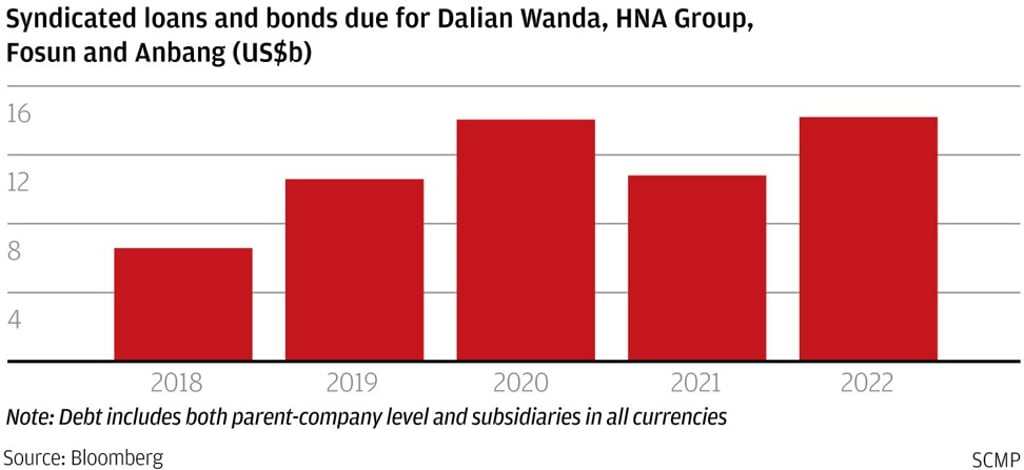

Buyers beware: China’s property bonds face the highest risk of default among borrowers in 2018

Chinese builders face a record US$31 billion of onshore and offshore bond maturities this year, which may more than double if put options are exercised, Bloomberg’s data show.

Bonds from China’s property developers face the biggest risk of default in the nation’s domestic debt market as the government’s funding curbs strain their finances, according to a survey of analysts and traders.

Ten out of 15 respondents in a Bloomberg survey late December see some payment failures among developers this year. Most predict yield spreads on corporate bonds that surged to four-year highs in 2017 to climb more. Builders are most vulnerable as they face policy risks with authorities restricting their funding to cool housing prices, according to China Merchants Bank.

Chinese builders face a record US$31 billion of onshore and offshore bond maturities this year, which may more than double if put options are exercised, Bloomberg’s data show. Fundraising curbs have hurt their ability to sell bonds in the domestic market, with onshore note issuance plummeting 67 per cent in 2017.

Qin said the defaults are more likely to happen with small regional developers. The Shanghai Stock Exchange raised the threshold for China’s property developers to sell exchange-regulated notes, people familiar with the matter said in late 2016. Accelerated new home price gains in November points to persistent price pressures and the likelihood that cooling measures will remain.

Interestingly, the sector could also be a “gold mine” if one knows how to find undervalued bonds, said Li Liuyang, an analyst in Shanghai at China Merchants Bank. There may be good opportunities within developer bonds because the government curbs could lead to overselling in some of the securities, he said.