Advertisement

Hong Kong M&A deals up by almost half in 2017 as mainland firms buy into property, insurance sector

Reading Time:2 minutes

Why you can trust SCMP

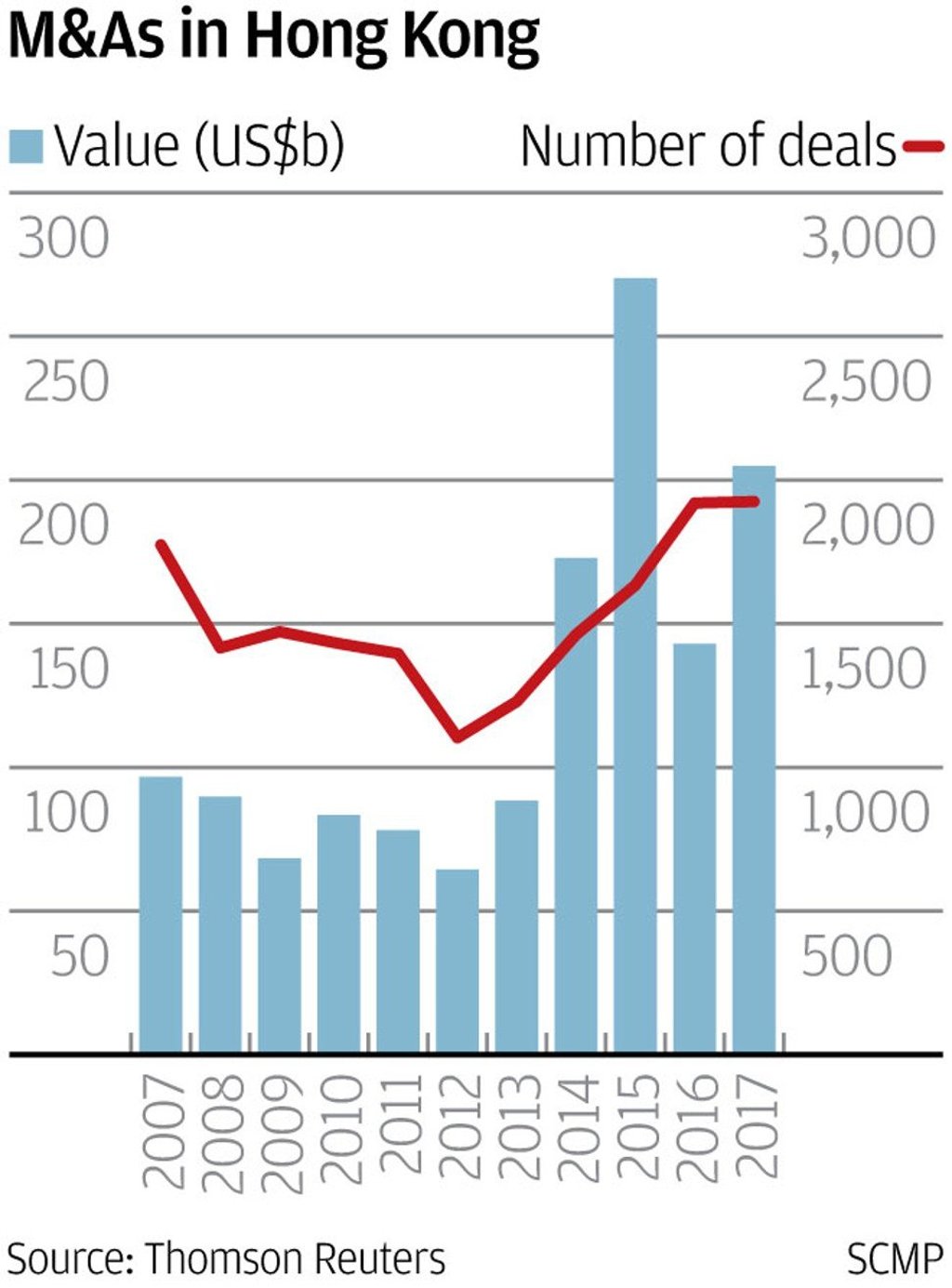

Mergers and acquisitions activity in Hong Kong is up by almost a half this year, data from Thomson Reuters shows.

The increase in deals has been driven by a string of mainland firms buying into Hong Kong property and insurance companies as well as internal restructuring of giant firms.

The city saw M&A deals worth US$204.8 billion this year, up 43.2 per cent from 2016, according to the data. That is still some distance behind the record set in 2015 of US$270.3 billion.

Advertisement

Another notable deal was China Unicom’s mixed-ownership reform, which saw a number of private-sector investors buy into China Unicom (Hong Kong) for US$11.26 billion (HK$88.1 billion).

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x