Insiders accumulating shares in Playmates, CLP, and Country Garden, filings show

Several combo purchases, with acquisitions by two former directors in Country Garden Holdings and two non-execs at CLP Holdings

Buying among directors rose for a third week while selling fell, based on filings on the Hong Kong stock exchange from May 15 to 19. A total of 38 companies recorded 205 purchases worth HK$252 million against 17 firms with 92 disposals worth HK$102 million.

The number of companies and trades on the buying side were up from the previous week’s 34 firms and 186 purchases. The buy value, however, was down from HK$315 million.

On the selling side, the number of companies was up from 15 firms previously but the number of trades and value were sharply down from 127 disposals worth HK$1.15 billion.

Aside from directors, buy-back activity rose with 22 companies posting 106 repurchases worth HK$756 million, based on filings from May 12 to 18. The figures were up from the previous five-day period of 20 firms, 93 trades and HK$654 million.

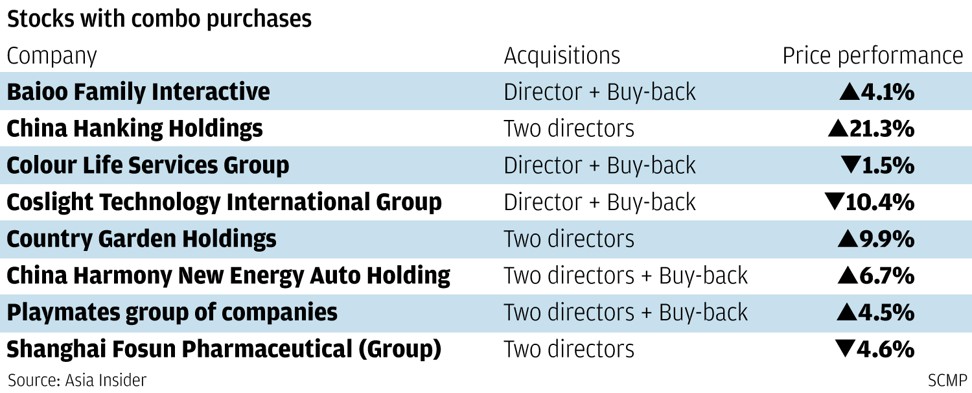

There is a common belief that good things come in pairs. This applies as well to corporate shareholder dealings as multiple buyers in one company are stronger signals that a stock is undervalued.

There were several combo purchases last week with acquisitions by two directors in Country Garden Holdings and CLP Holdings.

The purchases in Country Garden are worth noting as the acquisitions were made by two long-serving female executives, which is a rare occurrence in the Hong Kong insider market.

Aside from having multiple purchasers in one stock, another pairing that occurred last week was in the Playmates group of companies with acquisitions in Playmates Holdings and Playmates Toys. The most bullish activity was in Playmates Toys with rare purchases by two executive directors and buy-backs following the sharp fall in the share price this quarter.

Vice-chairman Yang Huiyan and executive director Yang Ziying acquired shares in mainland property developer Country Garden Holdings with a combined 23 million shares purchased from May 8 to 12 at an average of HK$7.46 each.

The purchases, which accounted for 17 per cent of the stock’s trading volume, were made on the back of the 70 per cent rise in the share price since February from HK$4.40.

Yang Huiyan resumed buying at higher than her previous acquisition prices with 20 million shares purchased from May 8 to 10 at HK$7.45 each. The trades increased her holdings to 57.44 per cent of the issued capital.

She previously acquired 10 million shares from January 19 to 20 at HK$4.41 each and 129.9 million shares from January to October 2016 at an average of HK$3.52 each. Prior to her purchases since 2016, she acquired six million shares in March 2014 at an average of HK$3.11 each and 87.5 million shares from June to December 2013 at an average of HK$4.32 each. She joined the group in 2005.

