Capital raising plan by Xi Jinping’s dream city builder elicits a yawn from Hong Kong investors

Investors gave their cold shoulder to the US$248 million IPO by Hebei Construction, already priced at the low end of a price range.

Hebei Construction Group, one of the first builders of the Chinese President’s dream city outside Beijing to tap the capital markets, has received a cold shoulder from investors, as its HK$1.93 billion (US$248 million) initial public offer was left partially subscribed.

Investors submitted bids for 42.76 million shares, less than 99 per cent of the number of shares on offer, the Baoding-based company said in a statement. The company’s shares are offered at the bottom of a price range of between HK$4.46 and HK$5.36, trading for the first time on the Hong Kong bourse on Friday .

In China, Xi Jinping’s new mega city is expanding underground

Hebei Construction joins Guangzhou Rural Commercial Bank in becoming one of the handful of companies snubbed by investors, as they poured their investments into technology start-ups and so-called new economy companies with businesses tied to the internet. Guangzhou Rural’s June IPO was only 45 per cent subscribed, and the stock traded briefly below its offered price.

Due to the undersubscription, the second-biggest among China’s privately owned builders will reallocate 573,000 shares to institutional investors, Hebei Construction said. Its cornerstone investor Zhongji Investment has already subscribed for 79.3 million shares, about 4 per cent of the company’s total issued share capital.

“We can surely have a finger in the pie,” said Hebei Construction’s president and executive director Shang Jinfeng in Hong Kong. “We have the geographical advantage, and the experience in transporting equipment and green infrastructure, in line with the state’s goal to build Xiongan into a green, liveable and modern urban area.”

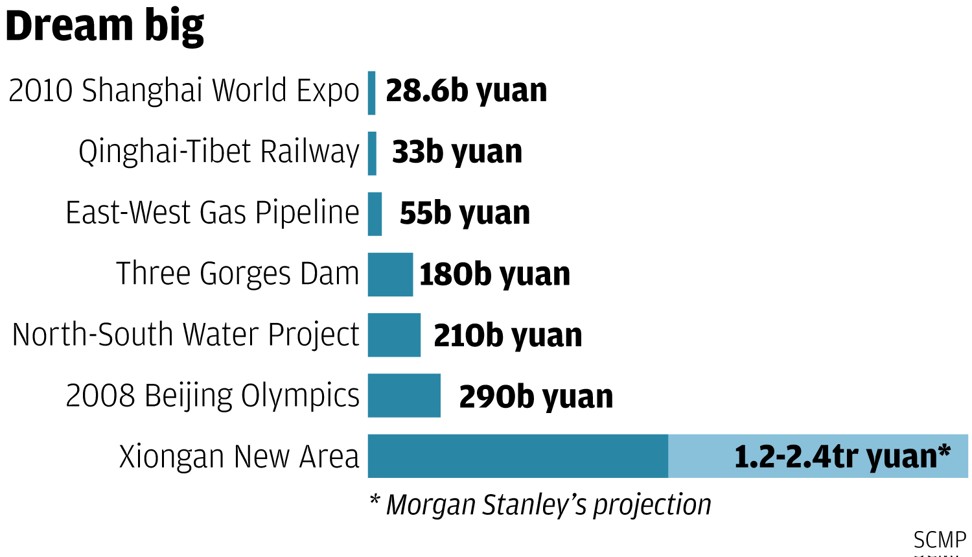

Xi’s dream city ‘won’t succeed without market reforms’

The company plans to use 40 per cent of the capital raised from its IPO to complete construction projects under contract, 40 per cent to fund commitments under existing and future public-private-partnership (PPP) projects, 10 per cent to repay outstanding bank loans, with the rest for general corporate purposes.

Hebei Construction’s 2016 net profit jumped 89 per cent to 768 million yuan, while first half net income rose 77 per cent to 503 million yuan. Its debt-to-capital ratio stood at 152.7 per cent at the end of June, and it had a total of 3.77 billion yuan of interest-bearing loans.