Swissport mulls a Switzerland IPO in 2018, opening up a funding avenue for cash-starved HNA

HNA is seeking at least 2.7 billion Swiss francs in valuation for Swissport, for which it paid that amount in 2015 to own.

Swissport, the world’s biggest ground and cargo handler at airports, said it’s aiming to raise capital through an initial public offering later this year in Switzerland, in a move that opens up a new funding source for its cash-starved parent HNA Group.

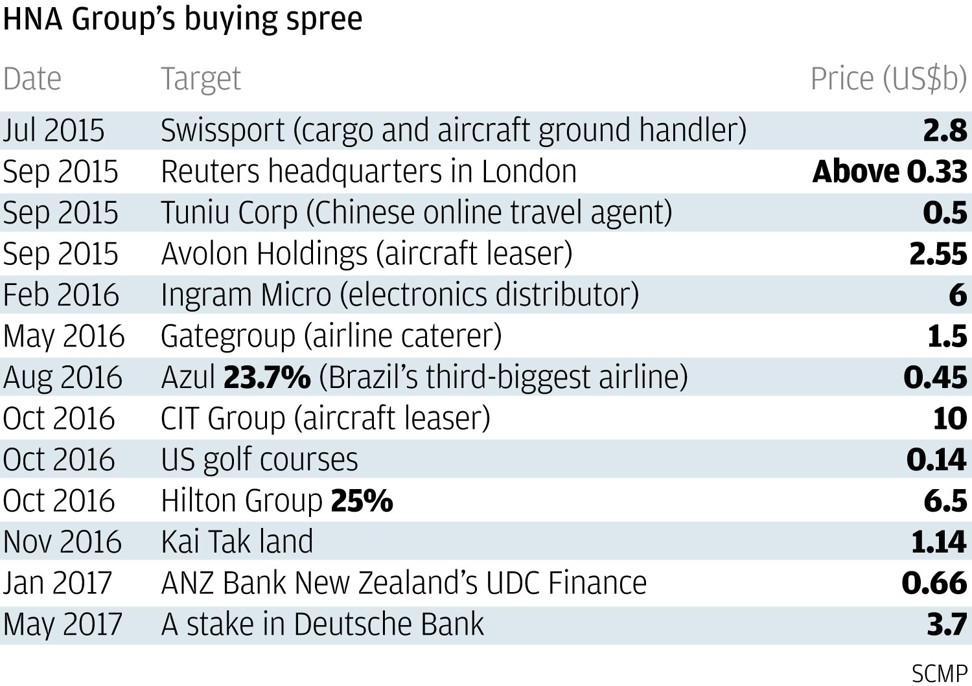

Based in Opfikon, Switzerland and wholly owned by HNA since 2015, Swissport plans to list its stock on the SIX Swiss Exchange in Zurich, according to a statement. Hainan-based HNA, which paid 2.73 billion Swiss francs (US$2.81 billion) for Swissport, is expected to retain a long term strategic stake after the IPO, operating the services company as an independent business, Swissport said.

“The objective of the contemplated IPO is to accelerate Swissport’s long term growth strategy, provide additional financial flexibility and liquidity, and position the company to strengthen its leadership position and service offerings,” Swissport’s chief executive Eric Born said, without disclosing the size of its offering or the amount of funds raised.

HNA, which already owns China’s fourth-largest airline fleet, is seeking a valuation of at least 2.7 billion Swiss francs for Swissport, according to a Reuters report, citing unnamed sources.

In a response to the South China Morning Post, Swissport said Rothschild is advising the company, but refused to disclose information surrounding the financial metrics of any proposed IPO at this time.

