How is digitalisation taking China closer to its goal of a stronger and efficient economy?

More dynamic firms will emerge and make the economy globally competitive

That Chinese businesses are improving their efficiency to move products and services up on the value chain is a long-discussed topic when assessing the growth potential of the world’s second-largest economy.

Once dominating the world’s markets of shoes, clothes, leather bags and even cigarette lighters, the mainland’s export-oriented manufacturers, most of which are mom-and-pop shops, were notoriously known as the champions of low-value exports as they took advantage of inexpensive labour and land costs.

“Efficiency is tangible now,” said Han Haifeng, chief executive of manufacturer Shanghai New Century Packaging. “Increased wage payouts to workers and higher land costs force us to improve it. Otherwise, we will be unable to keep the businesses running any longer.”

China’s economy, despite a slow down in its pace of growth since the global financial crisis of 2008, has seemed to have found a magic bullet – digitalisation – buoyed by the country’s booming development of e-commerce.

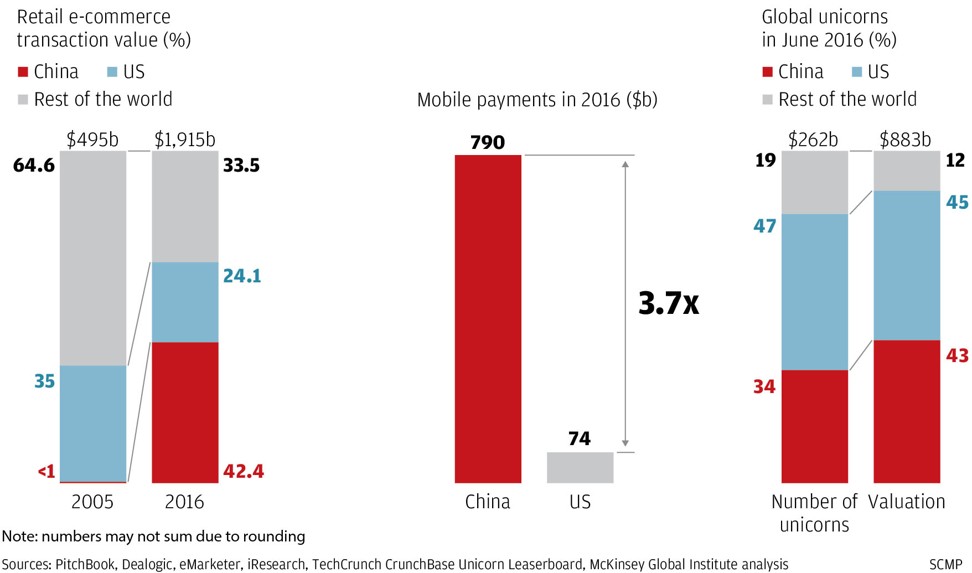

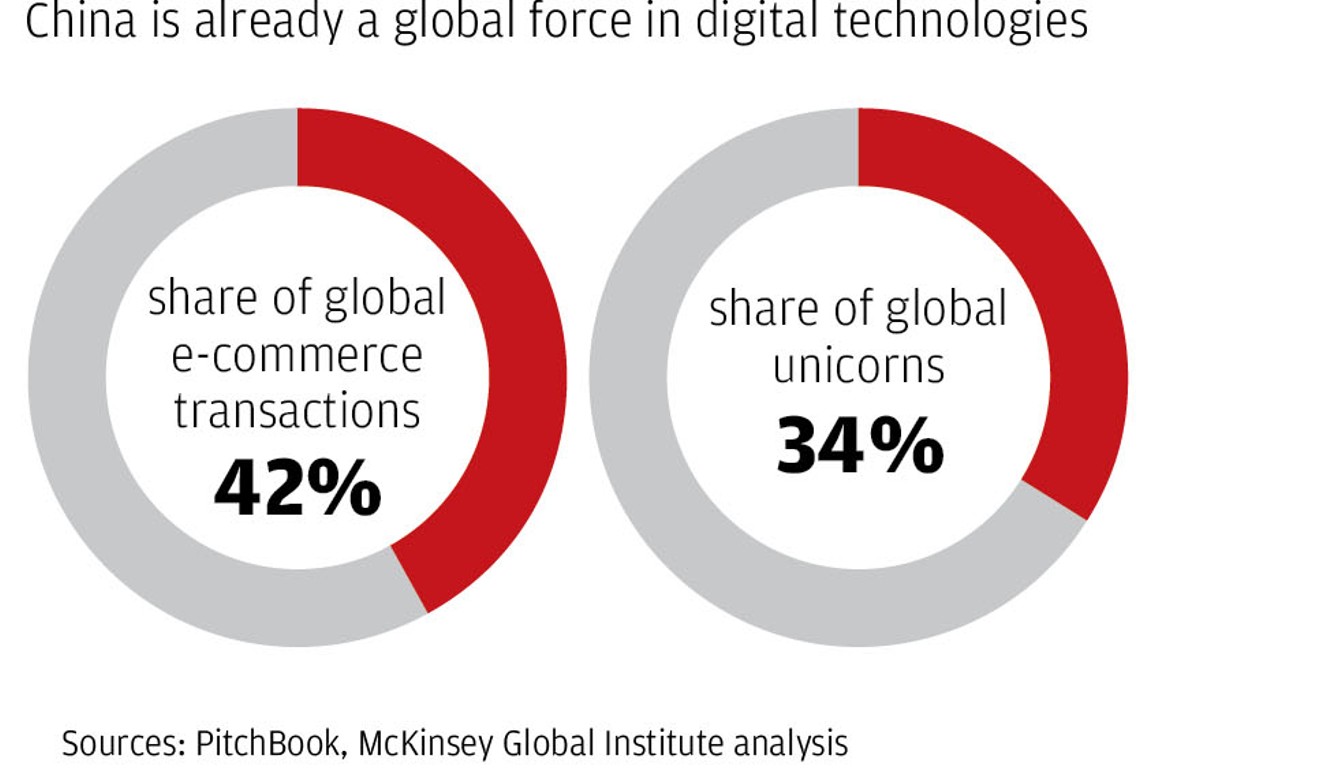

China has a 42 per cent share of global e-commerce transactions, processing 11 times more mobile payments than the United States, according to global consultancy McKinsey.

The mainland is also home to one-third of the world’s unicorns, or technology start-ups valued at more than US$1 billion.

However, going back to the basics of efficiency – the ability to accomplish something with the least waste of time and effort – China still has a long way to go and it remains to be seen how much the new round of “go-digital” drive can help improve the overall competence.

The fast pace of digitalisation is emerging to be a game-changer for the mainland’s economy.

In 2013, the United States was 4.9 times more digitalised than China, but that figure dropped to 3.7 times last year, according to McKinsey.

It added that digital forces will help restructure the value chains in China with more dynamic firms emerging and hence strengthen the global competitiveness of the economy.

Health care, logistics, automotive and real estate are also spearheading the next round of digitalisation amid the country’s ambitions of becoming a global innovative powerhouse.

China has more than 8 million logistics firms, more than 90 per cent of which are small-scale and individually owned.

Inefficient management at the transport businesses have been weighing on the economy, which passes huge logistics costs on to Chinese-made products, squeezing their profits and making it hard for them to sell.