Yang Ziying, on the other hand, acquired three million shares from May 8 to 12 at an average of HK$7.52 each, which boosted her stake to 0.02 per cent. She previously acquired an initial 2.75 million shares in August 2016 at HK$3.78 each. She joined the group in 2008.

Investors should note that there were buy-backs by the company earlier this year with 156 million shares purchased from January 5 to April 3 at an average of HK$4.47 each. The group previously acquired 1.08 billion shares from January to December 2016 at an average of HK$3.75 each.

The stock closed at HK$8.20 on Friday.

Non-executive director John Leigh and independent non-executive director Allen Charles acquired shares in utility firm CLP Holdings with a combined 25,000 shares purchased from May 12 to 15 at an average of HK$83.25 each. The purchases were made on the back of the 17 per cent rebound in the share price since December 2016 from HK$71.05.

Leigh recorded his first on-market trades since March 2016 with 10,000 shares purchased from May 12 to 15 at an average of HK$83.48 each. The trades increased his holdings to 8.88 per cent of the issued capital.

He previously acquired 10,000 shares in March 2016 at HK$69.25 each and 25,000 shares in June 2014 at HK$63.51 each. Prior to his purchases since 2014, he acquired 15.2 million shares from December 2012 to April 2013 at an average of HK$66.81 each and 78,000 shares from September 2006 to August 2011 at an average of HK$59.54 each.

Charles, on the other hand, recorded his first on-market trade since March 2013 with 15,000 shares purchased on May 12 at HK$83.10 each. He previously acquired an initial 12,000 shares in March 2013 at HK$66.70 each. The stock closed at HK$82.95 on Friday.

Toys designer and manufacturer Playmates Holdings recorded its highest acquisition price since it started its buy-back programme in November 1992 with 262,000 shares purchased from May 17 to 18 at an average of HK$11.93 each. The group previously acquired 6.42 million shares from January 3 to April 19 at an average of HK$10.24 each.

Prior to the buy-backs this year, the group acquired 500,000 shares from November to December 2016 at an average of HK$9.64 each, 113,000 shares in May 2016 at HK$10.48 each and 3.92 million shares in January 2016 at HK$8.62 each. Before these, it acquired 37.2 million shares from March 2011 to December 2015 at an average of HK$5.59 each and 18.25 million shares from 1997 to 2010 at an average of HK$1.04 each. The stock closed at HK$12.08 on Friday.

There were rare purchases by executive directors Alain Cheng Bing-kin and Sidney To Shu-sing and buy-backs in toy manufacturer and distributor Playmates Toys with a combined 4.16 million shares purchased from May 15 to 18 at an average of HK$1.24 each. The trades accounted for 12 per cent of the stock’s trading volume.

Cheng and To recorded their first acquisition since their appointments to their respective posts in 2010 and 2008. Cheng bought 143,000 shares on May 15 at HK$1.22 each, which increased his holdings to 0.15 per cent of the issued capital. He previously sold 1.38 million shares in March 2015 at HK$1.75 each, 10 million shares from January to April 2014 at an average of HK$3.63 each and 332,000 shares in July 2010 at HK 19 cents each.

To, on the other hand, bought 129,000 shares on May 15 at HK$1.21 each, which boosted his stake to 0.83 per cent. He previously sold 7.5 million shares from March to April 2014 at an average of HK$3.57 each and 2.7 million shares in July 2010 at HK 24 cents each.

Lastly, the company repurchased 3.9 million shares from May 15 to 18 at an average of HK$1.25 each. The trades were made on the back of the 15 per cent drop in the share price since March from HK$1.46. The group previously acquired 4.4 million shares from January 6 to 16 at HK$1.40 each. Prior to the buy-backs this year, it acquired 1.55 million shares in November 2016 at HK$1.20 each, 5.44 million shares from July to November 2015 at an average of HK$1.48 each and 99,000 shares in September 2012 at HK 46 cents each.

The stock closed at HK$1.30 on Friday.

Robert Halili is managing director of Asia Insider