Technology stocks hog the limelight and outperform the old economy in Hong Kong and mainland China

The best performing stocks on the main indices of Hong Kong, Shanghai and Shenzhen in 2017 were all related one way or another to technology.

Hong Kong’s stock market operator and regulator pushed through a controversial overhaul of their listing rules this year to attract so-called new economy companies - including technology firms and biotechnology researchers - to raise capital in the city.

They have good reason to do so. The best performing stocks on the main indices of Hong Kong, Shanghai and Shenzhen in 2017 were all related one way or another to technology, or at least have a business strategy that taps into the new economy.

“Technology companies have overtaken financial, energy, industrial and commercial firms as the ones with the biggest market values and the most influence,” said Citic Securities’ analyst Xu Yingbo, who recommends buying Tencent Holdings, AAC Technoligies Holdings, Hanzhou HikVision Digital Technology and Sanan Optoelectronics. “China has already become one of the two global forces of technology innovation.”

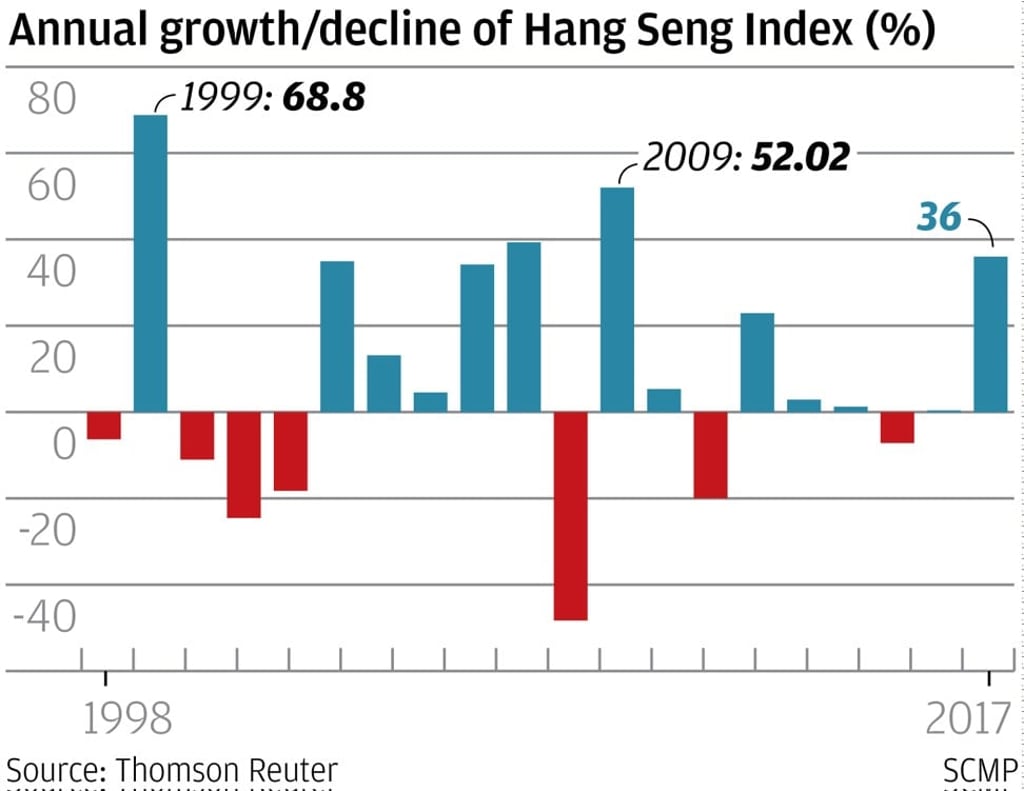

Hong Kong’s key Hang Seng Index rose 36per cent this year, while the China Enterprise Index (CEI) advanced 24.6 per cent.

The biggest winner on the China Enterprise Index, Ping An Insurance Group’s 109.7 per cent return, is making fintech and insurtech the signatures of its business strategy.