Beijing is looking to slash about 1 trillion yuan (US$151 billion) in national logistics costs by 2020, pinning hope on the latest digital technologies to enhance the efficiency of transport and delivery services.

McKinsey said real-time matching platforms can address the industry fragmentation while crowdsourcing can enable flexible capacity.

“The logistics industry is grappling with a severe problem,” said Xu Shuibo, founder and chief executive of Shanghai Tiandihui Supply Chain Management, the mainland’s largest online road transport operator. “It is difficult for the industry employees, most of whom are not well educated, to learn how to grasp the latest technologies and understand the new digitalised system to quicken expansion pace.”

Tiandihui’s online platform matches trucks with cargo, and connects more than 50 cities across the mainland. In 2016, Tiandihui reported 64 billion yuan worth of transactions on its platform, more than four times the previous year.

Despite the hurdles, Xu said the “future is bright” as efficiency holds the key to the success of China’s fragmented logistics industry and the economy.

The Chinese leadership too is strongly advocating digital transformation to help the economy secure a slower but sustainable growth pattern for the next few decades.

Jonathan Woetzel, director of McKinsey Global Institute, said that Chinese President Xi Jinping and Premier Li Keqiang are among the most forward-thinking state leaders worldwide, who have given priority to digitalisation to develop the economy.

When you take into account China’s powerful industry dynamics and the vibrancy of its consumer markets, its potential is far larger than most observers realise

“Conventional measures of digitalisation in China suggest that the nation is only in the middle of the pack,” he said. “But when you take into account China’s powerful industry dynamics and the vibrancy of its consumer markets, its potential is far larger than most observers realise.”

McKinsey said in its report about China’s digital transformation that the country’s digital journey has different characteristics.

Consumer-focused industries such as retail and entertainment are further ahead of other sectors.

Nonetheless, digitalised businesses have the potential to drastically reshape the country’s health care system with the use of internet of things and artificial intelligence technologies.

The disruptive technologies enable remote monitoring and self-management of health care and treatments, disintermediating traditional care delivery by hospitals.