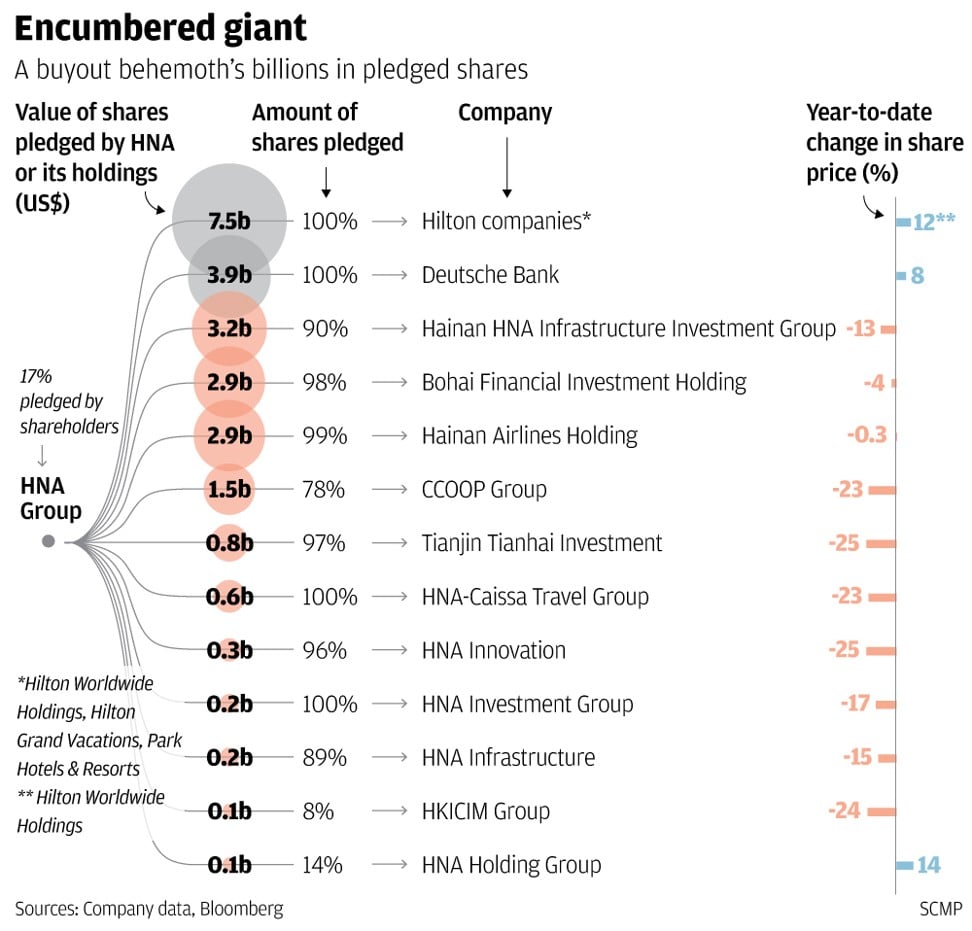

A successful fundraising would be good news for HNA. Trading in the stocks of 10 of HNA’s listed units were halted in China amid investor concerns about a financial distress facing the group.

These companies include Hainan Airlines Holding, Hainan HNA Infrastructure Investment Group, Tianjin Marine Shipping, Bohai Capital, HNA Caissa Travel Group, CCOOP Group, and HNA Investment Group.

HNA also has shareholdings in several Hong Kong-listed companies including HNA Technology Investments, CWT International and HNA Infrastructure.

On Friday, HNA Investment Group said it would terminate its real estate investment trust (REIT) project in Singapore with AEP Investment Management.

“Both parties have decided to terminate the cooperation as the HNA Commercial REIT’s IPO has been progressing very slowly due to many factors,” HNA said without elaborating.

Still, HNA’s chief operating officer Gao Jian said the trading halts of the units “have nothing to do” with the group’s liquidity.

HNA, which grew from a regional carrier in southern China into one of the country’s biggest privately owned conglomerates, had been among several Chinese asset buyers placed under the government’s scrutiny over the past year. Concerns were that their large debt-fuelled purchases were exposing the financial system to undue risk. The group’s acquisitions in the last two years ranged from golf courses to a stake in Deutsche Bank to owning the Hilton Group of hotels.

HNA’s founder and chairman Chen Feng acknowledged last week that the group is facing a cash crunch due to “a big number of mergers,” but expressed confidence that the problem can be managed with the support of banks and financial institutions.

Credit rating agencies didn’t seem to think so. S&P Global Ratings last year cut HNA’s creditworthiness assessment to B, from B-plus, citing concerns over the group’s “significant debt maturities” and “meaningfully higher” fundraising costs.

“We base the revision on our view of HNA’s aggressive financial policy and risks over tightening liquidity,” S&P analysts Andrew Mayes and Sharad Jain said in a November 29 statement. “HNA has significant debt maturities over the next several years and its funding costs are meaningfully higher than that of a year ago.”