Exclusive | More mainland Chinese buy insurance policies in Hong Kong, and the watchdog is taking notice

Insurance Authority chairman Moses Cheng has an extraordinary job ahead of him: regulating an insurance industry that has grown enormously thanks to China’s investors

Moses Cheng Mo-chi, the first chairman of Hong Kong’s new Insurance Authority (IA), was already enjoying a beckoning retirement before being called out by the government to establish the insurance watchdog agency.

At 67, Cheng has seen a lot of change in the city and in its financial and insurance industry. Cheng was one of the first full time law students to get his degree from Hong Kong University, taking his first job in 1973. Though he retired in 2015, he continued to work as a consultant. Known for his contributions to society and love of the arts, he is the founding chairman of Opera Hong Kong and the Child Development Matching Fund.

The new regulator took over from the Office of the Insurance Commissioner as the regulator for all insurance companies and overseeing about 90,000 insurance sales staff.

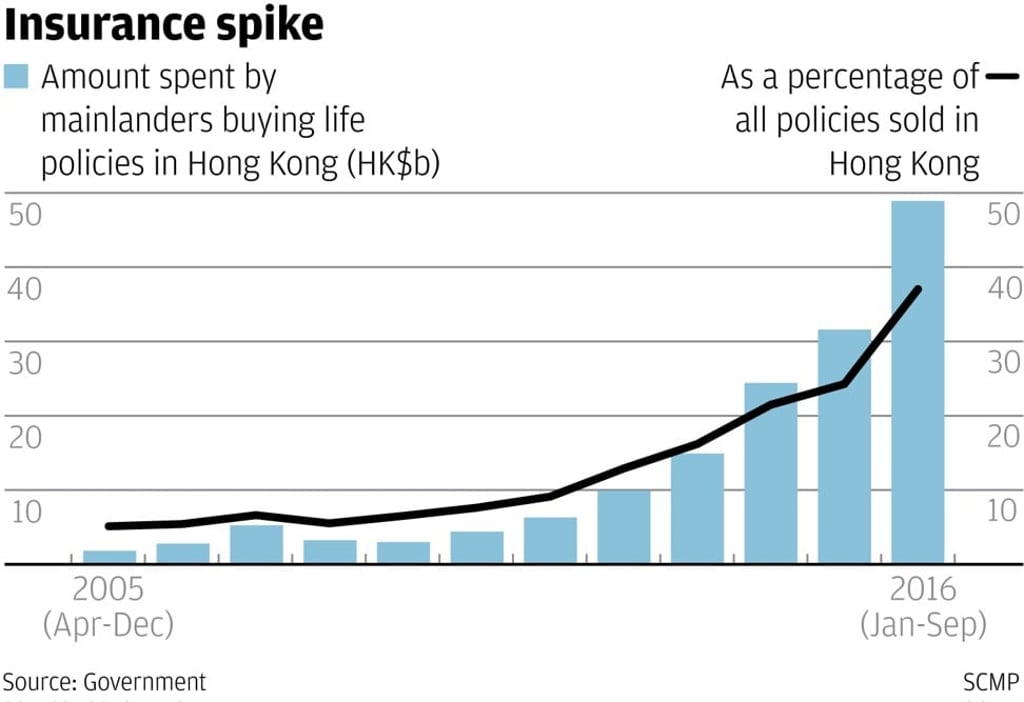

It’s no small task. The government debated the creation of such an agency for ten years, as the industry itself exploded. The gross value of insurance policy premiums in 2016 stood at HK$448.8 billion (US$57.5 billion), up 763 per cent from HK$52 billion in 1997, according to government statistics.