Mixing with the big boys: Hong Kong’s SMEs have a part to play in Belt and Road Initiative

All is not lost for Hong Kong’s SMEs in the big league of Beijing’s global trade strategy, as long as they find their niche and make the right investments

Hong Kong’s small and medium-sized enterprises (SMEs) are hardly the typical players that might be expected to benefit from Beijing’s “Belt and Road Initiative” where mega infrastructure investments are likely to dominate. But local merchandise trading executives say they too can play a part.

Victor Fung Kwok-king, the honorary chairman of 110-year-old Hong Kong-based global merchandise trading power house Li & Fung, said the initiative involves “much more than infrastructure building” in the 62 nations which span Central, South, Southeast, and Western Asia as well as Europe and Africa.

“We need to ask the question of what happens after the infrastructure is built,” he said in an interview with the South China Morning Post.

“There will be a rapid increase in trade, investment, people, culture and information flows, facilitated by a new form of multilateral institutions.”

After three decades of “globalisation of production – enabled by supply chain outsourcing,” he said the world will see rising globalisation of consumption, as consumers in emerging markets become richer.

Around two-thirds of global consumption still come from the 35 Organisation for Economic Cooperation and Development (OECD) nations, but that proportion is a drop from 83 per cent in 1980, he noted.

While the potential is huge, it will not be easy to capture the opportunities across the large number of developing nations with “totally fragmented markets with millions of small and medium-size enterprises”. The initiative, which connects a belt of overland corridors and sea routes, also aims to boost financial and trade ties for the 62 nations that lie along the routes.

It will be a game of “business-to-small businesses” trading, Fung said, where the key lies in using information technology to enhance efficiency.

Although Hong Kong businesses are seen to be lagging behind their state-owned mainland counterparts in depth and breadth of knowledge and experience dealing with the belt and road nations, Fung said Hong Kong firms have a “huge competitive edge” when it comes to conducting international business.

“The availability of market data and information is not the end of the story; it is how one uses and interprets the information to build an understanding of a business opportunity that is more important,” he said.

To bring value to belt and road business opportunities, Hong Kong people needed to gain a better understanding in the new markets than their mainland counterparts, and a better understanding of China than their belt and road business partners, he added.

What works in theory does not always apply in reality, not to say that there are no opportunities for SMEs. Successes have been few and far between, and the role of Hong Kong entrepreneurs as middlemen has evolved sparingly.

The only difference is the belt and road plan offers the Hong Kong entrepreneur a potentially bigger playing field across numerous geographies, rather than just the mainland 30 years ago.

To date, few SMEs have tracked successfully along the belt and road route.

“Playing the belt and road game is not easy as it is capital-intensive...it costs a lot to travel there, and the cultural difference, language barriers, currency volatility mean it takes a long time to see results,” said Joseph Chan Nap-kee, chairman of Hong Kong-listed Kaisun Energy Group.

The Growth Enterprise Market-listed firm, which bills itself as a “belt and road participant” in its communication materials, ventured into the coal mining business in 2011 – two years before President Xi Jinping (習近平)announced the initiative – by acquiring a few coal mines in Tajikistan in Central Asia.

But the firm, which also runs a mining machinery production business in Shandong province and a nascent related machinery leasing business in Central Asia as well as a zircon sand sourcing business in Vietnam, has remained in the red.

Much of the losses stemmed from the sharp depreciation of Tajikistan’s currency, which was affected by the Russian rouble’s decline as the country is highly reliant on the remittances of expatriates working in Russia, Chan noted.

