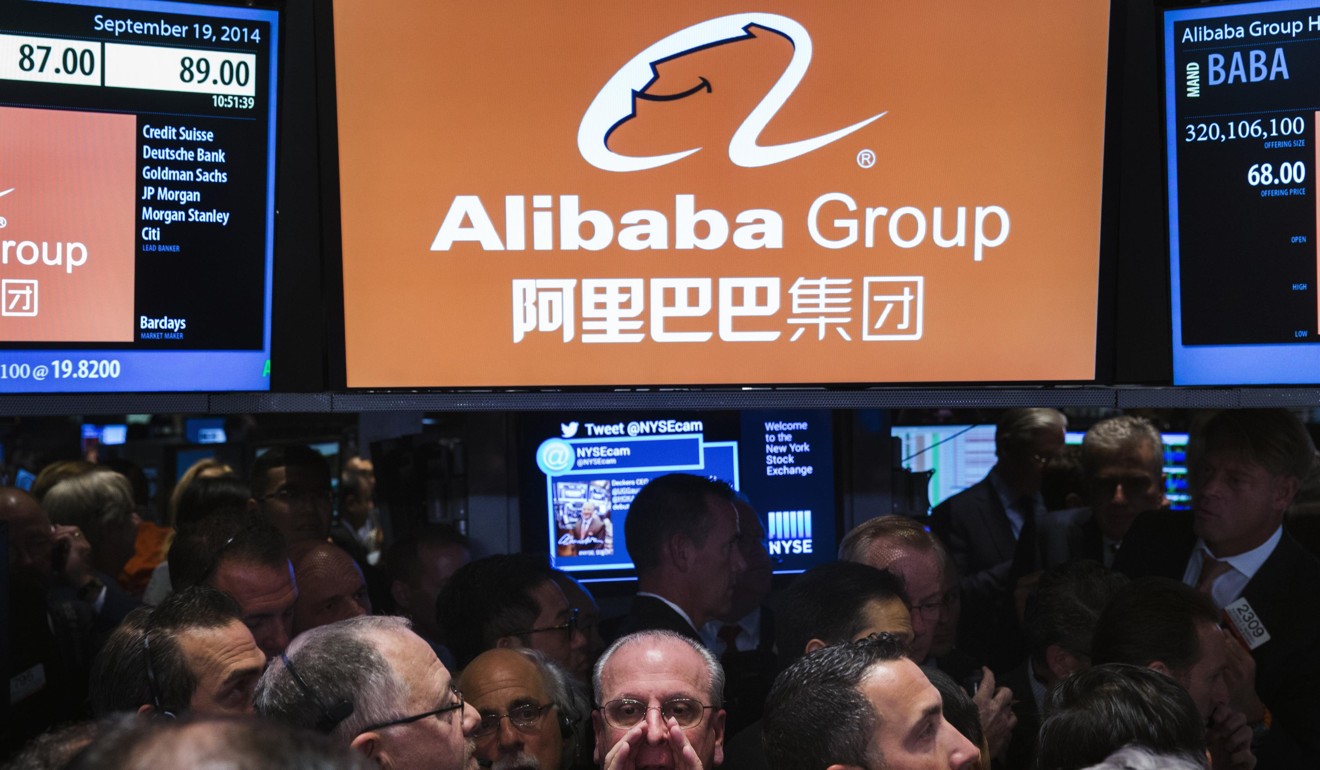

In 2014 New York also hosted the world’s largest IPO to date, when mainland China e-commerce giant Alibaba Group raised US$25 billion. Alibaba owns the South China Morning Post.

However, Hong Kong lays claim to the second and third biggest IPOs – Agricultural Bank of China’s US$22.1 billion listing in 2010 and Industrial and Commercial Bank of China’s US$21.96 billion listing in 2006.

Based on figures available for the first 11 months of last year, Hong Kong ranked as the eighth largest market worldwide in terms of market capitalisation, with US$3.29 trillion. That compares with the New York Stock Exchange at US$18.99 trillion, Nasdaq at US$7.69 trillion and Tokyo at US$4.99 trillion. Shanghai, Shenzhen, Euronext and the London Stock Exchange are also bigger than Hong Kong in terms of market capitalisation.

In terms of turnover, Hong Kong falls out of the top 10 with a ranking of 11th, having US$1.32 trillion worth of shares traded in the first 11 months of last year, far below Nasdaq which top with US$29.26 trillion, followed by New York Stock Exchange at US$18.23 trillion, BATS Global Markets at US$12.65 trillion and Shenzhen Stock Exchange at US$10.896 trillion. Turnover in BATS Chi-x Europe, Shanghai, Japan, London, Euronext and South Korea were also higher than Hong Kong.

If Saudi Aramco wants to list in Hong Kong, the city can host the IPO but can it increase market cap and turnover to match the others in the top 10?

This is why the city has to catch up, and the IPO Connect may be one of the new measures needed to attract more mainland investors to trade in the local market.