Why Hong Kong firms need to do better on environment, social and governance risks disclosure

KPMG says Hong Kong listed companies must step up their game when it comes to mandatory disclosure on environment, social and governance risks

The quality of the first mandatory disclosure by Hong Kong listed firms on their environment, social and governance performances leaves a lot to be desired and is far from sufficient to help investors make informed decisions, according to a recent survey.

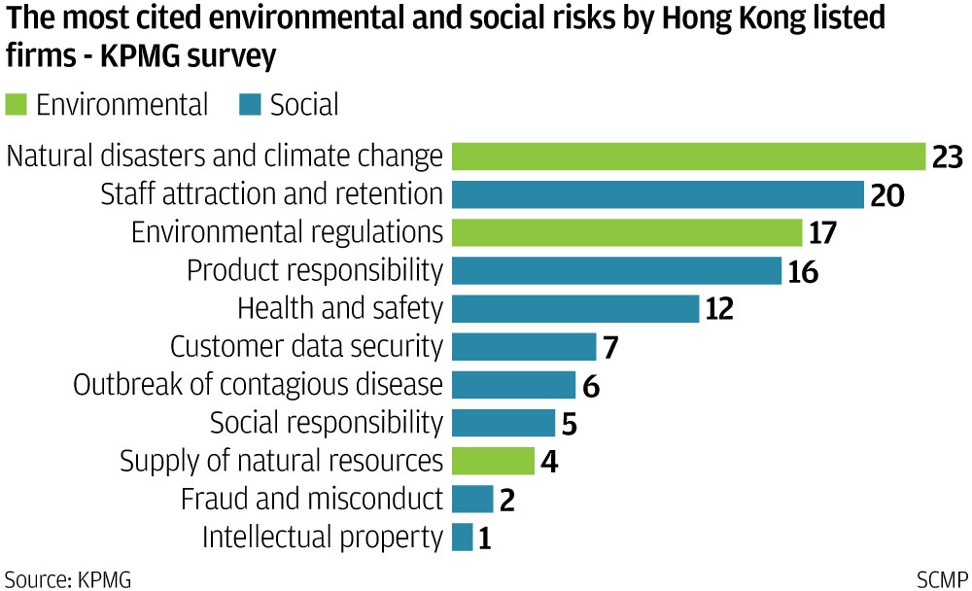

The findings from a review by audit and consulting firm KPMG showed a low regard for ESG risks as principal risks, unclear board engagement in ESG governance and poor disclosure on whether and how companies identified risks that were most relevant to them.

The survey revealed that most companies were at an early stage of the ESG journey. “Many have yet to demonstrate awareness of the significant ESG risks they are exposed to and the effective management of their impacts,” said the KPMG report, which was issued in November.

In its survey of the annual and ESG reports of 366 firms – around a quarter of all firms listed in Hong Kong, KPMG found only 16 per cent had identified one or more ESG risks as principal risks in their business reviews.

“The financial sector had the lowest rate of ESG risk disclosure … this is surprising given the growing environmental and social risks facing the clients [or] investees,” KPMG said.

Only 13 per cent of the firms said their board was responsible for ESG risk management, while 83 did not disclose their ESG governance structure.

This is not mandatory under the Hong Kong Exchanges and Clearing’s (HKEX) ESG disclosure rules that took effect last year.

Although 77 per cent of the firms reported on all 11 ESG aspects listed in the guidelines, only a third disclosed their methods for determining what risks mattered to their operation the most, which is also not mandatory.

This could reflect the adoption of a “box-ticking approach” by some firms, KPMG said.

Inadequate ESG risk deliberation and reporting means missed opportunities for companies to uncover ways to save costs, avoid penalties, mitigate risks and develop new businesses.

Sustainable investment is not only good for protecting the world for tomorrow’s generations, it can also be a route to superior portfolio returns

For investors, it means they have less relevant information for allocating more funds to firms with higher long-term return potential, and away from those ill-prepared for the risks.

Asked if it would consider tightening listing rules to require mandatory disclosure on ESG governance structures and explanations of the process for prioritising risks by importance to a firm, an HKEX spokesman said it reviewed the rules on a continuous basis and had published ESG reporting training material on its website.

ESG investing, which takes into account companies’ ESG risks besides traditional financial yardsticks like profitability and liquidity, has been gaining popularity worldwide as governments have made commitments to contain climate change, reduce social inequity and improve corporate governance.

“Sustainable investment is not only good for protecting the world for tomorrow’s generations, it can also be a route to superior portfolio returns,” said Sebastien Eisinger, head of investments at Swiss-based Pictet Asset Management, in a note last month.

He cited a joint study two years ago by Germany’s Deutsche Bank and University of Hamburg, which aggregated evidence from over 2,000 studies since the 1970s.

It showed that over half of the studies found a “significant positive relationship” between ESG factors and corporate financial results.

He also noted three other studies that showed ESG-focused firms tended to outperform peers on share prices, including one that said every US dollar invested in highly sustainable US firms in 1993 was worth US$22.60 by 2010, compared with US$15.40 for peers with low ESG scores.

ESG oversights by major companies have spurred investors and regulators to demand better risk management.

Examples include oil giant BP, which paid huge fines and saw its share price punished by investors for an inadequate safety system that resulted in the largest marine oil spill in the petroleum industry’s history in 2010.

German carmaker Volkswagen was also punished by regulators and investors after it admitted to rigging diesel-powered vehicles to cheat on government emissions tests, while a string of high profile corporate accounting scandals in Japan also highlighted governance risks.

Institutional investors in Asia excluding Japan have been lagging in making, and systematically reporting, so-called responsible or sustainable investment, which takes ESG factors into consideration.

According to a report by Global Sustainable Investment Alliance – a network of organisations promoting responsible investment, Asia saw US$52.1 billion of funds managed with “responsible” investment strategies, up 16 per cent from 2014.

But it is a fraction of the US$12 trillion reported in Europe, US$8.7 trillion in the US and US$473.6 billion in Japan.

Nick Pollard, managing director for Asia-Pacific at the CFA Institute, a 70-year-old US-based global association of investment professionals, said insufficient leadership in Asia excluding Japan by major asset owners in demanding ESG disclosure, and an absence of unified ESG definition and approach, were to blame.

“We still have a long way to go to get that kind of consistent level of understanding so that [investors] can make an informed decision,” he said.

Mary Leung Ka-yan, head of advocacy for Asia-Pacific at the institute, said little policy harmonisation has been seen globally.

“If you look at the reporting standards around the world, it is like an alphabet soup,” she said, adding investors and companies are often confused by the over 300 financial disclosure policies found globally.