New | i-Cable shareholders accept white knight, vote for rights issue to raise funds, continue operations

Operations at Hong Kong’s Cable TV will continue when its licence is renewed on June 1, after minority shareholders voted to approve a rescue plan led by the chairman of New World Development and his family to raise cash for the city’s financially distressed cable television network.

The company’s licence, which is due to expire on Wednesday, will be renewed after i-Cable Communications signed the renewal agreement with the government, said the company’s chairman Stephen Ng Tin-hoi.

The successful vote closes a tumultuous chapter in the history of the subscription-based pay television network, which was launched in 1993.

Its majority owner Wharf Holdings - owning 73.8 per cent of i-Cable - decided to throw in the towel after nine years of losses, saying in March it would stop investing more money into the cable television business.

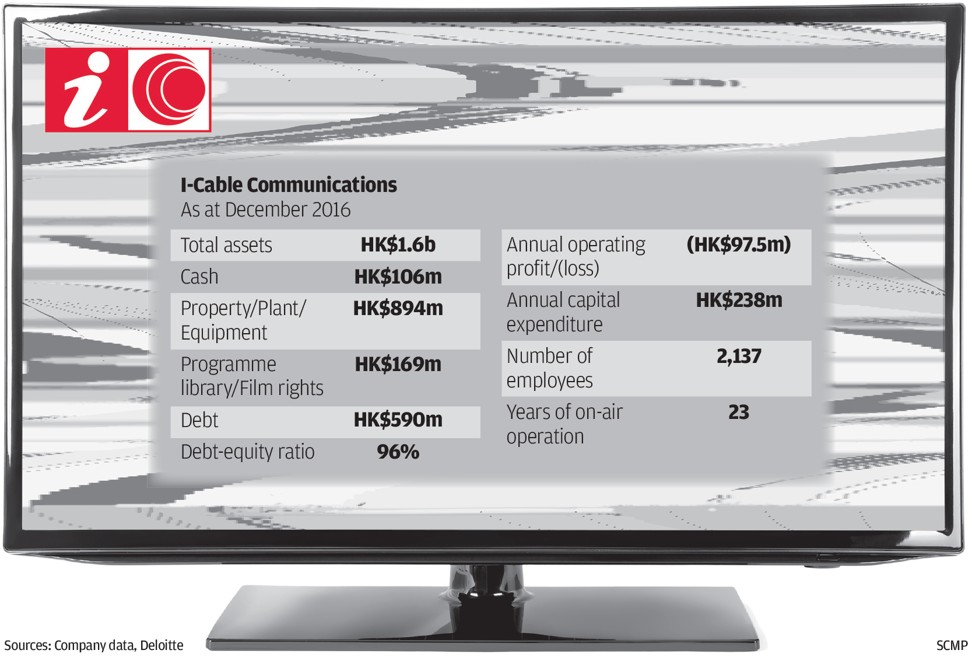

That left i-Cable struggling to operate under a cloud of uncertainty, with its operating licence due to expire on May 31. Last year’s net loss was HK$313 million, deteriorating from the HK$233 million loss in 2015.

New World’s chairman Henry Cheng Kar-shun and David Chiu Tat-cheong emerged as the main backers of Forever Top, the white knight consortium to the rescue, which will become the majority shareholder in i-Cable after the shares sale in which Wharf will not participate.

Chiu is chairman of property developer and hotelier Far East Consortium International and the second son of the late Deacon Chiu Te-ken.

Both Deacon Chiu and Cheng are former investors of free television broadcaster ATV during its heydays in the 1980s and 90s. ATV was forced to go off-air in April last year after 59 years, as funding dried up after numerous years of losses.

Under the rescue plan, i-Cable would issue shares to raise HK$669 million (US$85.8 million) to meet its investment commitments to the government and fund ongoing operations.

Wharf will swap HK$300 million of around HK$400 million of loans lent to i-Cable for shares, but it will distribute all of its i-Cable shares so that it will not hold any when the fund-raising plan is completed.

Existing shareholders can subscribe to three new shares for every five that they own, at a 66 per cent discount to the closing price before the plan was unveiled.

The consortium will take up the shares subscription right given up by Wharf.

Ng said i-Cable has no immediate liquidity problem, since it has only utilised around HK$650 million out of HK$800 million of its credit facilities, and the vast majority of its subscribers and advertisers have not defaulted on payments.

But he conceded the funding uncertainty since March had seen some buildings’ owners hesitating to allow infrastructure work to connect to i-Cable’s free Fantastic TV service launched two weeks ago, and the delay in some programming decisions.

“We hope to make up for loss time in terms of the connection work,” he said. “In areas where we have had shortcomings in terms of programming due to the uncertainties, we will make improvements as soon as possible.”

Current management will work with the consortium to increase the latter’s understanding of the business, and hope to forge agreement on the overall direction of the company so that a “through train” management transition can be achieved, Ng added.

Under i-Cable’s agreement with the consortium, the existing top management will stay after the control transfer except Ng, who will step down the day the shares subscription is completed.

David Chiu said just over a month ago, that up to 10 per cent of i-Cable’s staff might have to go as part of his rescue plan to save HK$200 million in a one-off cost-cutting exercise.

Ng said today that almost 15 per cent of i-Cable’s over 2,000 staff have left the firm voluntarily amid the uncertainty since the start of the year.

“I don’t know whether the departures fits in with the 10 per cent staff reduction he had in mind,” Ng said, adding current management has not laid off anyone since the start of the year and has no major staff reduction plan until the control transfer in around five months time.

David Chiu told reporters on Monday afternoon he welcomes i-Cable shareholders’ approval of the financing plan, adding he would “respect and strive to keep the current management”, given his company does not have much television industry talent.

The rescue and financing plan was supported by 89 per cent of eligible shareholders at the Monday meeting.

Not everybody was happy with the plan, as some minority shareholders pelted i-Cable’s management with questions.

The stock, which fell by almost 26 per cent since the start of the year and closed flat at HK$0.58 on Monday, has never recovered from its 1999 initial public offering, when the HK$10.39 offer debuted at HK$15.75. It gained as much as 12 per cent after the vote result was unveiled at noon, but all the gains were given back.

“I will support today’s resolutions for the financing plan, including the rights issue,” said Danny Chan, who has been an i-Cable shareholder for 13 years, and who convenes the Investor Interest Concern Group, a corporate governance group. “I am saying this because I feel we have no other choice. Saying no means the company cannot continue to operate and our investments will turn into nothing.”

Chan didn’t like that fact that minority shareholders had been denied the ability to transfer their subscription rights, which would enable cash-starved investors to find someone else with the money to participate in the rights issue.

From i-Cable’s point of view, it was a firm and fast comitment from shareholders that is of greater importance, as the company needed to move quickly with the plan, Ng said.

“As the financing plan needs approval from the Communications Authority and may only be completed in mid September ... in the interest of the company, there was no arrangement for right holders to sell their shares subscription rights.”