Hong Kong’s Hang Lung Properties sees 2017 underlying profit fall on declining China mall rental income

Including a revaluation gain, net profit rose 31 per cent, and the developer expresses confidence in its outlook

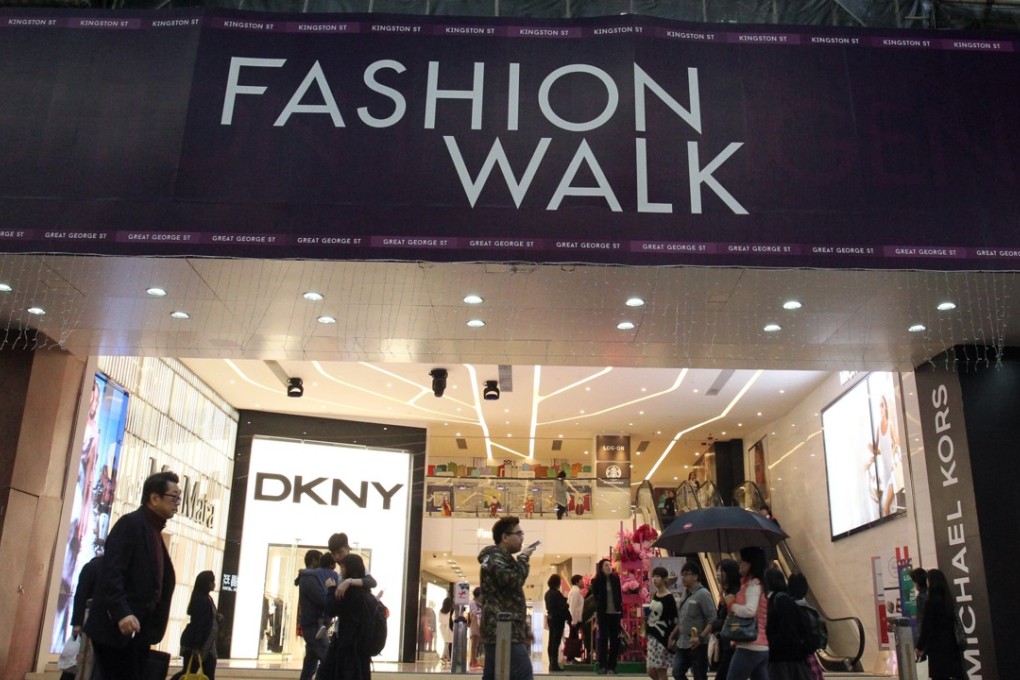

Hong Kong developer Hang Lung Properties, which owns the Fashion Walk shopping area in Causeway Bay and eight shopping centres in China, reported a 13 per cent fall in 2017 underlying profit, citing fewer property sales and a decline in rental income from its mainland China business.

Underlying profit for the year, which excludes revaluation gains in investment properties, dropped to HK$5.53 billion (US$707.3 million), although net profit jumped 31 per cent to HK$8.12 billion after a revaluation gain of HK$2.59 billion, above the range forecast by analysts in a poll by Reuters of HK$3.59 billion to HK$7.1 billion.

It will pay a final dividend of 58 HK cents, unchanged from last year. Turnover fell 14 per cent to HK$11.19 billion.

Its profit from property sales declined 30 per cent to HK$2.23 billion in 2017. In 2017 it sold just 226 units of The Long Beach housing estate in southwest Kowloon; one semi-detached house at 23-39 Blue Pool Road on Hong Kong Island, and the last duplex unit of The Harbourside apartment complex in West Kowloon.

“Don’t underestimate the difficulty of this market,” said company chairman Ronnie Chan Chi-chung, noting its volatility and saturation by financially strong players with years of experience.

“No one should expect Hong Kong to be a low priced real estate region. It will not happen.”