“China has abundant samples of patients for global medical service firms to explore,” said Angela Wu, a marketing manager with US-based medical service start-up HistoWiz, which uses digital technologies to manage histopathology data. “We want to localise our businesses in China sooner rather than later.”

In the property industry, digital businesses such as Airbnb and WeWork are turning residential and commercial properties into fragmented units before renting them to customers in a flexible manner.

Commercial property developers such as Singapore’s CapitaLand are embarking on apps that allow visitors to either book parking spaces at their shopping centres or find the stores they want to increase foot traffic. Collection of data about consumers’ behaviour in-store paves the way for them to better design promotional activities so as to attract shoppers to come back to the malls frequently.

While the purveyors of technology are well on their way to flourishing in China’s economy, traditional companies are bearing the brunt of pain brought by the transformation.

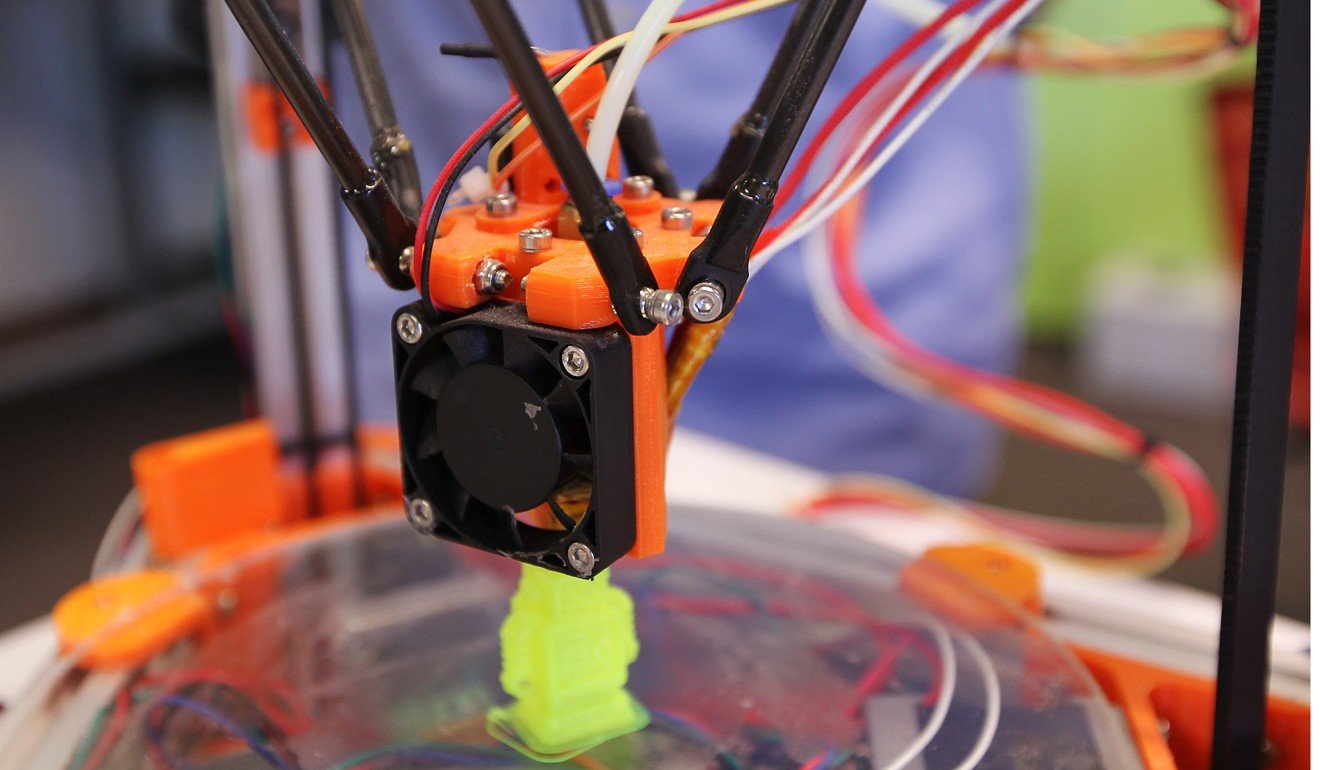

“Old-fashioned business leaders like me are facing a do-or-die situation,” said Han, 45, the owner of the packaging business. “I am too old to learn 3D print technologies to survive the competition. And the company’s financial condition doesn’t allow us to conduct a head-to-toe business change.”

He added that venture capital funding, despite growing by leaps and bounds in China, is a far-off dream for his company.

