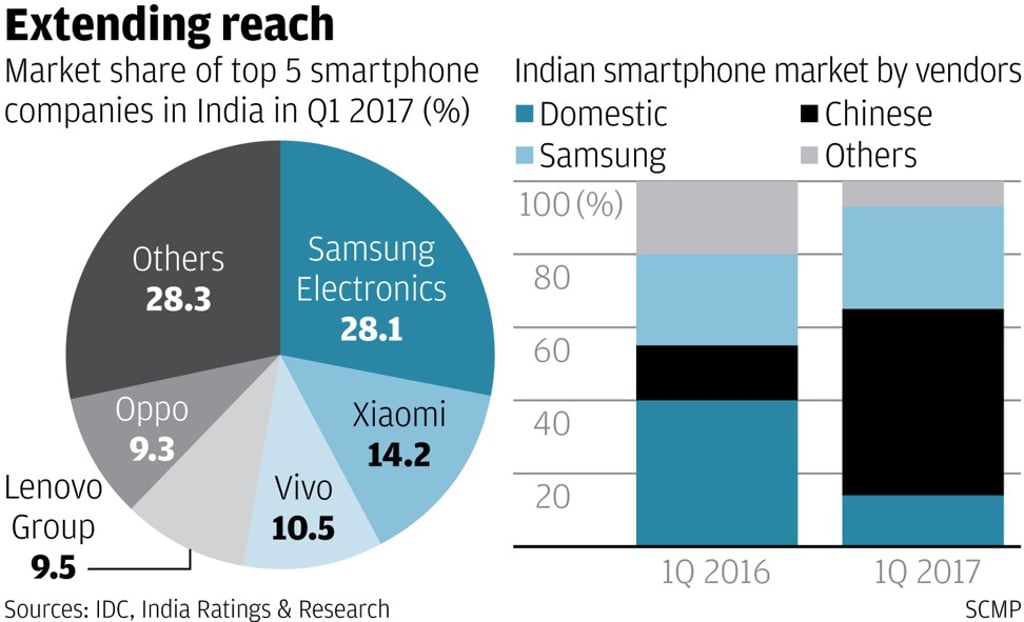

Indians warm to Xiaomi, Vivo, Oppo, pushing Chinese brands to 51 per cent of market

Chinese smartphones are conquering India, with Lenovo, Oppo, Vivo and Xiaomi together making up more than half of the country’s sales in the first three months of the year, a tremendous jump from a mere 15 per cent a year earlier, according to a report by India Ratings & Research (Ind-Ra).

Local Indian manufacturers -- such as Micromax Informatics, Lava International and Karbonn Mobiles -- were the biggest losers during the period, while South Korea’s Samsung Electronics went from strength to strength, extending its market lead over every other brand as the single most popular smartphone in the world’s second-most populous market.

“Consumption power in India is lower than developed markets, but Chinese brands have always been able to be competitive in sales volumes” by keeping their costs low, said Analysys’ Beijing analyst Zhao Ziming.

China’s conquest of India’s market took less than a year, offering a sanctuary for Chinese brands amid razor thin profit margins due to excess competition and saturation at home. First-quarter shipments increased 15 per cent to 29 million smartphones from a year earlier in India, compared with the Chinese market’s tepid 1 per cent growth over the same period, according to data by Counterpoint.

Xiaomi’s Redmi 4, with a retail price starting from 6,999 rupees (US$108), was one such success, catapulting the Beijing-based company from nowhere to the second-largest slice of the market, with 14.2 per cent of first-quarter shipments.