Donald Trump’s showdown over the US debt ceiling could trigger a major meltdown

‘In the next few weeks, negotiations are needed to overhaul the country’s tax system, keep the government running and avoid a costly default on the nation’s debt’

Who said the “unthinkable” never happens? The 2008 financial crash, the election of President Donald Trump and Britain’s Brexit vote were all major risk events that blindsided global markets. Right now, the world seems to be sliding towards another unthinkable event – the spectre of a US government debt default and markets hardly seem that bothered. It could be a horror show of epic proportions.

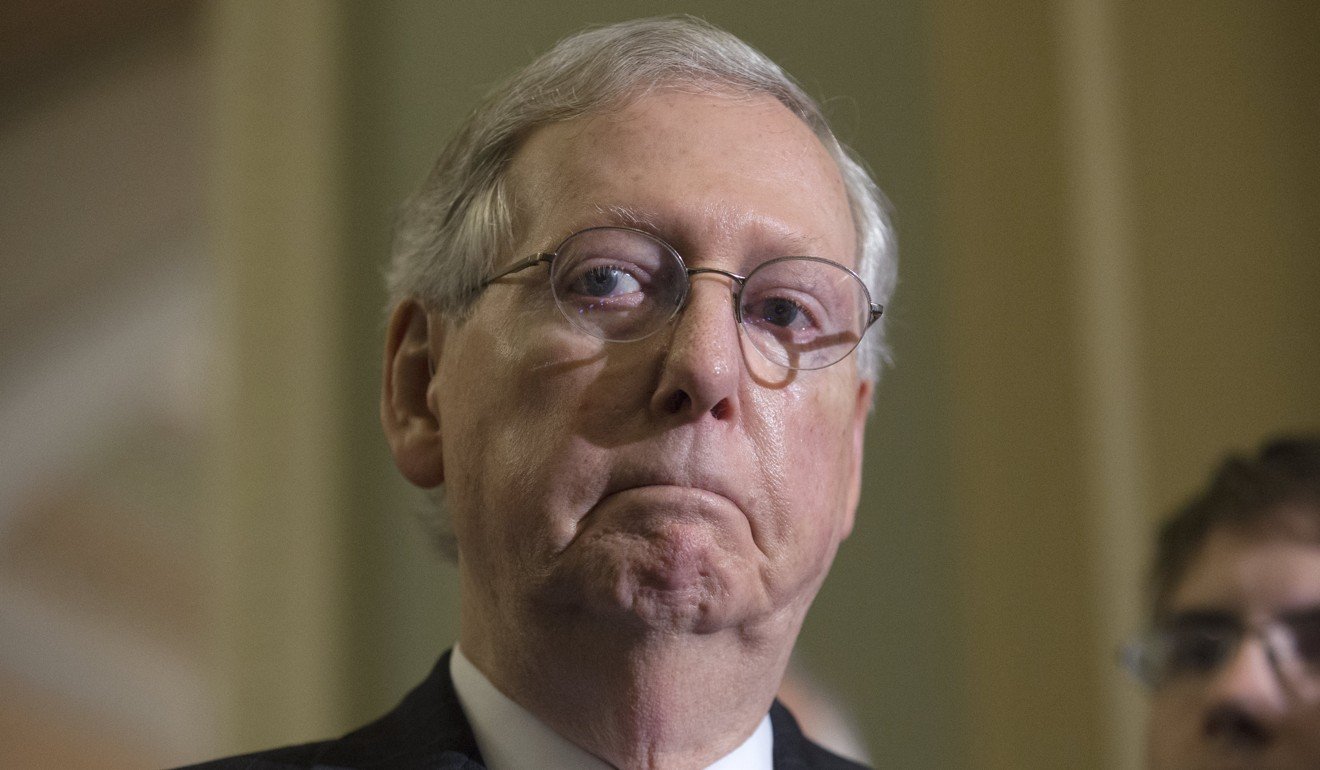

When crises loom, steady-headed politicians tend to step back from the brink and avert disaster by building bridges and mending fences. Trump’s disaster-prone presidency is in trouble. Isolated, petulant and increasingly pugilistic, the president is starting to lash out and holding the government debt ceiling bill to ransom, using it as a bargaining chip to ramrod through key pieces of his failing legislation.

It is a high-risk gamble that could backfire spectacularly for world markets and the global economy. Trump is threatening a government shutdown over his long-promised border wall with Mexico and time is running short. In the next few weeks, negotiations are needed to overhaul the country’s tax system, keep the government running and avoid a costly default on the nation’s debt.

Meanwhile, Trump’s devil may care attitude is worrying. In the run-up to last year’s November elections, Trump quipped “I would borrow, knowing that if the economy crashed, you could make a deal”, in other words, if the economy got into trouble he could always ask the country’s creditors for some relief. This sort of thinking from the leader of the world’s biggest debtor nation should rock markets to the core.

Of course, Donald Trump as a businessman is no stranger to the world of corporate bankruptcy. But recourse to Chapter 11 is no option for the US government, or the US Treasury market. US government securities are the cornerstone of the global savings market, used by private investors, investment managers and central banks alike, as a rock-solid protection for their funds.

Anything which affects the integrity of the US Treasury market, whether it is the threat of government shutdown, downgrade of its much-vaunted AAA-status or, in the worst-case scenario, a default has serious consequences. Donald Trump is playing with fire using the government’s financial stability as a bartering tool. The world could get its fingers very badly burnt.

It would be catastrophic for borrows and investors. The knock to confidence in US Treasuries would see short and long term borrowing costs rising very sharply – bad news for consumers and business, with spending and investment intentions both being hit very hard. Expectations for global growth would be seriously downgraded with the risks of recession jumping higher.

The threat to global financial stability is immense. Contagion effects would spread like wildfire to other government debt markets. Banks use government paper for regulatory requirements, global pension funds invest in US treasuries for liquidity and investment purposes, while central banks hold US debt as a gilt-edged hedge for their foreign exchange reserves. The urge to dump bonds would be huge.

The US dollar’s share of the US$11 trillion global currency reserve market has been on the slide for years and could suffer a knockout blow. Asian central banks would come under pressure to offload US treasuries. China has just overtaken Japan as the largest holder of US Treasuries worth over US$1.1 trillion dollars. Europe’s collective official exposure to US treasuries is even bigger at US$1.3 trillion.

In a default situation, the rush to the exit could inflict serious collateral damage on market stability. Picking a figure for how high 10-year US yields could surge in the first instance would be a lottery. Doubling, tripling or even quadrupling the present 2.15 per cent going rate for 10-year treasury yields could all happen in a time-lapsed, domino effect over the next couple of years.

The damage would not be limited to bonds as credit and equity markets would all be subsumed into a new global contagion crisis. This time there would be nothing left in the central banks’ tool kits for putting global confidence back together again. More quantitative easing would be useless if the net effect is higher yields. Stock markets would go into a dangerous nose-dive.

The world’s only hope is that Trump starts seeing sense and steps back from the brink. He only has a few weeks left before the deadline to shut down government passes. If Trump takes markets to the brink, investors stand at the threshold of another global catastrophe.

David Brown is chief executive of New View Economics