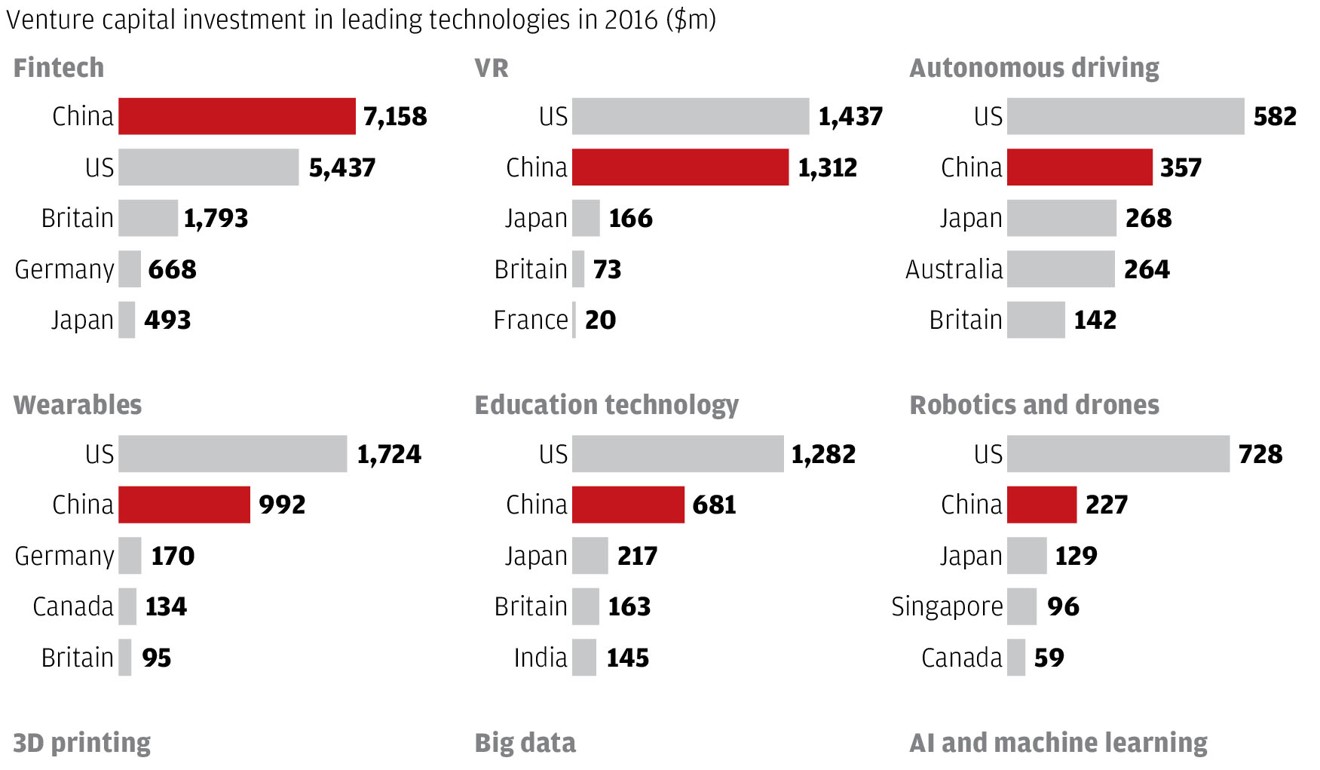

This is despite China being among the world’s top three venture capital investment destinations.

In 2016, a combined US$7.16 billion of venture capital funds was poured into the mainland’s artificial intelligence sector, topping any other market around the globe.

The country’s 3D printing businesses received US$221 million of investment last year, trailing only the US which saw US$602 million venture capital flowing to the industry.

According to McKinsey, the new round of digitalisation in China is likely to shift or create value equivalent to 10 to 45 per cent of industry revenue pools by 2030 in sectors like health care and logistics.

Besides, China’s digital businesses’ ambitions know no bounds. They are fast tracking globalisation while displaying their technological and financial might outside the country.

Alibaba and Tencent are expanding their e-payment network abroad to facilitate Chinese tourists’ purchases of goods.

Last year, Jinri Toutiao, operator of a news aggregation app, invested US$19 million in Dailyhunt, one of India’s largest local language content aggregation service providers.

Analysts say the home market will still be a focus for Chinese companies at present, while overseas investment and expansion is viewed as a move to test the waters.

“After all, the scale of the Chinese economy is huge enough to support a rapid growth of businesses,” said UBS analyst Hou Yankun. “The size of the economy and the market is definitely of benefit to further technology enhancement.”

However, sectors such as agriculture and construction have lagged behind in digitalising their businesses, the McKinsey report showed, adding that as these industries embrace technological innovation they can become more competitive and productive.

Once this takes off, there is no stopping the digital revolution.