China banks that funded HNA’s growth are said to halt new loans

An HNA bond prospectus shows that the group’s biggest funders are China Development Bank, Export-Import Bank of China, Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd., Industrial & Commercial Bank of China Ltd., China Minsheng Banking Corp. and Bank of Communications Co.

Several Chinese banks that helped fund HNA Group Co.’s global acquisition spree are losing their appetite for financing the company, according to people familiar with the matter.

Three of the banks have decided to stop extending new loans to HNA, said the people, who asked not to be identified because the information is private. One made the decision early this year, the second acted a couple of months ago and the third moved recently, the people said. A fourth bank trimmed its exposure to the company over the past few months and reduced the size of a credit line, one of the people said, without providing further details. The four lenders were among the eight largest providers of credit lines to HNA as of 2015, according to the latest publicly disclosed figures.

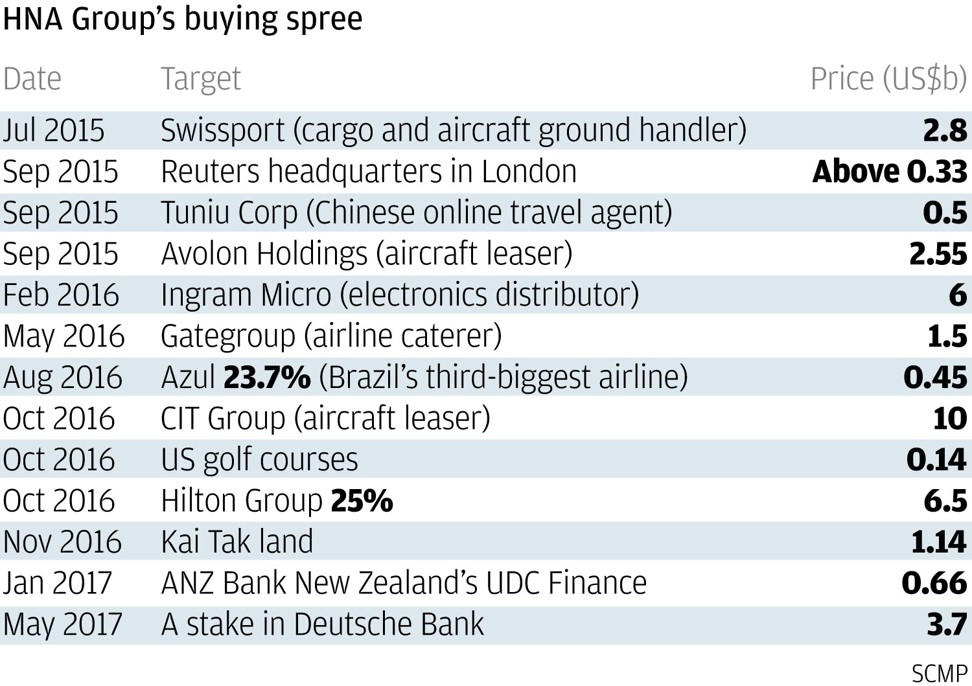

HNA, one of China’s most acquisitive companies, took on at least US$73 billion of debt as it transformed from an obscure regional airline into a worldwide conglomerate with multibillion dollar stakes in Hilton Worldwide Holdings Inc. and Deutsche Bank AG. While HNA has cash on hand and there’s no indication that the four banks have rebuffed requests for new funding or demanded early repayment, a dearth of fresh credit could further restrain HNA’s ambitions as Chinese regulators clamp down on the offshore deals to stem capital outflows and shore up the yuan.

Last month, regulators began assessing the dangers to China’s banking system posed by HNA and other prolific acquirers, including Fosun International Ltd. and billionaire Wang Jianlin’s Dalian Wanda Group Co.

President Xi Jinping signed off on a decision to bar state-owned banks from making new loans to Wanda for its overseas expansion, according to a Wall Street Journal report. At a twice-a-decade conference on financial regulation convened by Xi this month, policy makers pledged to rein in corporate borrowing and said that preventing systemic risk was an “eternal theme.”

HNA, which has announced more than US$40 billion of acquisitions spanning six continents since the start of 2016, said its financial position remains “strong” and noted that its debt-to-asset ratio decreased for a seventh straight year in fiscal 2016.

“We have always managed HNA so that we aren’t reliant on a single source of funding for our business,” the company said. “We have strong cash flow from our diverse operations, untapped credit available from a wide range of Chinese lenders, and access to equity markets through our many publicly traded subsidiaries.”

While HNA’s financial disclosures are limited because the parent company is unlisted, its annual report to bondholders provides some balance sheet details and information on its relationships with banks.

The source of those credit lines wasn’t disclosed in the annual report, but an HNA bond prospectus shows that China Development Bank, Export-Import Bank of China, Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd., Industrial & Commercial Bank of China Ltd., China Minsheng Banking Corp. and Bank of Communications Co. were the company’s biggest providers of credit lines at the end of 2015. All but Minsheng are controlled by the Chinese government.

Spokespeople for CDB, Bank of China, China Construction Bank, Ag Bank and Bocom didn’t answer calls and text messages seeking comment. ICBC and Minsheng declined to comment. Exim Bank said it couldn’t provide immediate comment.

One of the four lenders that suspended new financing to HNA was concerned about the company’s ability to post new collateral for loans, a person familiar with the bank’s thinking said. HNA and its units have pledged at least $24 billion of shares across 15 publicly traded firms as collateral, including the Hilton and Deutsche Bank stakes, public filings as of mid-July showed.

Lenders in China aren’t the only ones distancing themselves from HNA. Bank of America Corp. has told investment bankers to stop working on transactions with the company for now amid growing concerns about the group’s debt levels and ownership structure, people familiar with the matter said last week.

Other Wall Street firms, including Citigroup Inc. and Morgan Stanley, have largely steered clear of advising and financing the company on deals. HNA said on Saturday that its acquired companies have had business arrangements with BofA and that cooperation is proceeding normally.

HNA bond investors have grown more skittish in recent months.

The 2018 dollar bond of HNA Group International Co., an offshore unit of the conglomerate, fell to a record on Friday, lifting its yield to 12.6 per cent from about 5.4 per cent in April.

HNA has at least US$1.99 billion of bonds and loans coming due this year and another US$2.45 billion maturing in 2018, according to data compiled by Bloomberg.