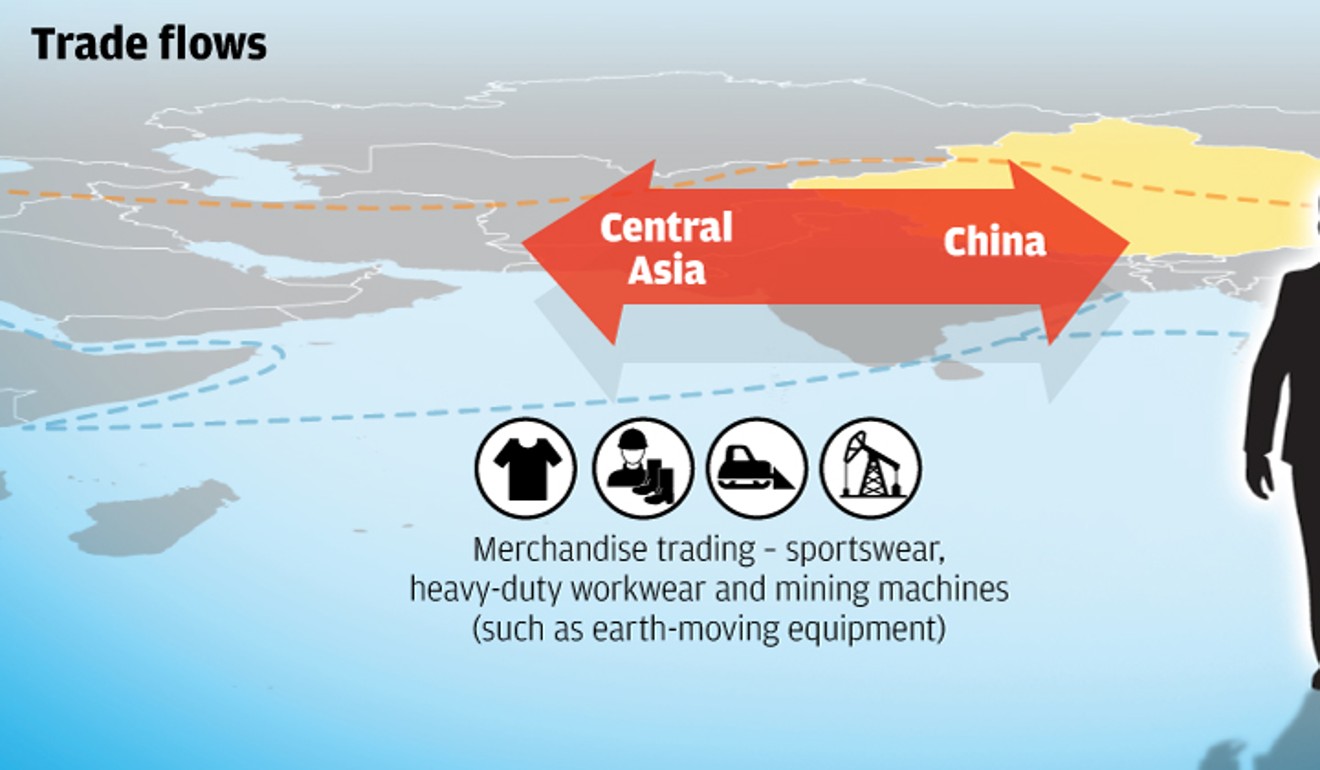

Still, Kaisun is not giving up. It now plans to become a middleman for online merchandise trading between Central Asian and Southeast Asian wholesalers buying China-made sportswear, heavy-duty workwear and eventually coal mining machines.

The firm has set up a subsidiary in Fujian province to conduct bulk procurement of China-made clothing, and will provide quality checks, logistics and export custom clearance services to the wholesalers in the buying nations.

Riding on the popularity of online sport games in Southeast Asia, Kaisun also plans to launch online tournaments and gatherings for the players, and profit from entrance fees, advertising and site rental income.

Another Hong Kong firm bridging the opportunities between China and belt and road economies is Mega Capital Group, a privately-owned Hong Kong-based firm.

It set up MCH Halal International two years ago to expand its international halal products trading business.

Halal products generally refer to food, drink, pharmaceuticals, health care and cosmetic products whose production processes are in accordance with Islamic law. They must not contain alcohol, animal blood, pork and pig products, and the method of slaughter of all meat sources must comply with the law.

Chief secretary Vivian Lau said Mega – whose businesses span the property, logistics, finance, insurance and trading sectors – had studied the halal products market for six years before launching its business plan after China announced the initiative in 2013.

“The initiative, which calls for closer economic relations with belt and road nations, many of which are Muslim ones, is a perfect match with our plan,” she said.

“With a population of two billion, the Muslim market is huge, but the opportunities are bigger than that since halal products are also consumed by non-Muslims for health and lifestyle reasons.”

She would not say who owns the company, except that it is owned by a Southeast Asian businessman of Chinese descent.

MCH helps halal food producers in China expand their exports into Southeast Asia and the Middle East, and bring foreign halal products to the Greater China market.

This is done through its Greater China “agent”, eHalal.com, a business-to-business trading platform set up a year ago by the Malaysian government to allow companies to promote and trade halal products.

Chinese halal exports are minuscule and the country only accounts for 0.1 per cent of the world’s consumption of US$3.2 trillion of halal products, so there is room for growth, Lau said.

In the Middle East, MCH inked in January a memorandum of understanding with the government-backed Dubai Multi Commodities Centre for MCH to import coffee grown in Yunnan province by state-owned Yunnan State Farms Group into Dubai for global distribution.

How did the firm muscle its way into an unfamiliar market like halal products?

Lau said besides hiring experts of halal products and sending local staff overseas to receive training in halal institutions, Mega’s background and Southeast Asia ties have helped.